NFTs Are Crashing (Again). Here’s Why.

The NFT space isn’t what it used to be. This has become painfully obvious to those within Web3 over the past few months. From controversial memecoin escapades to overwhelming regulatory initiatives, the magic of the metaverse has been palpably waning throughout 2023.

As it stands, the current state of the non-fungible ecosystem is a far cry from the market highs that helped kick off the year. Yet, this round of “NFTs are crashing” feels different than times past. With this bout, the causation behind NFTs slowing down feels more nuanced. Rather than fear, uncertainty, and doubt (FUD) leading the market down, there could be something more at play.

NFTs by the numbers

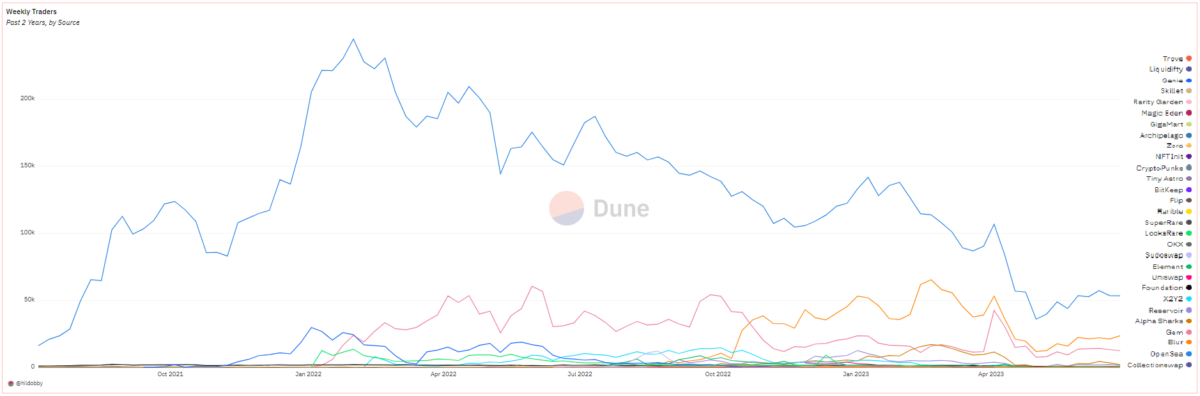

Although community sentiment is difficult to measure quantitatively, market health can usually be gauged by the charts. These looked good at the beginning of the year, with NFT sales up 43 percent. This was a welcome change from the bear market that enveloped the majority of 2022.

Yet, in recent months it’s become clear that the success we witnessed in Q1 has not continued. Thus far in 2023, the majority of NFT sales volume has been generated on Blur (more on that later). And while volume was up in a big way during the winter, after peaking in February, both volume and trades dropped and dwindled throughout the spring.

It initially didn’t seem all bad, though, because, at the start of the sunny season (June), the NFT market witnessed a slight uptick in activity. But upon further inspection, it became clear that this uptick might not necessarily be indicative of a positive trend but rather a variety of issues currently unfolding across a range of prominent blue-check projects.

Bored Apes and Azuki

Most notably, the Bored Ape Yacht Club and Azuki — which have each respectively become the center of attention at some point in 2023 — have been feeling the heat. Although, over the past few months, the majority of NFT sales volume has come from these two projects, this latest round of trading seems oddly decoupled from the rest of the NFT ecosystem.

That’s because instead of demand fueling trading and resulting in floor prices rising, as we’ve seen time and time again with the launch of secondary collections, current trading seems to be the result of floor prices dropping and traders subsequently looking to cash in on a good deal.

While this isn’t uncommon in Web3, especially as Blur continues to dominate the market, it’s odd for such an event to happen to BAYC. As a silo within the NFT space, BAYC (and CryptoPunks, for that matter) has anecdotally existed in a world of its own, unwavering in the face of speculation and regulation. But recently, this has changed.

In the case of BAYC, floor prices have been steadily dropping. At the time of writing, the collection floor sat around 30 ETH (about $57,000). Notably, this is the lowest we’ve seen Apes fall since 2021. A similar narrative is playing out with Azuki, with the brand’s core collection having hit a floor of just under 7 ETH ($13,000).

Although there are a number of reasons this price action may be happening, many holders and enthusiasts have pointed to dilutions and fragmentation as the root cause. More specifically, BAYC holders have felt disenfranchised by Otherside and HV-MTL, effectively splitting the Yuga NFT ecosystem. Similarly, Azuki enthusiasts were thrown into a tizzy in light of the brand’s recent controversial expansion, Azuki Elementals.

Of course, there are still considerations to be made regarding the effect that BAYC and Azuki are having on the market. For one, holders from blue chip collections such as these have actually remained rather steadfast. Yet, while HODLers be HODLing, price is (and historically has been) determined by incremental buyers and sellers. Long story short, if there are no new buyers, there is often a slow bleed downwards.

Furthermore, while Bored Apes and Azuki NFTs waning undoubtedly affects the NFT ecosystem at large, they aren’t the sole catalysts for NFTs going down. Azuki Elementals did serve to remove somewhere around $38 million from the ecosystem, which means even whales are likely being conservative with their purchases currently.

The Blur effect

Another probable candidate partially responsible for this latest crash isn’t collectors but rather the platforms and marketplaces they operate within. When once OpenSea was the dominant force in the greater NFT market, Blur has unequivocally taken over as the major breadwinner of the non-fungible ecosystem. Of course, the path to Blur’s prominence wasn’t devoid of controversy, and even now, the greater NFT community speculates about how the platform’s infrastructure might push NFT collection prices down.

The most major point of contention concerning Blur comes from its native token, $BLUR. Through several airdrops, the token sought to reward platform loyalty and user engagement — a system we’ve seen used many times over with governance and community tokens ($RARI, $LOOKS).

However, the $BLUR token rewards (paired with a royalty-free marketplace) is a major draw for high-profile collectors. While Blur’s aforementioned monopoly on NFT sales volume is undoubtedly impressive, it’s recently come to light that a handful of prominent traders might be using the platform’s incentivization system to wield an influence over NFT prices.

Now, Web3 observers are wondering if the marketplace’s successes didn’t come without a potentially larger cost to the broader NFT ecosystem. In response, some have even taken the stance that Blur’s popularity as an opportunity for token farming might have the power to tank the NFT market altogether.

A holistic view of the blockchain

Specific cases like BAYC, Azuki, and Blur aside, though, there’s more to be said about the NFT macroclimate as a contributing factor to the current downward trend we’re seeing within the NFT market itself. And surely top of mind for most within the blockchain industry is that ETH is pumping, and the government is watching.

At this current stage of maturation in Web3, the unpredictable price action of crypto paired with mounting regulation of the crypto and NFT space have added a palpable layer of uncertainty to the future of the blockchain industry. These factors, above many others, are surely influencing buyer behavior and contributing to market fluctuations.

Specifically, in the case of ETH, significant price action often poses a threat to the price of NFTs. As ETH rises, many traders opt to take profits or, at the very least, reconfigure their portfolios to use ETH as a safe haven for market volatility. In other cases, collectors might attempt to offload some NFTs at floor prices or seek out major sale opportunities (like a sub-30 ETH Ape), further influencing the market.

If we were to look at an even more macro view of Web3, though, it seems likely that advents like Soulbound Tokens, NFT Ticketing, and “phygital” goods struggling to truly cross over to the mainstream might also be having an effect. Overall, there’s been a decrease in major brands entering the NFT space, and the acronym itself has gone down in usage in pop culture compared to where it was at the height of the initial boom.

Of course, it truly is anyone’s guess where the NFT space will be even a year from now. But with market factors in mind, creators, collectors, and builders alike would do well to be mindful of the changing NFT landscape and remember why the creators of culture began flocking to the blockchain in the first place.