Blue-chip NFTs hit hard as over 1,200 liquidations rock market

The NFT market experienced a significant shock in the past three days, with over 1,200 NFTs being liquidated due to a record-low plunge in the floor price of several prominent or ‘blue-chip’ NFTs

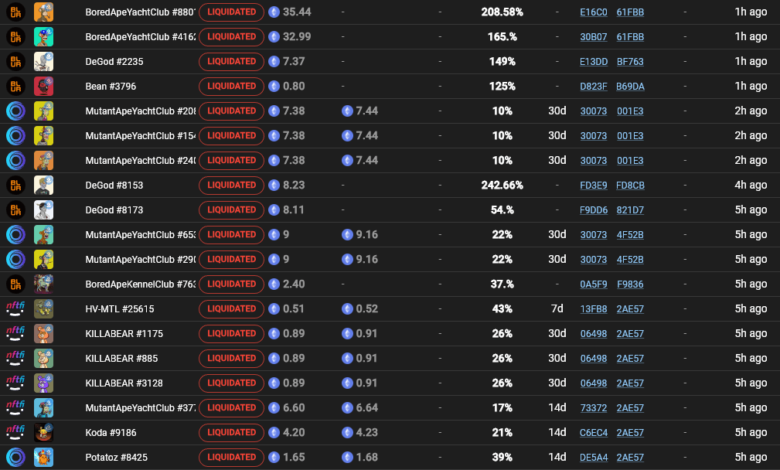

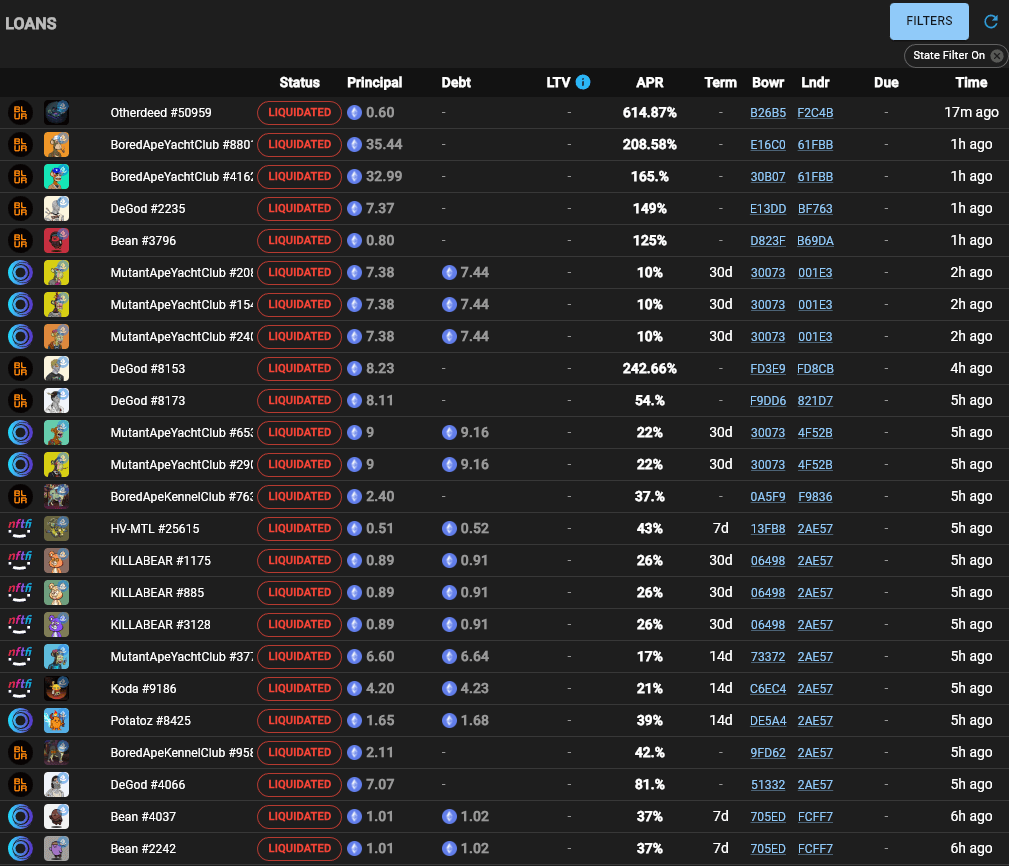

Data from the NFT analysis site, Snow Genesis, shows that hundreds of NFTs used as collateral for loans are at risk of being liquidated. While some of these debts have been repaid, several NFTs have already been listed for auction. The table below shows the most recent NFT liquidations from Snow Genesis as of press time.

CirrusNFT, Wumbo Labs, noted that several investors who took loans on their blue chips NFT, including Azuki, CloneX, MAYC, and BAYC, were impacted during the period. Beanz NFT collection saw the most liquidation as 636 of its NFTs—3% of its total supply— were affected.

Cirrus said the pace of these liquidations was alarming, highlighting the daily average for last year to be between 10-15 NFTs. However, He added:

“Good news is that the rate of liquidations has slowed drastically over the last few hours and there aren’t a crazy amount of underwater loans left.”

NFTs floor price tank

Over the past week, the floor price of several NFT collections massively plunged despite the upward price movement across the broader crypto market.

Bored Ape NFTs floor price crashed below 30 ETH on July 2, its lowest value since October 2021, before recovering to its current worth of 31.5 ETH, according to Coingecko data.

At its peak, Bored Ape NFTs sold for over 500 ETH, with several A-list celebrities, including Justin Bieber spending over $1 million on one of the collections.

Azuki also recorded substantial losses for its holders following the shoddy release of its Elementals collection. The floor price of the collection fell by more than 20%, with its community members proposing to sue its founder Zagabond for 20,000 ETH.

Meanwhile, other blue-chip NFT collections like DeGods, Pudgy Pegions, Azuki Elementals, and BAKC, Moonbirds also took significant hits to their value during the reporting period.