5 Best Stock Market Trading Apps in 2024

Are you a beginner who wants to explore what the stock market has to offer or an experienced trader looking to find the best stock market app to take your trading journey to the next level? Then, you’ve come to the right place. In this article, I will list all of the best apps for stock trading and investing. Which one is your favorite?

What Is the Best Stock Market App?

Charles Schwab, Fidelity, and Interactive Brokers are all among the best stock trading apps on the market. All in all, however, there are a lot of great stock market apps and online brokers available out there for passive and active traders alike.

No matter what kind of investments you prefer, you can find something that will suit you — the problem is finding stock trading apps that are both reliable and have great rates and low fees. Here are some of the best stock apps you get right now.

Charles Schwab

The Charles Schwab mobile trading app is widely considered one of the best all-around options for active traders. As one of the most reputable and trusted online brokers in the industry, it has earned a great reputation that is also backed up by the features and rates that it offers.

In 2020, Charles Schwab acquired TD Ameritrade, another popular trading platform specializing in active trading (it supported futures trading, forex, and crypto trading). As a result, all TD Ameritrade user accounts were moved to the Schwab platform.

Key Features

- Large Fund Selection: Features a vast array of funds with low expense ratios and no transaction fees.

- Advanced Trading Tools: Attracts active traders with $0 commissions on stock and ETF trades.

- Educational Resources: Ideal for beginners who need guidance on investment.

- Extensive Research: Offers both Schwab’s own equity ratings and third-party analyses.

Pros

- Offers four trading platforms without minimum fees.

- Great mobile app for trading on the go.

- $0 fee: Charles Schwab offers commission-free trading on stocks and ETFs.

- Comprehensive research tools for informed trading decisions.

- A wide variety of commission-free stock, options, and ETF trades.

Cons

- The low interest rate on uninvested cash might be a drawback for some users.

Charles Schwab is suitable for both beginner investors looking for educational resources and advanced traders seeking sophisticated tools and extensive research options. It’s also a great choice for those interested in accessing a wide selection of funds without transaction fees.

At the time of writing, Charles Schwab also had the Schwab Investor Reward program, which offers up to $2,500 when you open and fund an eligible account with a qualifying net deposit of cash or securities.

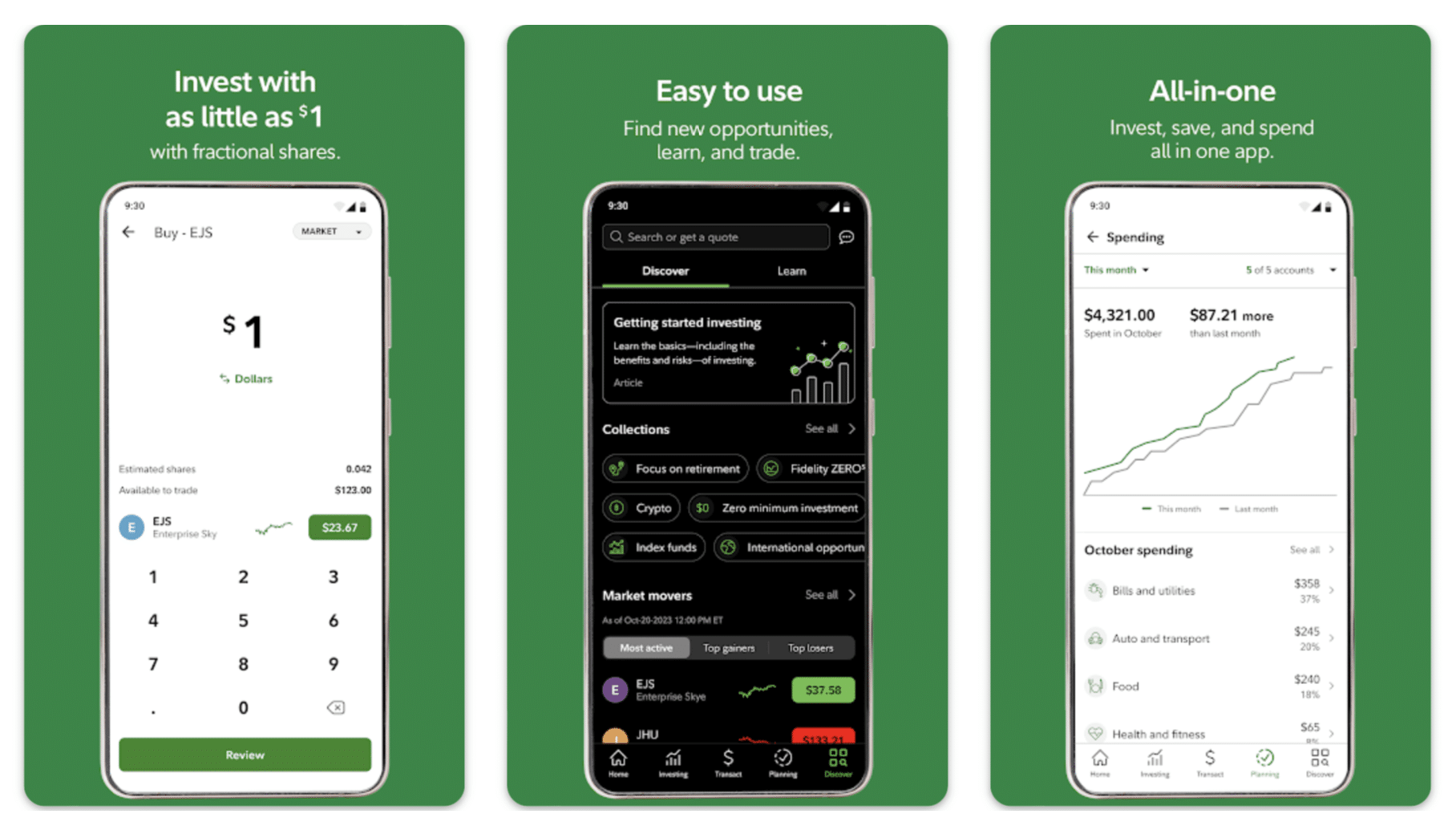

Fidelity

Fidelity is another famous and reputable trading platform that offers a wide variety of different investment tools. It stands out for its comprehensive suite of services, robust research tools, and strong customer support, making it a solid choice for investors of all levels of experience.

Key Features:

- Commission-Free Trades: Offers $0 trading commissions on stocks, exchange-traded funds (ETFs), and options.

- Research and Tools: Access to a broad range of research providers and a top-notch mobile app and tools.

- Customer Service: Known for strong customer service.

- Index Funds: Provides expense-ratio-free index funds.

Pros:

- Large selection of more than 3,300 no-transaction-fee mutual funds.

- A great mobile app with a high App Store rating that makes trading accessible and efficient.

- High interest rate on uninvested cash, beneficial for cash management.

Cons:

- Broker-assisted trade fees are on the higher side, which might be a consideration for traders requiring personal assistance.

Fidelity is great for beginners due to its comprehensive resources. Active investors may also appreciate its $0 commission trades and advanced trading platform. Its extensive mutual fund offerings and no-expense-ratio index funds make it an attractive option for long-term investors as well.

SoFi Invest

SoFi Invest is a stock trading app that stands out for its commitment to providing a user-friendly and comprehensive trading experience, especially for those new to investing. Its focus on educational resources and customer support further adds to its appeal for beginners.

Key Features:

- Commission-free trades: SoFi Invest offers commission-free trades on stocks, ETFs, and fractional shares.

- Good for all types of investors: The platform is praised for its user-friendliness and strong mobile app experience.

- Great investment selection: In addition to all the usual options, it also provides unique access to IPOs, free financial counseling, and no account minimums.

- Mutual funds: In 2024, SoFi added mutual funds to its line-up, enhancing its appeal as a well-rounded investment platform.

Pros:

- No trading commissions and no account minimums make it accessible for beginners.

- Offers fractional shares, allowing investment in high-value stocks with less capital.

- Access to free financial counseling and IPO investments.

Cons:

- The interest rate on uninvested cash is considered low compared to some competitors.

SoFi Invest is ideal for new investors seeking an easy entry point into trading with the convenience of commission-free trades and a strong support system that includes financial counseling. The addition of mutual funds and access to IPOs makes it a more complete platform suitable for a broader range of investment strategies.

At the time of writing, SoFi Invest was offering up to $1,000 in free stock to users who sign up via the mobile app. This promotion is subject to terms and could be an attractive incentive for new users to explore the platform.

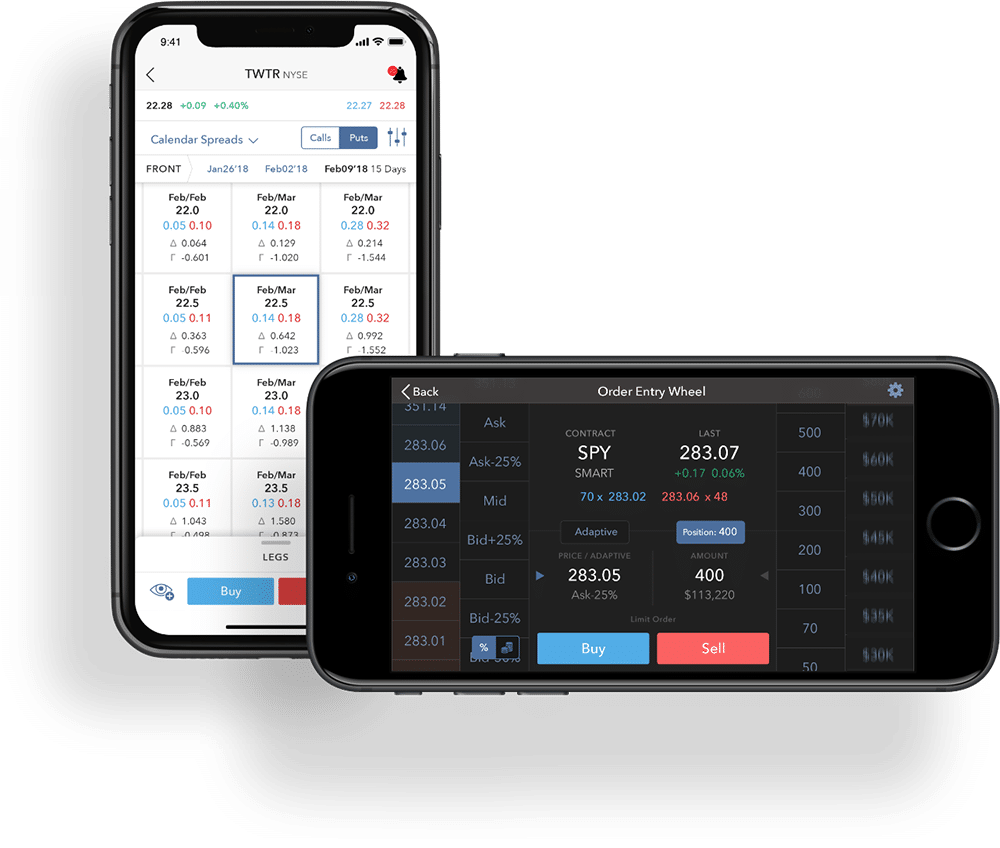

Interactive Brokers

Interactive Brokers is recognized for its advanced trading tools and competitive fees, catering to both novice and experienced traders. While the platform’s complexity may be daunting to beginners, the wealth of features and investment options can be highly beneficial to those willing to navigate its learning curve.

Key Features:

- Extensive Access to Global Markets: As one of the leading online brokerages, Interactive Brokers provides access to over 135 markets in 33 countries.

- Competitive Margin Rates: Offers some of the lowest margin rates in the industry, making margin trading more accessible and cost-effective for traders looking to leverage their investments.

- Comprehensive News Feeds and Research: This includes real-time data, market analysis, and forecasts to help traders make informed decisions.

Pros:

- Competitive low trading fees and high interest on cash balances.

- Broad range of investment products across global markets.

- Low Minimum Investment Requirement.

- Access to a wide array of research tools and resources.

- High-quality order execution.

- No inactivity fee and low withdrawal fees.

Cons:

- The account opening process and desktop platform can be complex for beginners.

- Customer service might feel understaffed at times.

IBKR suits active traders who value a robust trading platform with advanced features and competitive fees. It’s also a strong option for those interested in international trading and a wide range of investment options. Beginners may find the platform complex, but the potential learning curve is worthwhile for accessing powerful investment tools.

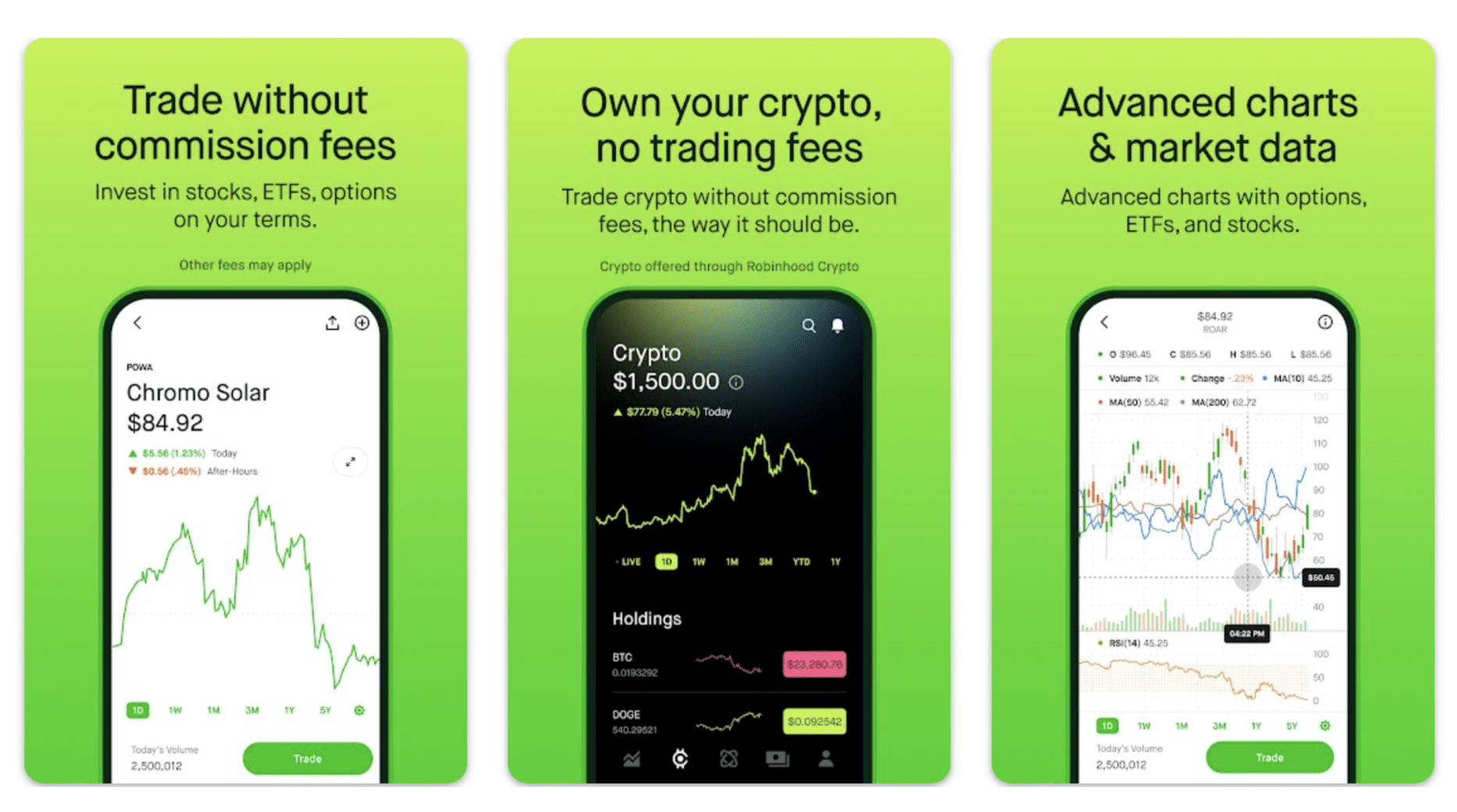

Robinhood

The one that, arguably, started it all: Robinhood was the entry point for a lot of casual traders.

Robinhood’s approach to democratizing investing has significantly impacted the brokerage industry, prompting many to offer similar zero-commission trading options. While it has opened the doors for many new investors, it’s essential to weigh its features, pros, and cons against individual investment goals and strategies.

Key Features:

- Commission-Free Trades: Robinhood is famous for pioneering commission-free trades in stocks, ETFs, options, and cryptocurrency.

- Fractional Shares: Robinhood supports fractional share trading, allowing investors to buy a piece of a stock or an ETF with as little as $1.

- Great for New Investors: The platform is celebrated for its simplicity and intuitive mobile app design, making it very user-friendly for beginners.

- Access to Cryptocurrency Trading: Unique among many online brokerages, Robinhood offers the ability to make cryptocurrency trades alongside traditional investment options.

Pros:

- Zero commission for trades, including cryptocurrency and options trading.

- No minimum deposit requirement.

- Provides fractional shares, enabling investment in high-value stocks with less capital.

- Offers an IRA with a 1% match on contributions, encouraging retirement savings.

Cons:

- Customer support is reported to be limited, which could potentially affect user satisfaction.

- Has faced reliability issues in the past, including outages and trade restrictions during volatile market periods.

Robinhood is most beneficial for new investors looking to dip their toes into investing without hefty fees or for buy-and-hold investors who prefer a hands-off, minimalist approach to managing their portfolios. Its intuitive app design and simplified trading process can also appeal to mobile users who prioritize convenience and ease of use over advanced trading tools and research capabilities.

The platform’s approach to investment, which emphasizes ease over detailed analysis, makes it an attractive option for newcomers but may fall short for those seeking in-depth research tools or a wider range of investment options.

How to Invest in Stocks

Investing in stocks is an excellent way to build wealth over time, appealing to everyone from the passive investor to the advanced investor.

Before diving in, it’s crucial to understand the basics of the stock market and the different investing strategies available. One of the first steps is to choose a reputable brokerage service that aligns with your investment goals and experience level. These platforms offer access to a variety of investment options, including stocks, bonds, ETFs, and IPO investing. They also provide essential tools like real-time market data, which is vital for making informed decisions.

When starting your investment journey, it’s important to consider how much you’re willing to invest. Many online brokerages now offer a low or even no investment minimum, making it easier for beginners to get started.

However, it’s not just about how much you invest but also how you invest. Diversifying your investment portfolio is key to managing risk and achieving steady growth. Whether you’re a passive investor looking to set and forget your investments or an advanced investor seeking to leverage complex strategies, there’s a place for you in the market. It may also be beneficial to consult with financial planners or utilize resources provided by your brokerage to enhance your understanding of the market.

Here are some tips to help you start investing in stocks:

- Start Small. Begin with an amount you’re comfortable with, even if it’s low, to get a feel for the market. Many platforms allow purchasing fractional shares, making it easier to start small.

- Educate Yourself. Take advantage of educational resources offered by brokerage services and independent platforms. Understanding investing strategies, market trends, and the mechanics of IPO investing can significantly improve your investment decisions.

- Make Use of Technology. Don’t hesitate to use apps and platforms that provide real-time market data and analytics. This can help you make more informed decisions and stay updated on market movements.

- Diversify Your Portfolio. Spread your investments across different asset classes to mitigate risk. Including stocks from various sectors, bonds, ETFs, and even exploring IPO investing can provide balanced growth.

- Consider Your Financial Goals. Align your investment choices with your long-term financial goals. Whether saving for retirement, buying a house, or accumulating wealth, your goals should influence your investing strategies and risk tolerance.

Remember, investing is a marathon, not a sprint. Patience, continuous learning, and staying informed are key to navigating the stock market successfully.

FAQ

What is the best stock market app for beginners?

Robinhood is one of the best stock market apps for beginner investors. There’s a reason why a lot of users got introduced to the stock market through it: in many ways, this app democratized stock market trading. Robinhood is highly regarded for its straightforward interface, making it simple for newcomers to trade stocks or even just buy shares of stock.

The ideal app for a beginner is one that balances simplicity with the depth of features, offering advanced tools when the user is ready to progress, all while keeping a finger on the pulse of market news.

How to find stocks to buy?

Finding stocks to buy requires a blend of research, strategy, and the right tools. Start by defining your investing strategies and goals. Are you a passive investor looking for long-term growth, or are you more aggressive, interested in IPO investing or high-volatility stocks for short-term gains? Utilize brokerage services that offer comprehensive real-time market data and advanced tools for analysis.

Mobile trading apps like Fidelity are renowned for their in-depth market news, analytics, and educational resources, helping investors identify promising shares of stock. These platforms allow for a detailed examination of stock performance, company fundamentals, and market trends. Additionally, engaging with financial planners or using educational resources provided by these apps can offer insights into market dynamics and investment opportunities, guiding your decision-making process.

What are the best investment apps?

When it comes to the best investment apps, the focus is on versatility, offering a range of services from mobile platforms to advanced tools for both beginners and advanced investors. Apps like Charles Schwab and Interactive Brokers excel by providing a comprehensive investment account experience, including access to a wide range of investment options, real-time market data, and personalized advice from financial planners.

These platforms stand out among the best stock trading app options due to their ability to cater to a broad spectrum of investment needs, from simple stock trades to comprehensive portfolio management, all accessible through mobile apps for on-the-go trading and investing.

What is the safest stock investment app?

The safest stock investment app is one that, besides robust security features and reliable customer service, is backed by a reputable financial institution. For stock traders looking for security and peace of mind, apps like Fidelity and Charles Schwab are often considered among the best stock trading apps. They provide extensive security measures, including two-factor authentication, fraud protection services, and encryption of personal and financial information. These platforms are well-regarded in the industry, ensuring that users have a secure environment for trading stocks.

What is a good free stock trading app?

A good free stock trading app is one that combines zero commission fees with a user-friendly interface and a solid range of investment tools. Robinhood is widely recognized as the best stock trading app for those looking to trade stocks without incurring hefty trading fees. It’s designed with beginners in mind, offering a straightforward platform for stock traders to buy and sell shares without the hassle of extra costs. Additionally, Robinhood provides access to real-time market data, making it a popular choice for investors seeking a cost-effective and efficient trading experience.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.