What Are the Consequences of the XRP Lawsuit for Ripple and Token Holders?

- The SEC’s lawsuit against Ripple has put the status of XRP under scrutiny, affecting both Ripple’s operations and the token’s market value.

- Ripple maintains that XRP is not a security, while XRP holders have filed a class-action lawsuit against the SEC.

- The lawsuit’s outcome could reshape crypto regulations and classifications, and the future of the crypto market at large.

- PROMO

The United States Securities and Exchange Commission (SEC) launched a lawsuit against Ripple Labs, the company responsible for the crypto XRP. The SEC asserts that Ripple carried out an unregistered securities sale, making XRP’s future uncertain. The lawsuit, initiated in late 2020, has far-reaching implications for Ripple, XRP, and its numerous holders worldwide.

Ripple’s core contention with the SEC revolves around classifying XRP as a security. The SEC’s stance is that XRP was sold as an investment contract, thereby making it a security, which necessitated proper registration. Ripple, however, argues that XRP is a currency, not a security, hence exempt from such regulations.

Ripple’s Access to XRP Reserves Hampered

A significant consequence of the lawsuit is Ripple’s lack of full access to its XRP reserves. The company traditionally held a substantial amount of XRP and has periodically sold portions to fund its operations.

As the SEC lawsuit ensued, Ripple’s ability to access its reserves faced considerable restrictions. The SEC has posited that Ripple’s sales of XRP from its reserves were essentially a way of raising funds without going through traditional routes like initial public offerings (IPOs) or venture capital. This has implications for the company’s liquidity and capability to continue operations as before the lawsuit.

Ripple has reported experiencing difficulties attracting new customers in its home market, the United States.

It is noteworthy that while Ripple has seen growth in other parts of the world, America remains a key market for any financial technology company. Ripple’s long-term success hinges largely on its ability to operate freely in the US market. The ongoing lawsuit and the potential regulatory changes that could follow have cast doubt on this ability.

If the SEC’s assertions prevail, it could drastically affect Ripple’s funding model and overall business strategy.

Token Holders Pose a Threat in Court

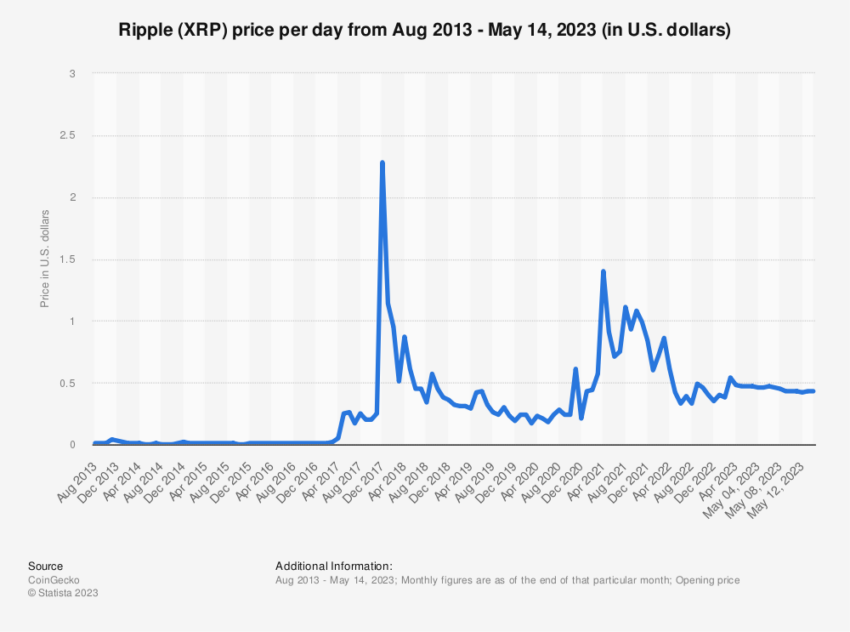

The XRP lawsuit’s consequences extend beyond Ripple to the numerous token holders worldwide. In the immediate aftermath of the lawsuit’s announcement, XRP’s price plummeted, causing substantial losses for its holders.

This was further compounded by numerous crypto exchanges delisting or suspendingXRP trading, limiting liquidity for XRP holders.

While XRP’s price has shown signs of recovery, the ongoing legal uncertainty casts a shadow over its future. The lawsuit’s outcome could lead to a renewed surge in XRP’s price or further devaluation. XRP holders, therefore, find themselves in a precarious position, waiting for the lawsuit’s resolution while grappling with the volatility of their holdings.

For this reason, XRP holders have united to intervene in the legal proceedings. Their argument is that the SEC, as a protector of investors, has failed them by pushing a lawsuit that directly devalues their holdings.

XRP holders contend that the SEC’s actions have led to significant losses. In a unique display of investor activism, XRP holders have sought to protect their interests in the ongoing legal battle.