Litecoin Price Weakens Below $100 As Bears Extend Their Grip

Litecoin (LTC) has recently faced a significant decline in its price, with bears gaining momentum as it slumps below the crucial $100 mark. LTC, often referred to as the “silver to Bitcoin’s gold,” has been a favorite among investors seeking an alternative to the pioneer cryptocurrency.

The bearish momentum behind Litecoin’s decline raises questions about the factors driving this price slump and the potential implications for the broader cryptocurrency market.

Will Litecoin be able to regain its strength and recover from this setback, or is there more downside ahead?

Bears Pull LTC Price Down

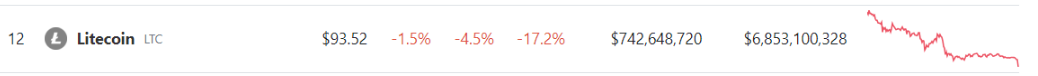

Litecoin is currently experiencing a downturn in its price, with CoinGecko reporting it at $93.52. This marks a significant decline of 4.5% within the last 24 hours and a substantial seven-day slump of 17.2%.

Source: Coingecko

As the price slips below the crucial $100 mark, traders and investors are closely monitoring the situation and assessing the potential factors that could influence LTC’s rebound.

The recent dip below $100 has sparked concerns among market participants, indicating that sellers might be gaining the upper hand.

Traders and investors are now paying close attention to the $90-$92 price range as a critical zone that could determine the outcome of the ongoing battle between the bulls and the bears.

LTC market cap currently at $6.8 billion on the daily chart: TradingView.com

According to an LTC price report, if the price manages to hold above this level and the bulls can regain control, it could indicate a potential recovery for LTC.

However, a breach of this support zone may further fuel the bearish sentiment and lead to additional downward pressure on Litecoin’s price.

Insights And Technical Factors To Consider

To anticipate how Litecoin will rebound from this slump, traders and investors should closely examine various insights and technical factors. Factors such as trading volume, price patterns, and support/resistance levels should be considered to gauge the strength of a potential rebound.

Apart from technical considerations, market sentiment and external factors also play a crucial role in Litecoin’s price movement. As the broader cryptocurrency market often influences individual assets, monitoring industry-wide trends becomes vital.

LTC seven-day price action. Source: Coingecko

Traders and investors should keep a close eye on Bitcoin, the leading cryptocurrency, as Litecoin has often displayed a strong correlation with its price movements.

If Bitcoin experiences a significant recovery, it could potentially boost sentiment across the cryptocurrency market and provide support for Litecoin’s rebound.

Any positive developments in terms of regulatory clarity or major adoption announcements may also generate renewed interest in Litecoin and drive its price higher.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pexels