ORC-20 Standard, Enhanced Version Of The BRC-20 What’s Special

What is the ORC-20 standard?

ORC-20 is an open standard for ordinal tokens on the Bitcoin network, created with the aim of adding new features to the BRC-20. It aims to be backward compatible with the BRC-20, to improve adaptability, scalability, and security, while eliminating double spending, which has been a problem for some. BRC-20 token.

As with BRC-20 Tokens, ORC-20 is an experimental project with no guarantee that tokens generated according to this standard will have any value or utility. They can bring new features, but they can also bring a host of new problems, bugs, and trade-offs that market participants will naturally exploit.

What is an ORC-20 token?

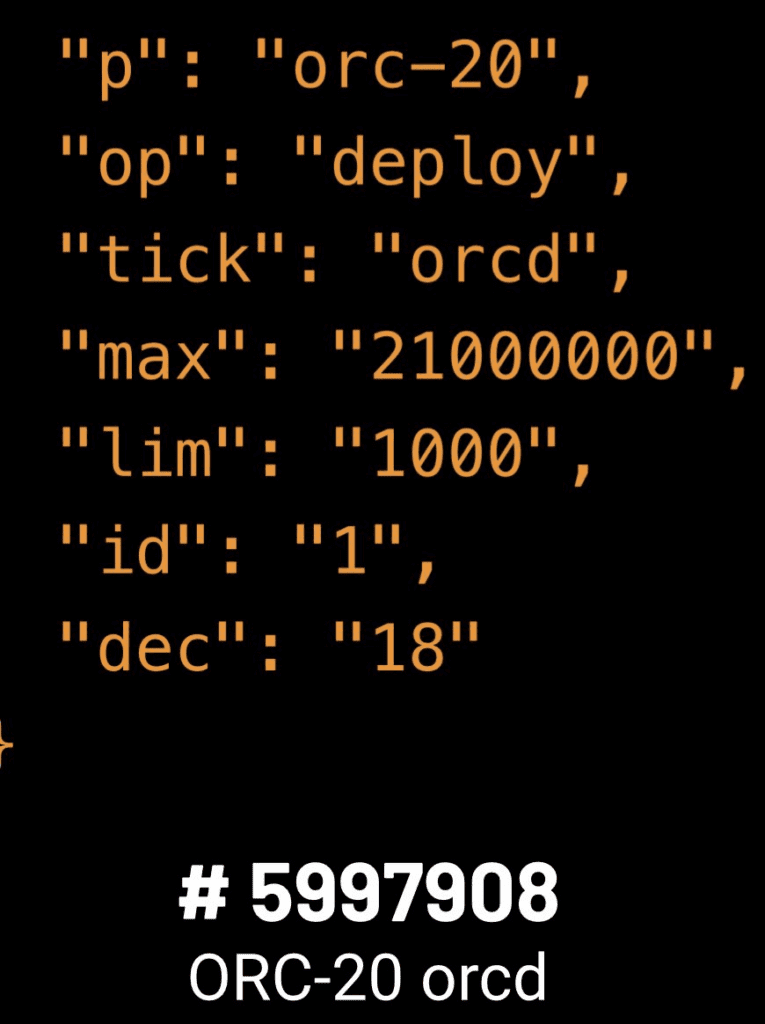

ORC-20s, like BRC-20 tokens, are JSON files added to the Bitcoin blockchain and written to satoshi with an ordinal serial number. The ORC-20 JSON format supports more formats and includes key-value pairs.

All ORC-20 data is case-insensitive. These tokens leverage a transaction model based on the UTXO model. In each transfer, the sender specifies the amount the recipient will receive, and the remaining balance will be sent to the sender, making it easier for them to transfer.

After completing each transaction, the previously recorded balance will no longer be valid; hence the UTXO model applies. Each submitted event can include a nonce, and the sender can partially cancel the transaction by specifying the nonce.

How the ORC-20 standard works

Operations of ORC-20 include basic events, including deploy, mint, send, cancel, upgrade, and custom events. You can add new keys to the standard event to introduce constraints, various behaviors, or new operations.

Each operation is inscription data with key-value pair, by default in JSON format. Operation keys must be lowercase. Value data are case-insensitive.

The ORC-20 is backward compatible with the BRC-20 and eliminates the possibility of dual consumption. ORC-20 allows changing of the initial and maximum amount that can be issued and has no fixed limit on namespaces and names.

The UTXO model is used to ensure there is no repeated consumption in transactions and allows the cancellation of transactions using the “op” field.

What are the improvements of ORC 20 over BRC 20?

The main limitations of BRC20 are as follows:

Improvements of the ORC-20

- Deploy a new ORC-20 or migrate an existing BRC-20 with a deployment event.

- Mining ORC-20 tokens with mint event.

- Send ORC-20 token with send event.

- ORC-20 partial transaction abort with abort event.

- Upgrade an existing ORC-20 (e.g. max supply and mint) with an upgrade event.

How does ORC-20 prevent double spending?

The transaction model used in ORC-20 is based on Bitcoin’s UTXO model. When a transfer occurs, the sender specifies the amount the recipient will receive and specifies the remaining balance to be sent back to themselves, simplifying the transfer process.

In the UTXO model, the previously recorded balance becomes invalid after each transaction is completed, in accordance with the UTXO principle. Each “submit” event in an ORC-20 token can include a nonce. This allows the sender to include a unique identifier for the transaction, which can be used to cancel the transaction if needed partially. By specifying a nonce, the sender can undo and reverse a transaction that has not been fully processed.

ORC-20 Token Opportunities

The ORC-20 token standard offers an opportunity for traders to create even more tokens on Bitcoin, add more variations, change supply and release, and create artificial scarcity for these tokens, only to exploit the hype demand by issuing new tokens for dumping in the market.

They can make it easier for regular wallets to transfer without users using coin control to protect their coins. This will help get tokens to the secondary market and exchanges for trading pandemic. This will make it easier for miners to sell their tokens to the market, access liquidity, and disappear like bandits with on-chain satoshi that cannot be retrieved once the transaction is confirmed.

Risks of ORC-20 Token

Those who intend to invest in ORC-20 tokens should first understand that ORC-20 is an experimental project and there are no guarantees as to the value or usefulness of tokens produced according to the standards of this standard. While ORC-20 can potentially improve the token standards of the Bitcoin network, it has received much criticism for being complex and does not offer a significant advantage over existing standards.

The fate of ORC-20 depends on how the community responds to it and its ability to address these concerns. Users should exercise caution and investigate thoroughly before interacting with ORC-20.

Move BRC-20 to ORC-20

The ORC-20 protocol also facilitates the migration of existing BRC-20 tokens through the use of wrapper ordering. Using “wrapper order” you can rewrite your previous satoshis and switch to other ordinal token standards, such as from BRC-20 to ORC-20.

To migrate your existing BRC-20 tokens, you need to implement a wrapper order to convert them. Only the BRC-20 deployer can perform the migration.

So even if you bought BRC-20 tokens with a fixed supply and thought you were holding a certain percentage of the supply, you could still be diluted if miners’ tokens decide that they want to tap into market demand and move to ORC and give themselves a new supply of coins to hit the market.

Conclusion

Above is our full share of ORC-20 standard and ORC-20 tokens. The ORC-20 standard helps to overcome all the current limitations of the BRC-20. Just like the explosion of the BRC-20, the ORC-20 could be the name of the next rocket launcher because of the cheers from the community. But before deciding to invest in ORC-20, users should understand that ORC-20 is an experimental project and there is no guarantee of value for tokens created using this standard. There has been a lot of criticism surrounding the ORC-20 that they need to be simplified and offer a significant advantage over existing standards.

What do you think of the ORC-20 token? Will it take off and move more speculation to Bitcoin? Are the tools used to create these standards widely adopted? Or will all of this fail like previous attempts to add non-native assets to the Bitcoin base chain?

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.