What Ripple’s stablecoin plans mean for ‘down by 6%’ XRP price

Ripple will launch its stablecoin on its XRP Ledger (XRPL) and the Ethereum network to meet the growing demand for the asset

- Ripple will launch its stablecoin later this year.

- This comes at a period when its XRP Ledger witnesses low user activity.

Crypto payment firm Ripple has announced its plans to launch a stablecoin pegged to the U.S. dollar on its XRP Ledger (XRPL) and the Ethereum network later this year.

According to the announcement blog post, the enterprise blockchain solutions provider said its stablecoin will be backed 100% by US dollar deposits, short-term US government treasuries, and other cash equivalents.

Ripple added that its foray into the stablecoin market is to meet the growing demand for this category of digital assets.

The payment firm added,

“This is a natural step for Ripple to continue bridging the gap between traditional finance and crypto.”

XRPL recent troubles

Ripple’s decision to float its stablecoin comes as its XRPL faces a significant decline in user activity. On-chain data revealed that the network has seen a drop in user activity since the beginning of the year.

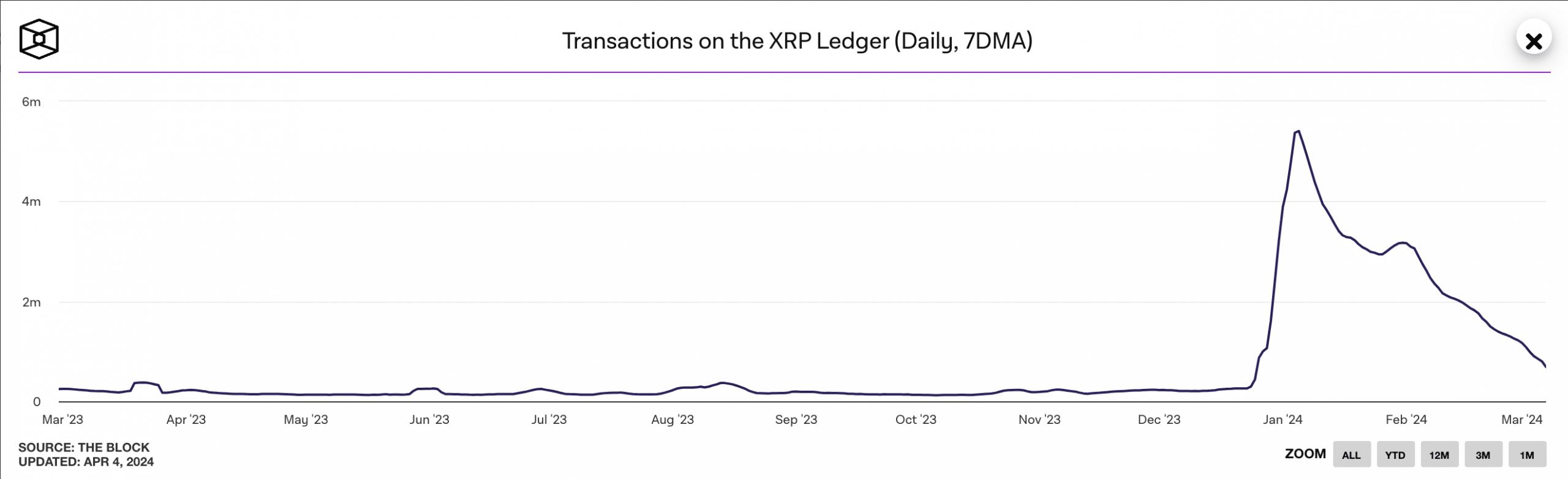

According to The Block data dashboard, the daily count of transactions completed on the XRPL has declined since 4th January. On a seven-day moving average, the network daily transactions count fell 87% between January and March.

The fall in daily transactions recorded was due to the decrease in the number of unique addresses active on XRPL as senders or receivers during this period. Per The Block data, the daily count of active addresses on the network dropped by 45% in the year’s first quarter.

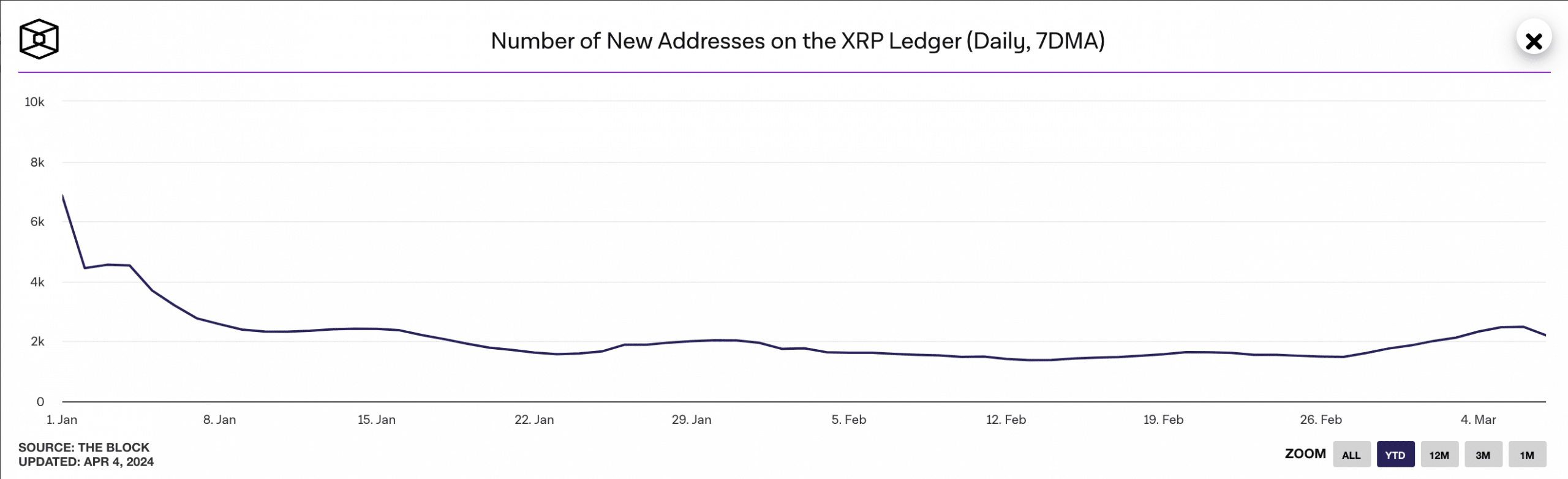

Further, new demand for XRPL also plummeted in Q1. During the 90-day period, the number of unique addresses that appeared for the first time in a transaction on the network cratered by 68%.

Selling pressure mounts

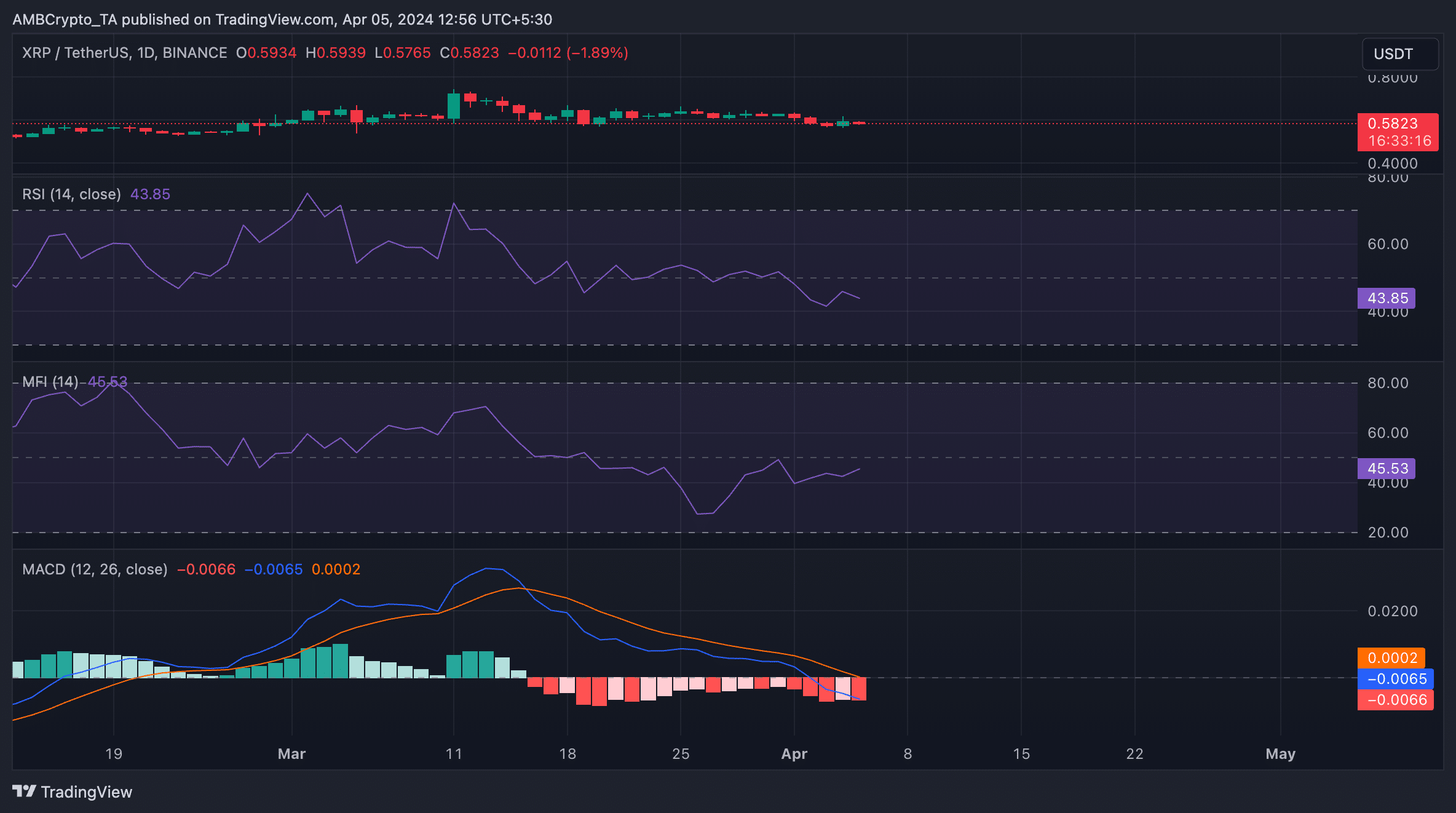

The cryptocurrency market’s general decline last week affected XRP’s price, which dropped by 6% in the past seven days. Signaling a hike in selling pressure, the token’s key momentum indicators assessed on a 1-day chart trended downward.

Spotted below their respective center lines, XRP’s Relative Strength Index (RSI) and Money Flow Index (MFI) were 43.89 and 45.59. These values showed that XRP sell-offs outpaced its accumulation among market participants.

Suggesting that XRP’s price may extend its losses, its MACD line was below zero as of this writing and rested under the signal line.

Realistic or not, here’s XRP market cap in BTC’s terms

When these lines are positioned this way, it signals that the shorter-term moving average is below the longer-term moving average.

Traders interpret it as a sign to exit long positions.