Surging Bitcoin Dominance Threatens Altcoins: Investors On High Alert!

The Bitcoin market experienced a surge in accumulation as institutional investors continue to acquire more coins, bolstering both short-term and long-term holdings. This trend has been accelerated by the recent banking crisis in the United States and other countries, prompting prominent entities like MicroStrategy Inc., Tether USDT, and Tesla Inc. to increase their Bitcoin acquisition rates. Tesla, led by Elon Musk, has notably held onto its substantial Bitcoin holdings of approximately $184 million over the past two quarters.

Institutional Demand Soars Ahead Of Bitcoin Halving

Amidst this rising institutional demand, the market anticipates the upcoming fourth Bitcoin halving, scheduled for around April 27, 2024. Historically, Bitcoin halving events have triggered significant bull markets within the crypto space, often materializing a few months after the halving occurs.

Analyst Predicts Negative Exchange Balance

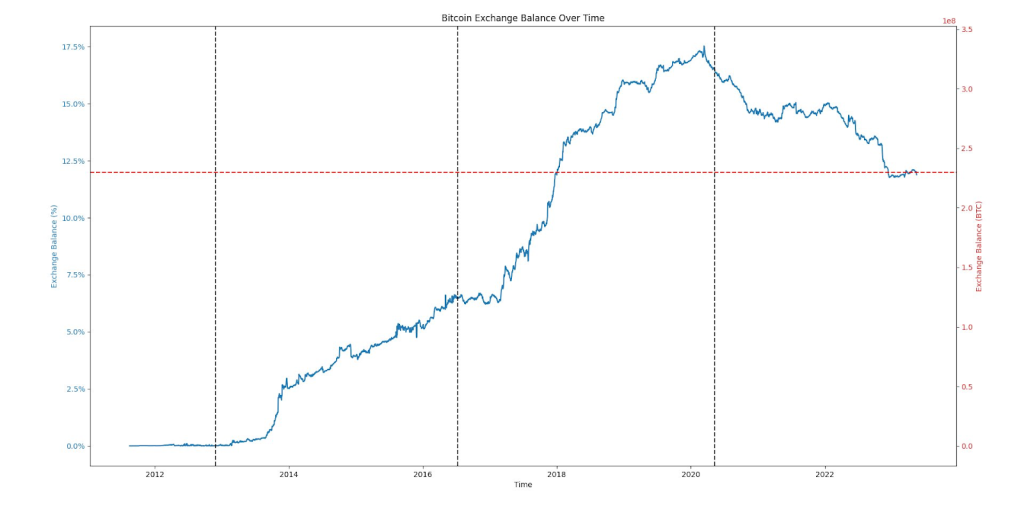

According to James V. Straten, an analyst associated with Glassnode, the upcoming Bitcoin halving is expected to result in a negative exchange balance for the first time. Straten points out that the Bitcoin exchange balance has already fallen below 12 percent for the second time this year.

“It should get interesting from April 2024 onwards,” the analyst concluded.

Altcoin Market Faces Liquidity Crunch

The liquidity within the altcoin market heavily depends on Bitcoin, as most coins are paired with BTC. Consequently, as more coins are withdrawn from exchanges, the possibility of a liquidity crunch in the near term increases. Additionally, the ongoing crypto crackdown in the United States is expected to thin out the liquidity in top digital assets, leading to heightened volatility in the altcoin market.

Also Read: Popular Analyst Says Altcoin Market is Weakening, says PEPE is a Sign – Coinpedia Fintech News