Ripple CLO Alderoty: Federal Judge’s Ruling Has No Impact On XRP

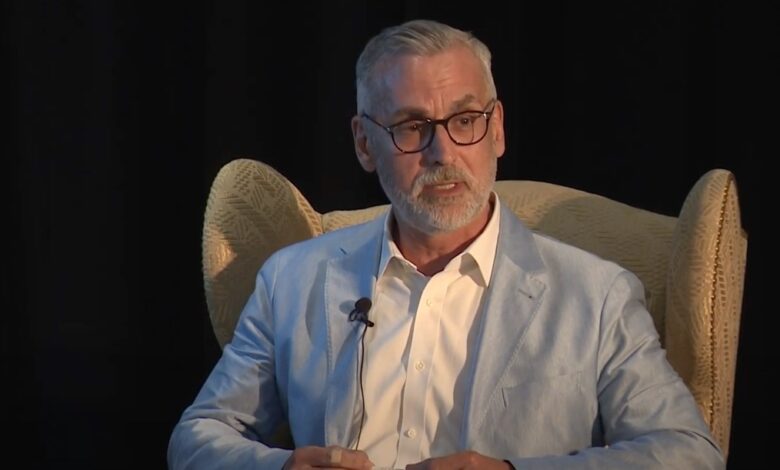

Bad news for Ripple and XRP? The U.S crypto regulation landscape, already mired in uncertainty, has been thrown into further turmoil yesterday following diverging judicial opinions about the classification of cryptocurrencies as securities. However, Ripple Labs’ Chief Legal Officer (CLO) Stuart Alderoty has held firm, insisting that a recent controversial ruling against Terraform Labs has no bearing on the Ripple case.

Ripple CLO Brushes Off Chatter

This fresh judicial storm began when U.S. District Judge Jed Rakoff recently approved the SEC’s case against Terraform Labs, challenging the precedent set by Judge Analisa Torres in the Ripple case. Judge Rakoff rejected the distinction drawn in the ruling between public and institutional sales, leading many in the crypto space to speculate about the potential implications.

In the aftermath, the former SEC enforcement attorney claimed that Judge Rakoff’s decision is perhaps the first, but certainly not the last rejection of the Ripple decision, as Bitcoinist reported. Brushing off the chatter, Stuart Alderoty issued a clarifying statement, asserting:

Let me be clear about some confusion going around – the ruling in the Terra case changes NOTHING about the Ripple ruling that XRP is not a security. […] Our ruling came after a full factual record (developed over 2+ years) was presented to the Court.

Alderoty also indicated that the Terra case was still in its early stages, adding that the presiding judge had to accept all SEC allegations as true for the time being. He hinted at what he perceives as a misinterpretation of Judge Torres’ reasoning by Judge Rakoff.

In addition to his reassurances about the Ripple ruling’s stability, Alderoty addressed the nascent Terra case, reminding the public that “the Terra case is just starting and that Judge has to accept everything that the SEC alleges as true (for now).”

He left further deep analysis to others but hinted at what he considers a misreading of the Ripple Judge’s reasoning by Judge Rakoff, particularly, “missing the point that secondary market traders can’t ‘invest money’ in anyone or anything if they don’t know who they are buying from.”

Ripple’s senior staff software engineer, Neil Hartner, supported Alderoty’s stance, stating, “If the SEC can prove their claim that Terra promoted promises that typical purchasers, no matter the venue, were well aware of, then that could satisfy Howey. The judge hasn’t ruled they proved that, just that the case has merit if it can be proven.”

The Ripple case had been lauded as a watershed moment in crypto regulation, as Judge Torres ruled that the XRP token was not a security when sold to the general public on secondary markets, but it was when sold directly to institutional investors. This decision was based on the Howey Test. Torres found that institutional sales of XRP fell under this test, while public sales did not.

The recent Ripple ruling brought a wave of optimism in the crypto market, but the Terra case reopens the debate on crypto regulation and the application of the Howey test. However, as CLO and senior Software Engineer remind us, the Terra case is still in the early stages with no solid evidence tabled as of yet.

At press time, the XRP price was at $0.69. Thus, XRP continues to consolidate after the rally of the SEC decision. Holding the 23.6% Fibonacci retracement level at $0.685 is crucial for a renewed push towards $1. Otherwise, a decline to $0.64 seems likely.

Featured image from CryptoGlobe, chart from TradingView.com