Simple Interest vs. Compound Interest: Which One is Better?

beginner

Interest rates play a pivotal role in our financial lives, impacting everything from our savings to the cost of borrowing money. This article aims to delve into two fundamental types of interest rates: simple and compound. To make informed financial decisions, it’s critical to understand the distinction between them, how they’re calculated, and their potential impact on your finances.

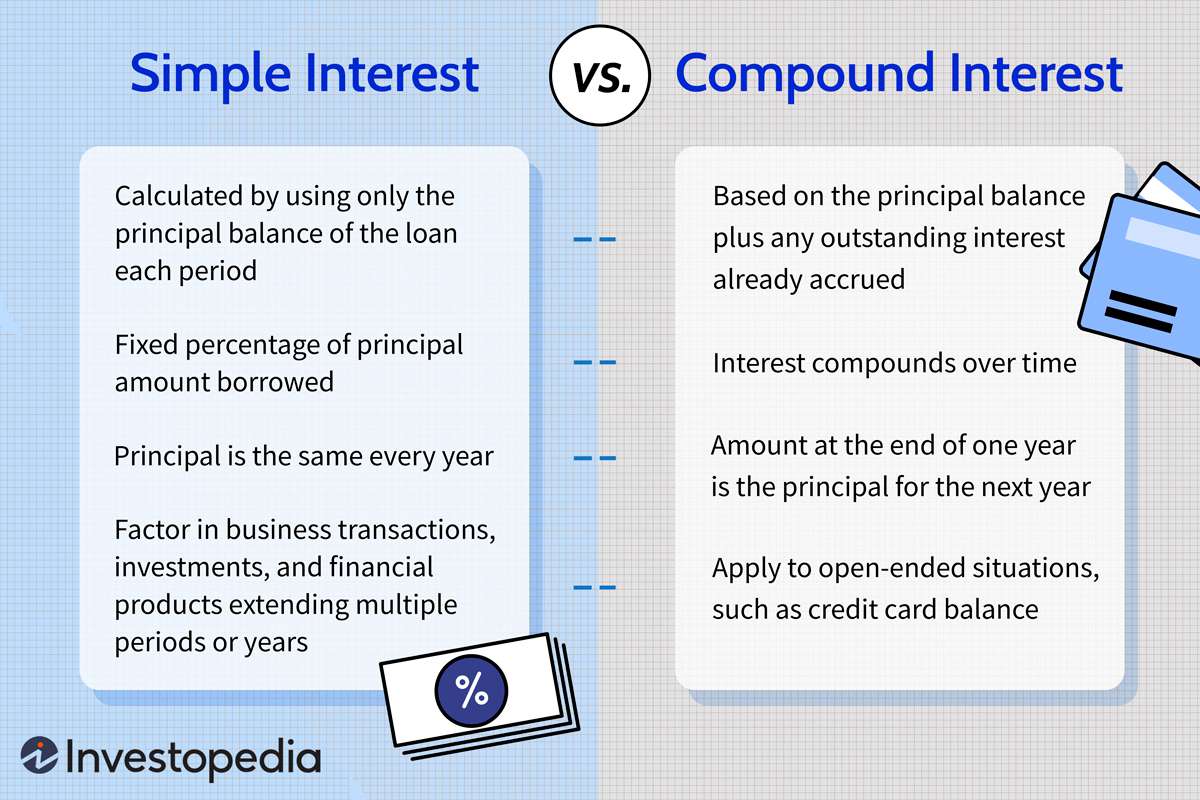

Simple interest is a straightforward concept computed on the original amount of money (principal) without taking into account any previously accumulated interest. On the other hand, compound interest takes into account not only the principal amount but also the interest that has accrued over time, leading to faster growth. This article will introduce you to their respective formulas, offering a clear understanding of how to calculate compound and simple interest. Additionally, I will outline the key difference between simple and compound interest.

My name is Daria Morgen, and I have been in the crypto industry since 2014. Being able to calculate compound interest has been a great help in my own investment journey, and I hope this article can help you to enhance your own trading strategies, too.

What Is Simple Interest?

Simple interest is calculated on the initial amount of money deposited or borrowed. It doesn’t consider any interest previously earned or charged. Many financial institutions, like banks and credit unions, use this model for certain products, such as student loans and some types of savings accounts.

How Does Simple Interest Work?

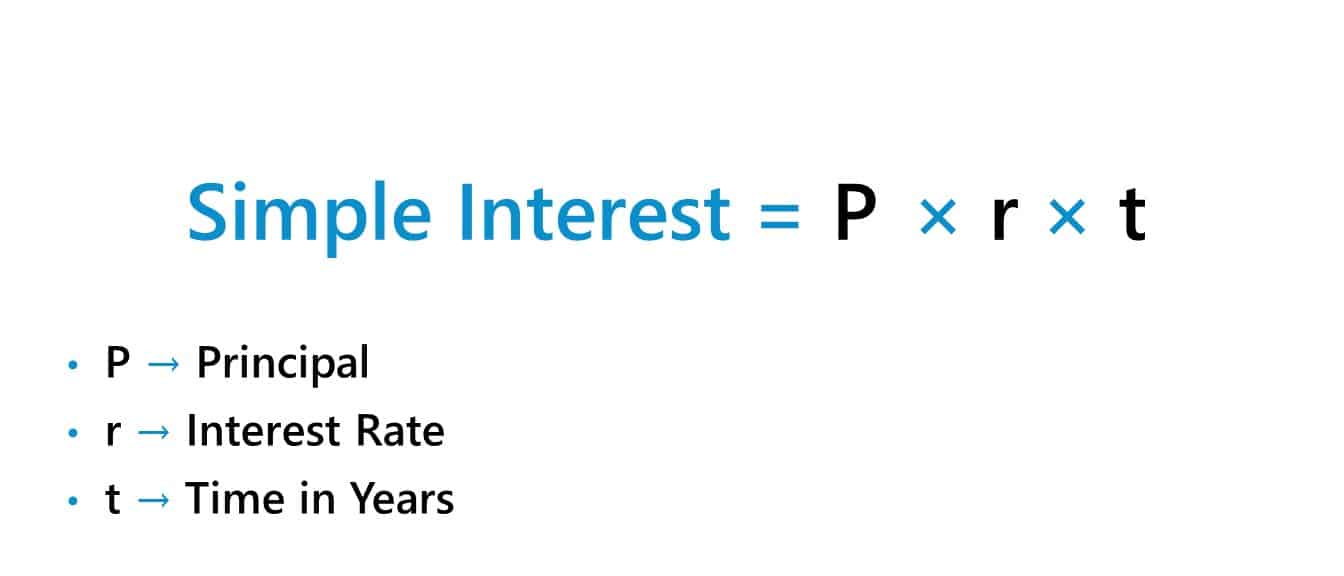

The simple interest formula is pretty straightforward:

Simple Interest = Principal * Annual Interest Rate * Time

This formula tells us that the interest is a product of the principal amount, the annual interest rate, and the time period for which the money is borrowed or invested. The time is typically expressed in years.

For instance, if you have a credit card that charges simple interest, you’re only ever charged interest on the principal balance, regardless of any accumulated interest from previous billing periods.

Simple Interest Example

Let’s assume you deposit $1,000 in a savings account with an annual interest rate of 5% and leave the money there for one year. The simple interest earned would be:

Interest = $1,000 * 5% * 1 = $50

At the end of that year, you would have $1,050 in your savings account.

What Is Compound Interest?

Compound interest, on the other hand, can be thought of as “interest on interest.” It takes into account both the principal balance and the interest that has previously been added.

Compound interest is common in many financial products like credit cards, savings accounts, certificates of deposit (CDs), and even some student loans.

How Does Compound Interest Work?

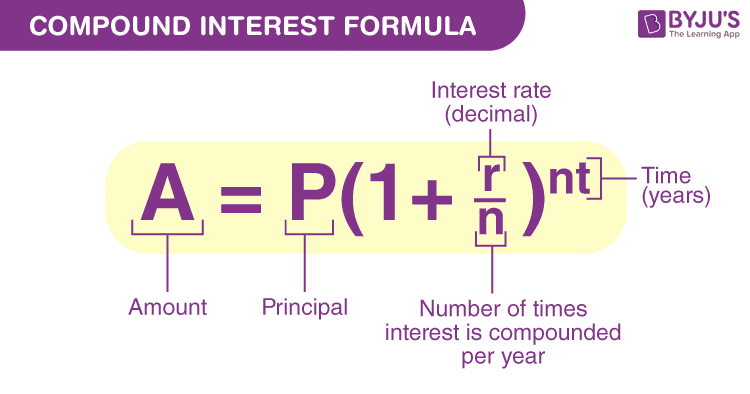

The formula for compound interest is a bit more complex than the simple interest formula:

Compound Interest = Principal * (1 + Annual Interest Rate / Number of Compounding Periods)^(Number of Compounding Periods * Time) – Principal

This formula demonstrates that the interest is calculated on the initial amount and the accumulated interest from previous time periods. The number of compounding periods can vary. It could be annually, semi-annually, quarterly, or even daily.

Compound Interest Example

Let’s take the same $1,000 deposit at an annual interest rate of 5%, but this time, the interest is compounded annually. At the end of one year, your savings account would have:

Interest = $1,000 * (1 + 5%/1)^(1*1) – $1,000 = $50

This looks the same as the simple interest example, right? That’s because the effects of compound interest really start to show over longer periods of time. Let’s say you leave the money for five years instead:

Interest = $1,000 * (1 + 5%/1)^(1*5) – $1,000 = $276.28

At the end of five years, you would have $1,276.28 in your savings account. That’s significantly more than you’d have with simple interest.

Simple Interest vs. Compound Interest. Which One to Choose?

Whether simple or compound interest is better for you depends on whether you’re borrowing or investing money.

If you want to borrow money, you’d generally prefer a loan with a simple interest formula, as you’d end up paying less over the loan term compared to compound interest. This is because you’re only being charged interest on the original principal, not on any accumulated interest.

Conversely, if you’re investing or saving, compound interest could be more beneficial as it allows your money to grow at a faster rate over time due to the effect of compounding. This means that you earn interest not only on your original investment but also on the interest that your investment has already earned.

Simple or Compound Interest for Crypto

When it comes to investing in cryptocurrencies, the choice between simple and compound interest depends on your financial goals and risk tolerance. If a crypto platform offers interest on holdings, compound interest could lead to more substantial growth over time. However, as with any investment, it’s crucial to understand the risks and potential rate of return.

In conclusion, understanding the differences between simple and compound interest is critical for making informed financial decisions. It can greatly impact how much you end up paying on loans or earning on investments over a period of time.

FAQ

What is the formula for calculating interest?

The formula for calculating simple interest is quite straightforward: Simple Interest = Principal * Annual Interest Rate * Time. It’s calculated on the initial principal amount without considering the interest that accumulates over time.

In contrast, the compound interest formula is more complex: Compound Interest = Principal * (1 + Annual Interest Rate / Number of Compounding Periods)^(Number of Compounding Periods * Time) – Principal. Compound interest is calculated on the initial principal and also on the accumulated interest from previous periods.

How are simple interest and compound interest different?

The key difference between simple interest and compound interest lies in how the interest accumulates. Simple interest is calculated only on the original amount (principal) that you deposit or borrow, whereas compound interest is calculated on the principal amount and any accrued interest. This means that with compound interest, you earn or owe interest on the interest.

Which type of interest can earn more money over the long term?

Over the long term, compound interest can earn more money. This is due to the effect of compounding, where you earn interest on both the money you’ve originally invested and the interest you’ve already earned.

How do simple interest rates affect monthly payments on loans?

For personal loans or any other loan that utilizes simple interest, the monthly payment mostly stays the same throughout the loan term. This is because the interest is calculated only on the original principal, and the overall loan amount doesn’t increase due to the additional money generated by accumulated interest.

Does the frequency of compounding interest affect how much interest you earn or owe?

Yes, the frequency of compounding can significantly impact the amount of interest earned or owed. The more frequently interest is compounded, the more interest accumulates, provided that the annual rate remains the same. For example, interest compounded daily will accrue more than interest compounded annually.

How does the Annual Percentage Rate (APR) relate to simple and compound interest?

The Annual Percentage Rate (APR) is a standardized way of expressing the cost of borrowing money, which includes both the interest rate and any fees associated with the loan. For loans with simple interest, the APR and the interest rate will typically be the same. However, for loans with compound interest, the APR will be higher than the stated interest rate due to the effect of compounding.