Where to Draw the Legal Line?

In March 2023, the SEC charged eight celebrities with violating certain provisions of the Securities Act of 1933 in their promotion of cryptocurrency assets. The charges stem from Section 17(b) of the act, an anti-fraud and anti-touting provision that addresses the failure to disclose payments related to promotional activity.

The group of celebrities — which included Lindsay Lohan, Jake Paul, and Ne-Yo —specifically faced accusations of illegally promoting Tron (TRX) and/or BitTorrent (BTT) tokens offered by companies under the direction of Tron founder Justin Sun.

While the SEC won the case, the questions at the heart of the matter remain unanswered: Where does praising a cryptocurrency end and promoting one begin? Can there be such a thing as legitimate cryptocurrency promotion? And what determines the status of the asset as a security?

Other ongoing legal battles related to the illegal promotion of crypto — including those involving celebrities endorsing FTX like Tom Brady, Larry David, Stephen Curry, and others — revolve around the same crucial questions. With more than 20 percent of U.S. consumers owning and using crypto, it’s evident that clear lines need to be drawn when selling and promoting digital assets.

So, where is that line? And is there a legal difference between merely supporting a specific digital asset and unlawfully promoting it?

“Reasonable consumer/investor” vs. public figure/celebrity

At the most foundational level, the first question that should be asked is how we define what it means to “patronize” and support a particular digital asset — where an individual is merely sharing their investment holding with family, friends, and colleagues —versus what it means to “promote” that particular digital asset to a community-at-large with the specific intent of persuading another to invest their money into that individual asset.

Patronizing a digital asset isn’t too different from a person simply sharing what stocks they own with a family member, friend, or colleague. In this case, we have to assume that the average consumer doesn’t fully understand the mechanics of cryptocurrency, how it works, and the laws surrounding it — especially since the laws and regulations surrounding it are almost non-existent when it comes to the sale and promotion of digital assets.

So, what is “tipping” the scale of an individual harmlessly sharing excitement about a particular digital asset to taking a substantial step in wanting to create an “economic reliance” of such a magnitude that crosses into SEC territory?

It would seem that the specific facts and circumstances of the promotion that is predicated upon the following:

(1) who you are as a person/company,

(2) the resources at your disposal to intentionally communicate and promote the asset,

(3) the likelihood that your message/promotion will reach a large community of people, and

(4) the likelihood that the message/promotion will heavily influence a third party’s decision so as to create an economic reliance and financial decision based upon your social status.

Addressing the first element of “who the promoter is,” it would make sense to apply a “Reasonable Person” standard, which would draw the line of whether we are talking about an everyday consumer (experienced or novice) or a public figure/celebrity, which carries additional weight and responsibilities.

In most cases, it would appear that a reasonable, average consumer who is supporting and sharing their investment into a particular digital asset is (in most cases) not likely doing it for the expectation of helping increase the floor price or market price of that particular asset.

#TRX 🚀 @justinsuntron https://t.co/xh6xB6fNmo

— Jake Paul (@jakepaul) February 13, 2021

A public figure or celebrity, on the other hand, has by and through their “public” status a uniquely powerful ability to communicate at large a message or idea that has a very strong likelihood of persuading massive amounts of people to act or behave in a certain way – regardless of how experienced or well-versed they are in being able to convey such a message accurately.

For this reason, identifying who is actually promoting the digital asset is crucial in assessing the “why” behind their promotion and whether it constitutes an “illegal promotion” under current securities law.

The “look and feel” of the promotion

Another important aspect of determining the difference between patronizing and promoting is the “look and feel” of what is being shared. We’ve seen the SEC come down hard on celebrity endorsements of digital assets that ultimately speak to the look and feel of the celebrity’s promotion of a cryptocurrency, including the verbiage and nature of the disclosures specifically expressed in the post.

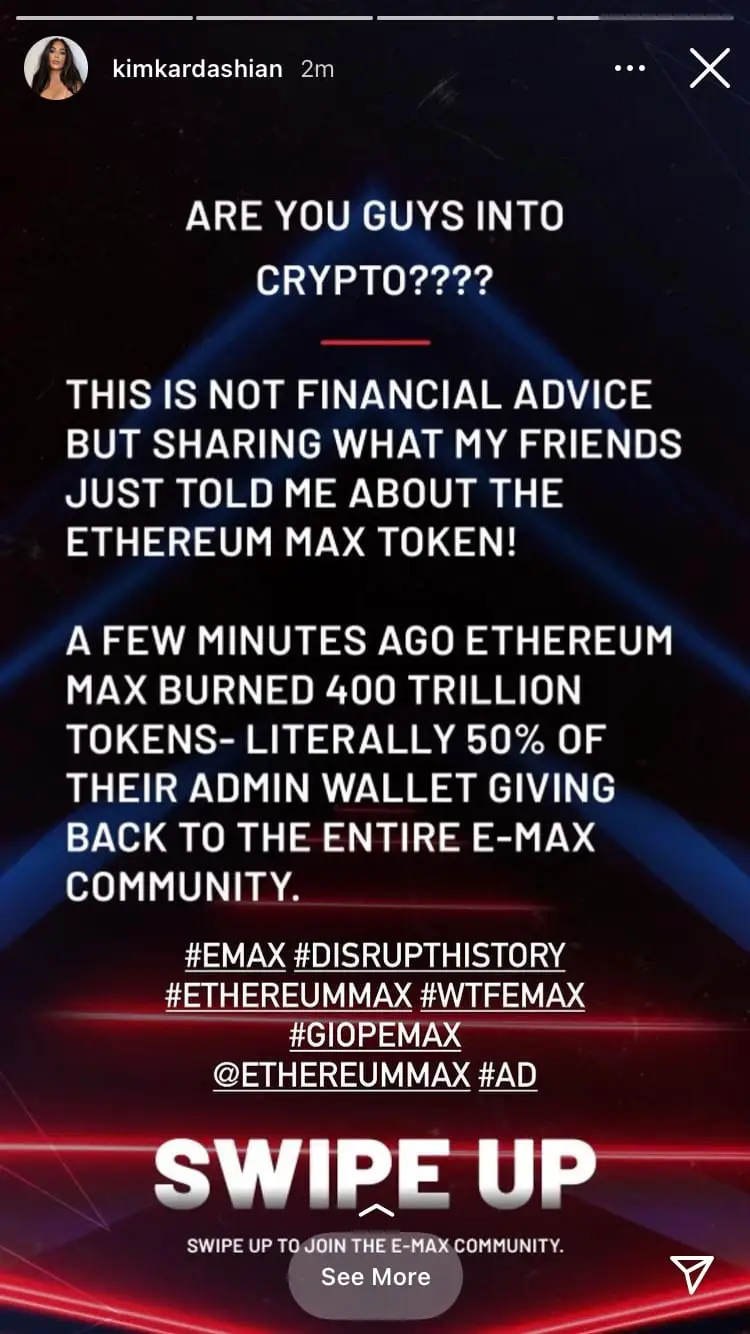

This began in October 2022 with Kim Kardashian and her illegal promotion of EthereumMax (EMAX).

While Kardashian agreed to settle the charges, paying $1.26 million in penalties, disgorgement, and interest, the SEC found that Kardashian had failed to disclose that she was paid $250,000 to publish a post in 2021 on her Instagram account (which now has 359M followers) about EMAX tokens.

Her post contained a link to the EthereumMax website, which provided instructions for potential investors to purchase EMAX tokens, but nothing else. While Kardashian had stated in her post that it was “not financial advice” in addition to adding different hashtags including “#ad,” the SEC said that wasn’t enough for compliance.

Other celebrities targeted by the SEC included Floyd Mayweather, Jr., DJ Khaled, Lindsay Lohan, Jake Paul, Soulja Boy, Akon, Ne-Yo, and Lil Yachty for the same reasons.

thanks guys, bought some BNB, DGB, TRX, KLV, ZPAE and FDO 💪🏾 what’s next? let’s go ✔️

— Soulja Boy (Draco) (@souljaboy) January 22, 2021

Then, in November 2022, FTX declared bankruptcy, leading to the collapse of the exchange and one of the biggest financial scandals since Enron and Bernie Madoff.

From Tom Brady, Madonna, and Gwyneth Paltrow to David Ortiz, Larry David, Jimmy Fallon, and more, the SEC brought its charges as FTX’s collapse continued to unwind while also showcasing the need for public figures to make the proper disclosures on their social media posts and TV advertisements that they are getting paid to promote these digital assets.

This was a reminder and warning to celebrities and other public figures that they cannot escape the requirements of the anti-touting provision of Section 17(b) of the Securities Act of 1933, which requires them to disclose to the public when they are getting paid to promote something, how much they are getting paid to promote investing in securities.

Under Section 17(b), a “promoter” is prohibited from publishing or circulating an article or communication for ‘a consideration received’ without fully disclosing that consideration. Under the law, a “consideration” is a mutual exchange of value that helps solidify the enforcement of a legal contract or agreement.

Navigating the unknown

Unfortunately, there is still a gray area concerning the anti-touting provisions of Section 17(b), because it only applies if the instrument being promoted is a “security.” And we still don’t have clear guidance on what constitutes a “security.”

This brings us to the recent sudden crackdown by the SEC against two of the world’s biggest crypto exchanges and the ongoing debate and controversy surrounding the SEC’s “enforcement by regulation” approach that is greatly harming the growth and development of the industry.

Senator Cynthia Lummis (R-WY), who, in addition to Senator Kirsten Gillibrand (D-NY), has been a strong advocate for the establishment of a complete regulatory framework, took to Twitter to share her adamant belief that the SEC has “failed to provide adequate legal guidance on what differentiates a security from a commodity.”

My statement on the SEC suing Coinbase, inc. https://t.co/5KNEM0IPSV pic.twitter.com/EgRIxrIcjj

— Senator Cynthia Lummis (@SenLummis) June 6, 2023

Both she and Senator Kirsten Gillibrand (D-NY) have been the driving force behind their proposed, landmark bipartisan legislation – the Responsible Financial Innovation Act, that would create a complete regulatory framework for digital assets that encourages responsible financial innovation, flexibility, transparency, and robust consumer protections while integrating digital assets into existing law – such as Howey.

The landmark 1946 U.S. Supreme Court case of Howey is the heart of any traditional securities analysis, presenting elements that must be considered in helping determine whether an instrument is considered a “security” or “investment contract.”

An industry-wide grey area

As it stands, this industry is operating in the gray in terms of how they introduce a digital asset to its customer base and the mechanisms underlying its purchase and sale of them, including the methods they use to promote and/or otherwise advertise the asset offering.

The pending litigation that we are watching unfold will unquestionably bring those circumstances front and center, beginning with what criteria makes a digital asset or offering a “security” (versus a commodity) and how a company or brand is able to legitimately promote that asset or offering to investors and the general public without violating securities law.

The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Readers of this article should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction.