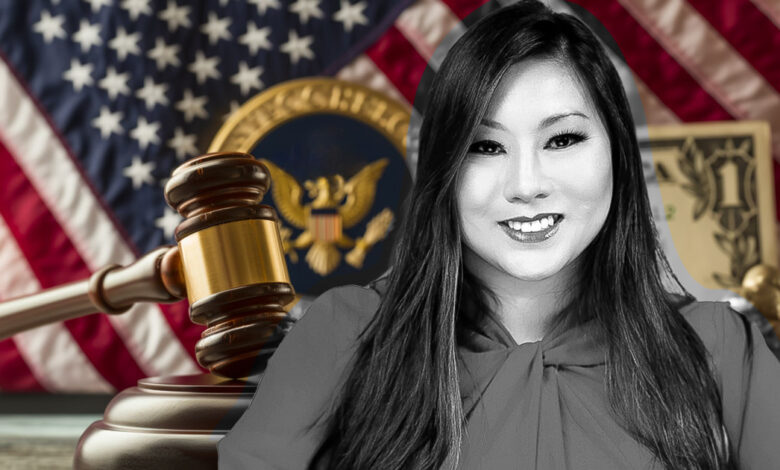

CFTC’s Caroline Pham says KuCoin charges may infringe on SEC authority

CFTC Commissioner Caroline Pham said on March 29 that her agency’s charges against KuCoin may infringe on the duties of the SEC.

Pham acknowledged the CFTC case as an “aggressive enforcement action” and commended the Division of Enforcement for the move. However, she raised concerns about part of the allegations.

Distinction needed

According to Pham, the complaint suggests that fund shares held by investors can be a form of leveraged trading in their own right.

She said this interpretation does not distinguish between investments in funds, which are usually considered a security under the SEC’s jurisdiction, and the trading activities of a fund, which fall under the CFTC’s jurisdiction.

She emphasized the need for a distinction, writing:

“Owning shares is not the same thing as trading derivatives.”

Pham added that the CFTC’s handling of the issue “may infringe upon the SEC’s authority,” undermining investor protection laws and disrupting securities market foundations.

Some commentators previously observed that the case names Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) as commodities, potentially excluding those tokens from the SEC’s jurisdiction. Pham’s statements do not address this exact issue.

KuCoin charged this week

The CFTC filed civil charges against KuCoin and related companies on March 26 over allegations of operating an illegal digital asset derivatives exchange and, more broadly, violating the Commodity Exchange Act (CEA) by failing to register with the CFTC.

The US Department of Justice also filed criminal charges against KuCoin and two of its founders, including but not limited to alleged violations of anti-money laundering laws.

KuCoin responded to charges by assuring users that funds would remain safe and by asserting that it complied with various local laws. The company said that its lawyers are examining the claims.

The post CFTC’s Caroline Pham says KuCoin charges may infringe on SEC authority appeared first on CryptoSlate.