NFT Prices Are Still Lagging Behind Ether’s Gains

Ether, and crypto broadly, have posted gains of more than 10% since the start of the year, while NFT prices are trailing.

Stakeholders and analysts say utility and technological development are needed to bring growth

Crypto is inching toward bull-market territory, but non-fungible tokens (NFTs) have failed to benefit from the market euphoria.

While ether (ETH) is up approximately 70% year-to-date, NFT valuations aren’t following. Nansen’s NFT-500 index, which measures the valuation of the top 500 NFTs, has dropped 50% year-to-date when denominated in ether and 16% in dollar terms.

The Blue-Chip 10 index, which measures the valuations of the most prominent NFTs, such as CryptoPunks and the Bored Ape Yacht Club, is down 44% in ether terms, 1.7% in dollars.

OpenSea, the largest NFT marketplace, hasn’t fared much better. At the height of NFT mania in January 2022, the platform was clearing $387.48 million in fees every month and $120.45 million in revenue, according to data from DeFiLlama. Now, fees have slumped to $6 million a month and revenue to $1.39 million.

“NFTs have survived their first market cycle and have yet to take on a new jumping point in technology to usher in more user interest, like DeFi had with Uniswap’s AMM,” Nick Ruck, the COO of ContentFi, a decentralized IP-focused content financial ecosystem, said in an email interview. “Many new innovations are still being built to increase the use cases of NFTs, but it’s also partly due to the fact that NFT prices are generally negatively correlated with the USD price of ether.”

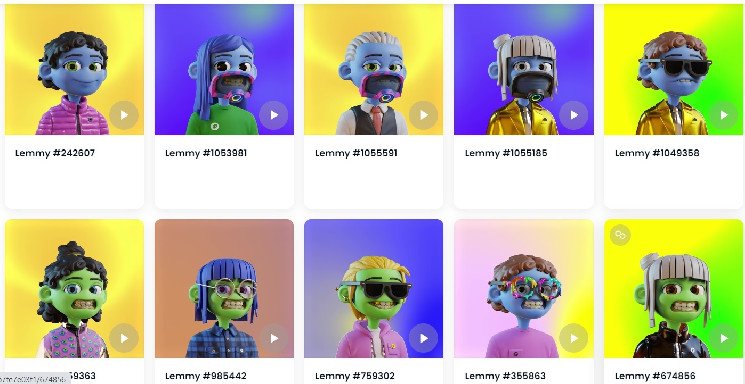

There are some signs of growth in the market, however, including a growing market of NFTs based on utility rather than monkey JPEGs, applying the technology to things like ticketing and loyalty programs.

Bitcoin ordinals also continue to grow in popularity, with miners appreciating the fees. Sora Ventures’ Jason Fang attributed their success to them being a hub for the growing development of something similar to a layer-2 for the Bitcoin blockchain.

“Bitcoin ordinals is not only a breakthrough for bitcoin utility, but also a hub that brings communities together,” he said in an interview by email. “Communities like Stacks, BSV, Rootstock, and even Starkware, which don’t usually interact with each other, are all exploring ways to get involved and build on Ordinals Protocol – everyone found a common ground and wants a piece of it.”

David Mirzadeh, Ecosystem Finance Lead of Taiko, says this utility is also the narrative driving the NFT rebound.

“I see NFTs recovering some of the ground they have lost once they move beyond just speculative JPEGs to assets with utilities in areas such as games, music, and social,” he said. “Until then, their price performance will largely depend on speculative hype and mania.”