Ripple CEO Calls on Trump for Sweeping SEC Reforms in First 100 Days

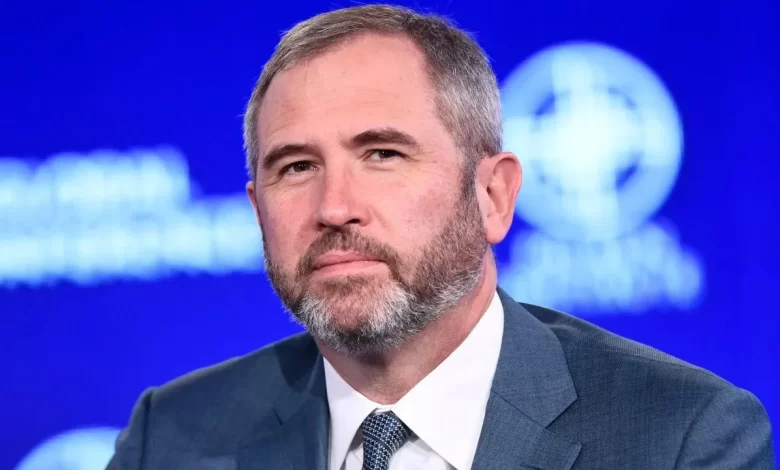

On Wednesday, Ripple CEO Brad Garlinghouse offered a pointed roadmap for the early days of Donald Trump’s administration, outlining immediate steps that could reshape digital asset regulation.

In a recent post on X, Ripple CEO Brad Garlinghouse congratulated Donald Trump on his 2024 election victory and issued a public call for immediate changes in U.S. cryptocurrency policy. Garlinghouse, who has long been vocal about digital asset regulation, highlighted his priorities for the Trump administration’s first 100 days, calling for a decisive reshaping of the U.S. Securities and Exchange Commission (SEC) and clarity on crypto regulations.

At the forefront of Garlinghouse’s recommendations is a call for the removal of current SEC Chairman Gary Gensler. “Fire Gensler. Day 1, no delays,” he wrote, indicating frustration with the SEC’s recent approach to cryptocurrency regulation. Garlinghouse further suggested appointing a new leader with a different perspective, proposing former officials such as Christopher Giancarlo, Brian Brooks, or Daniel Gallagher. According to Garlinghouse, each of these figures could play a critical role in “rebuilding the rule of law and reputation at the SEC.”

Garlinghouse’s remarks come amid Ripple’s long-standing legal battle with the SEC, which centers on the classification of its XRP token. In December 2020, the SEC filed a lawsuit against Ripple, asserting that XRP was a security and that Ripple’s sales of the token were, therefore, unregistered securities transactions. A partial ruling in July 2023 was a pivotal moment for Ripple, as Judge Analisa Torres determined that XRP’s sales on public exchanges did not violate securities laws.

However, Ripple’s institutional sales to hedge funds and other buyers were deemed to be unregistered securities offerings, leading to a $125 million civil penalty for the company. The case remains ongoing as the SEC has until October 2024 to file an appeal. In his post, Garlinghouse also urged Trump to foster bipartisan collaboration on digital asset legislation, specifically the digital asset market structure bill currently under Senate consideration.

Garlinghouse’s call for a “family dinner” between Republicans and Democrats underscores his desire for a more unified approach to crypto regulation—a stark contrast to the often polarized stance taken by U.S. lawmakers. The final point on Garlinghouse’s checklist involves greater regulatory clarity for ethereum, calling for the same treatment of ether and XRP as that of bitcoin, which has been largely exempted from classification as securities. This request aligns with the broader cryptocurrency community’s demand for consistency in how digital assets are classified under U.S. law.

Garlinghouse’s post echoes longstanding frustrations among crypto executives over perceived regulatory ambiguity and excessive enforcement action by the SEC. His call to action reflects a push for a clearer and potentially more favorable regulatory environment under Trump’s new administration. The eventual outcome of the Ripple-SEC lawsuit, alongside any forthcoming actions from the SEC, will be pivotal for the future regulatory landscape of digital assets in the United States.