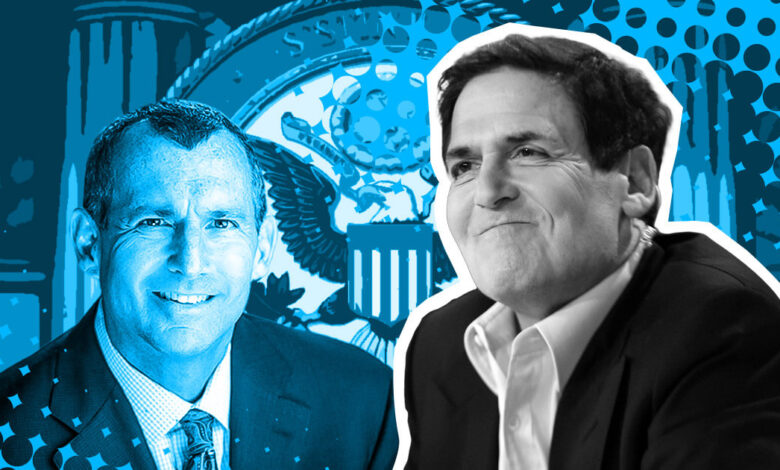

Mark Cuban debates crypto regulations with former SEC official

A recent Twitter exchange between two prominent figures in the world of finance and technology, entrepreneur Mark Cuban and former SEC official John Reed Stark, has drawn attention as an example of positive, civil discourse around complex and contentious issues.

The billionaire and the former enforcement official engaged in a spirited debate over the intricacies of securities law as they pertain to cryptocurrency. The conversation transpired in view of the public, with both parties passionately yet respectfully presenting their viewpoints.

John Reed Stark, now a private consultant, was the founder and former head of the SEC’s Office of Internet Enforcement. Mark Cuban is a billionaire entrepreneur known for his investments in various tech companies and as a high-profile media personality. He has been an outspoken advocate for cryptocurrencies and blockchain technology.

Spirited conversation

The debate centered around the notion of regulatory clarity in the realm of cryptocurrency, a hotly contested issue in the financial world.

Among Stark’s key arguments is against the notion of inadequate “regulatory clarity” in the cryptocurrency industry, arguing instead that securities regulation is intentionally broad and all-encompassing, with precision often deliberately avoided to allow for the regulation of a wide array of financial instruments. He also suggested that the crypto industry often cries foul and challenges the enactment of any specific regulatory crypto-related rules when they are introduced, despite their calls for regulatory clarity.

Cuban, however, countered these points from a practical standpoint, taking issue with the contention that all crypto projects can be lumped together under the umbrella of “enterprises.” “Not all crypto businesses that have tokens or are considering using tokens are large ‘enterprises,’” he wrote, continuing:

The vast majority of crypto applications are small. Maybe 3 people. I had someone from one of those small companies call the SEC and ask for guidance on getting registered. The response from the SEC was “here are some cases to review, get a lawyer to help you.”

That is the fundamental problem.”

Cuban likened this to cities enforcing licensing laws on a lemonade stand, arguing that it was fundamentally problematic to place “enterprise”-level burdens on extremely small startup projects.

He also raised concerns about the political implications of the personal goals of SEC executives and their influence over enforcement decisions.

The two figures continued the debate for over 24 hours and covered such topics as pink sheet stocks, FIDC insurance loopholes, celebrity culpability, and more. The entire discussion can be found here.

“Acres of common ground”

In spite of many disagreements and very different backgrounds, Cuban and Stark’s conversation avoided the common pitfalls of online debate. In his reflection after the fact, Stark commented that while they “often vehemently disagreed,” they nevertheless “discovered acres of common ground.”

In a social media landscape often characterized by hyperbole and dismissiveness, Stark and Cuban maintained a respectful, even amicable tone throughout their exchange and concluded by emphasizing points of agreement. Stark likened the exchange to “an old fashioned Town Hall meeting, except with millions of attendees and lots of participation.”