Billionaire Chamath Palihapitiya Predicts Market Rally, Says $6,000,000,000,000 Waiting To Be Deployed

Billionaire venture capitalist Chamath Palihapitiya says that markets are ripe for a strong rally as a deluge of capital looks to find a new home.

In a new episode of the All-In Podcast, the billionaire says that the macro picture is starting to look positive for the United States.

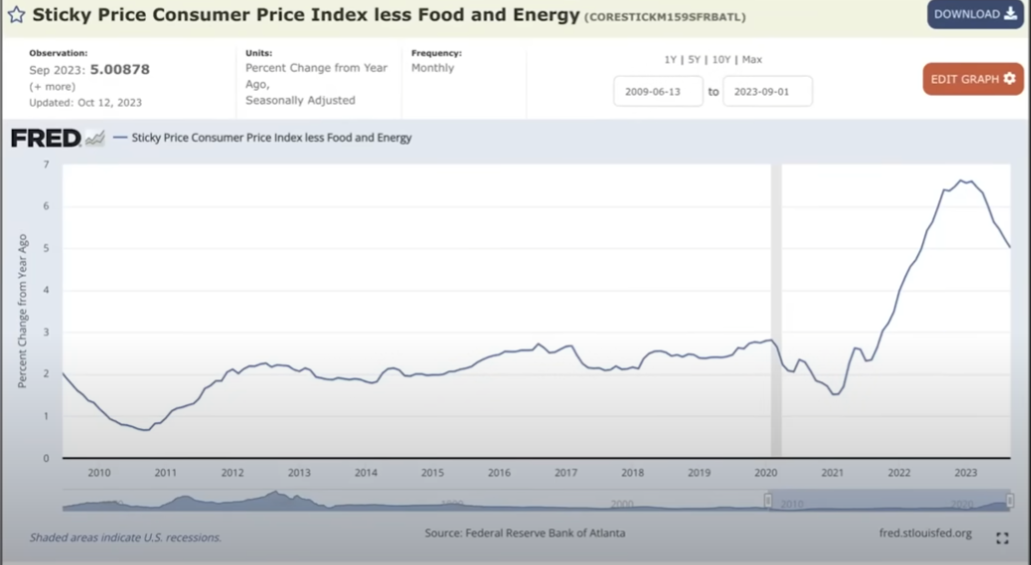

The Social Capital founder first looks at the consumer price index (CPI), which tracks the country’s rate of inflation over time. According to Palihapitiya, the CPI is starting to roll over indicating that high inflation rates are a thing of the past.

“We are really in a decent place with inflation. If you think about what’s going to happen in the next six months, it’s mostly in the bag… There’s a lag effect on a handful of [CPI] components, specifically rents, which when you roll them into this inflation rate, you’re going to see it really, really turn over very quickly.

So we know that inflation is falling. It’s going to fall even more.”

Palihapitiya then looks at the amount of capital stockpiled in money market funds. According to the venture capitalist, trillions of dollars worth of capital may move out of money market funds and flow into the stock market to chase higher gains.

“I think the setup is basically the following. There’s less money in the system. That’s a positive.

There’s more money on the sidelines… Look at the amount of money in money market funds – $6 trillion and growing, so that’s a really positive sign which is money will need to find a home…

So that’s trillions of dollars that have to get deployed… Now you introduce rate cuts and that’s a real accelerant. More than likely, I think what that means is that markets are set up to do pretty well, equity markets specifically.”

Palihapitiya ends his analysis by saying that he’s optimistic about the prospects of the US economy with the Federal Reserve poised to cut rates by mid-2024.

“Inflation is very much in the rearview mirror. Rates are going to get cut by the middle part of the year. The economy looks like it’s going to be a soft landing. That is actually very beneficial for the sitting president. It’s also good for equities. It’s good for us… I think we’ve had a fundamental change.”

I

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3