Bitcoin [BTC]: The rest of the month may not be fruitful, here is why

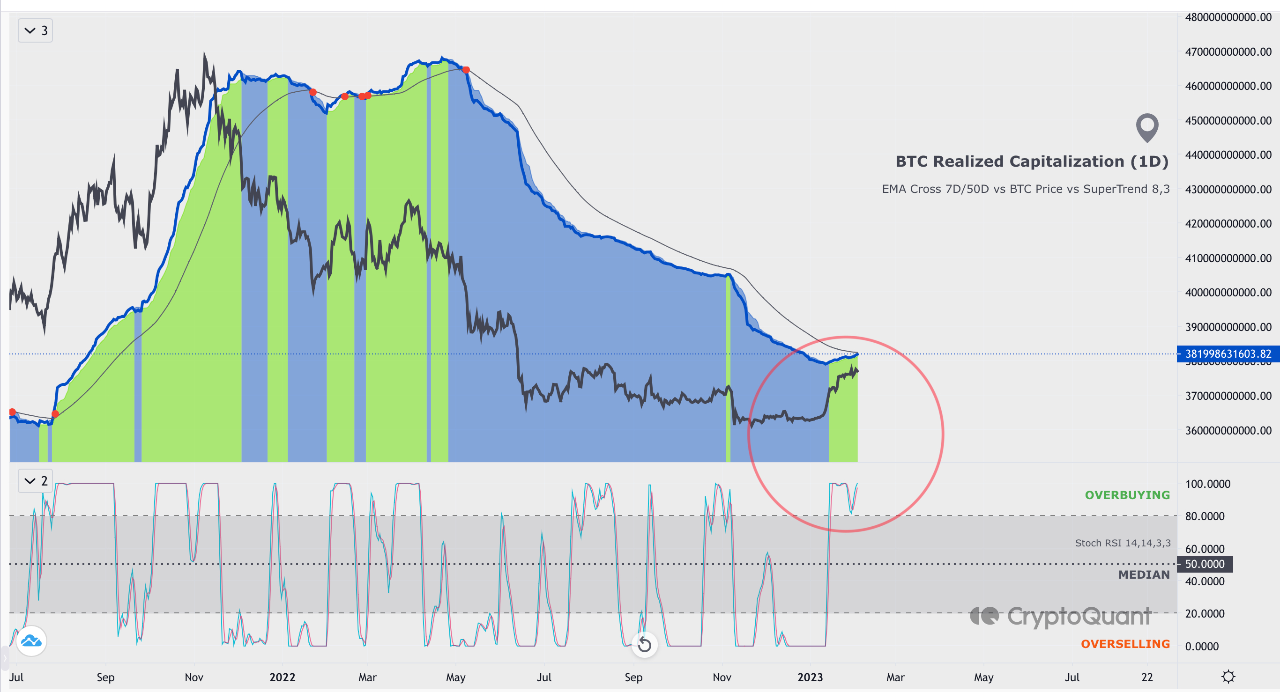

- BTC’s Realized Capitalization showed that the leading coin is now overbought.

- On-chain assessment hints at a price drawback in the coming days.

According to CryptoQuant analyst Axel Adler Jr, due to the bullish nature of the general cryptocurrency market since the year began, the Realized Capitalization metric for many assets grew significantly in the past 20 days.

The metric, which takes into account the cost of production for each coin, provides a more accurate picture of the market’s overall health and is considered to be a better indicator of the true market sentiment towards a cryptocurrency.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, an assessment of Bitcoin’s [BTC] Realized Capitalization metric over a single-day average revealed that the coin’s Stochastic RSI (Relative Strength Index) oscillator lay at the overbought region.

Generally, an asset’s Stoch RSI oscillator presents overbought conditions when the asset has been trading at a relatively high price for a prolonged period of time, leading investors to believe that the asset is overvalued and due for a correction. According to Adler,

“This implies that a possible adjustment or decline in the market may occur in the near future.”

Source: CryptoQuant

The whales have swooped in

While BTC’s price oscillated within a tight range in the last week, the on-chain analysis showed an uptick in transactions and accumulation among large investors.

According to on-chain data provider Santiment, the counts of BTC whale transactions above $100,000 and $1 million have jumped significantly during that period.

Source: Santiment

Likewise, during the intraday trading session on 3 February, a massive BTC transaction took place, marking the largest of such transfers in the last four weeks.

A new whale address emerged, going from zero to holding 13,369 BTC, valued at approximately $313.1 million, in a single transfer.

🐳 8 hours ago, the largest #Bitcoin transaction in 4 weeks took place. This brand new whale address went from nothing to suddenly holding ~13,369 $BTC (worth ~$313.1M) after a single transfer. Track this wallet here as prices fluctuate going forward. 👀 https://t.co/Vk7GTw4diT pic.twitter.com/G2IwLP0tpp

— Santiment (@santimentfeed) February 4, 2023

When the price of an asset starts to see a drawback and the whales begin to accumulate, it usually means that these large holders believe that the asset is undervalued and have started to buy more of it. It is often taken as a bearish signal which can further drive down the value of such an asset.

Is your portfolio green? Check out the Bitcoin Profit Calculator

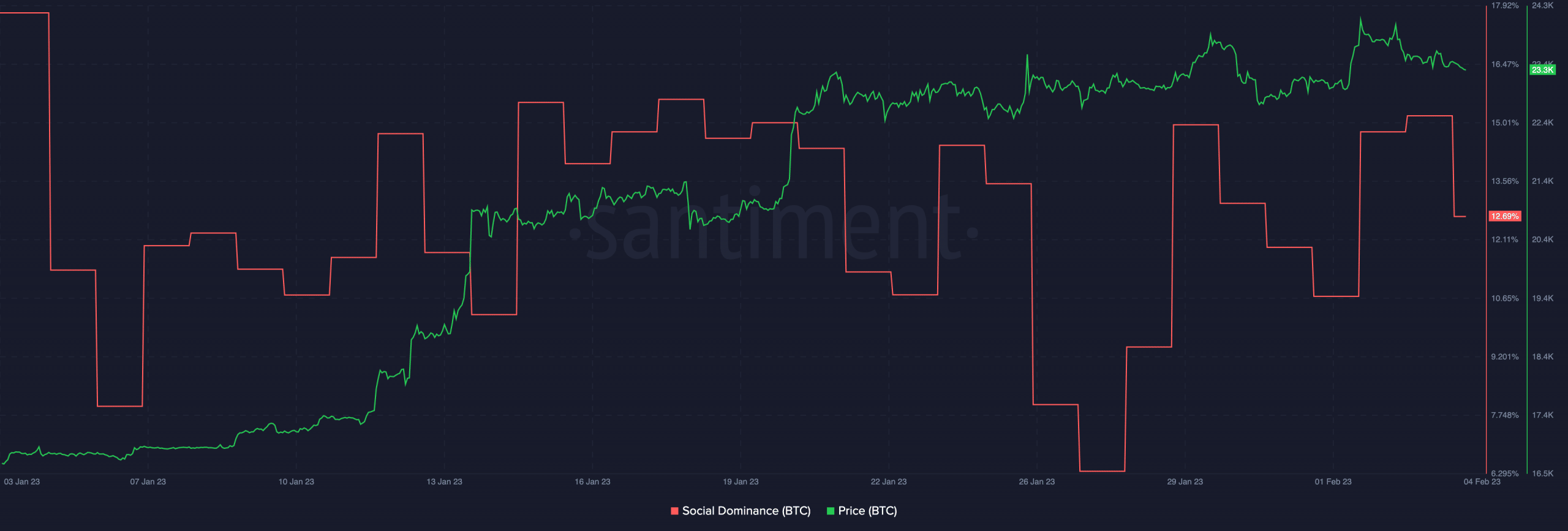

Further, BTC’s social dominance spiked significantly in the past few days. With its price oscillating in a tight range, gearing up to breakout in either direction, a surge in social dominance could mean the presence of euphoric sentiments in the market.

Such highs in social activity without a corresponding price rally often precede a price drawback.

Source: Santiment

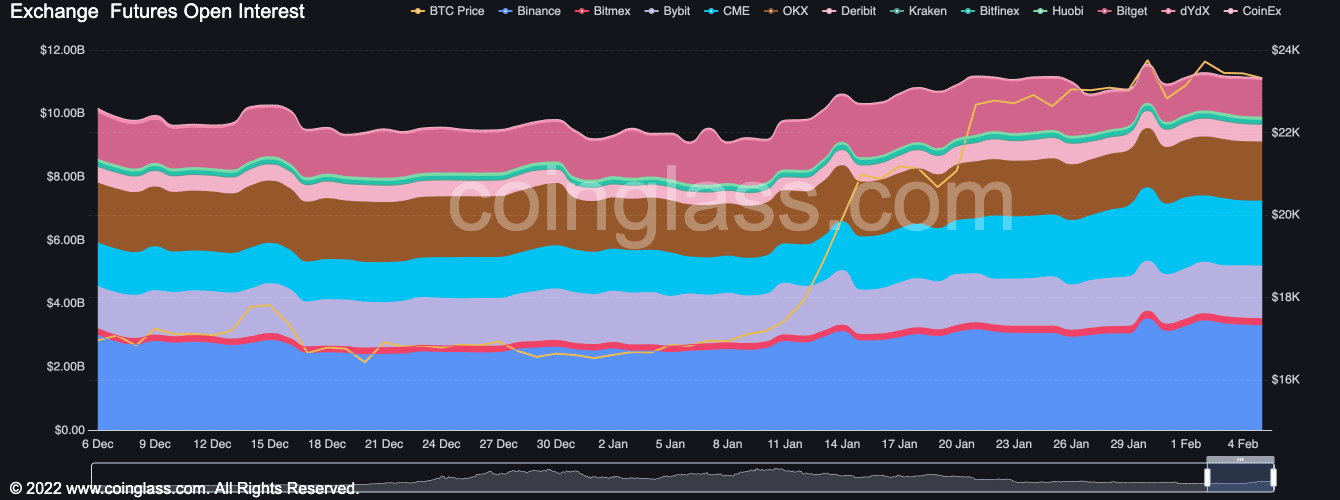

Finally, according to Coinglass, BTC’s Open Interest has been decreasing since the beginning of February. At $11.11 billion at press time, it has reduced by 2% since then.

Source: Coinglass