Top Analyst Issues Bitcoin Alert, Says BTC Could Witness 2015-Style Correction – Here’s His Downside Target

An analyst who continues to build his following with long-term Bitcoin (BTC) calls warns that the crypto king could go through a major correction similar to what happened about eight years ago.

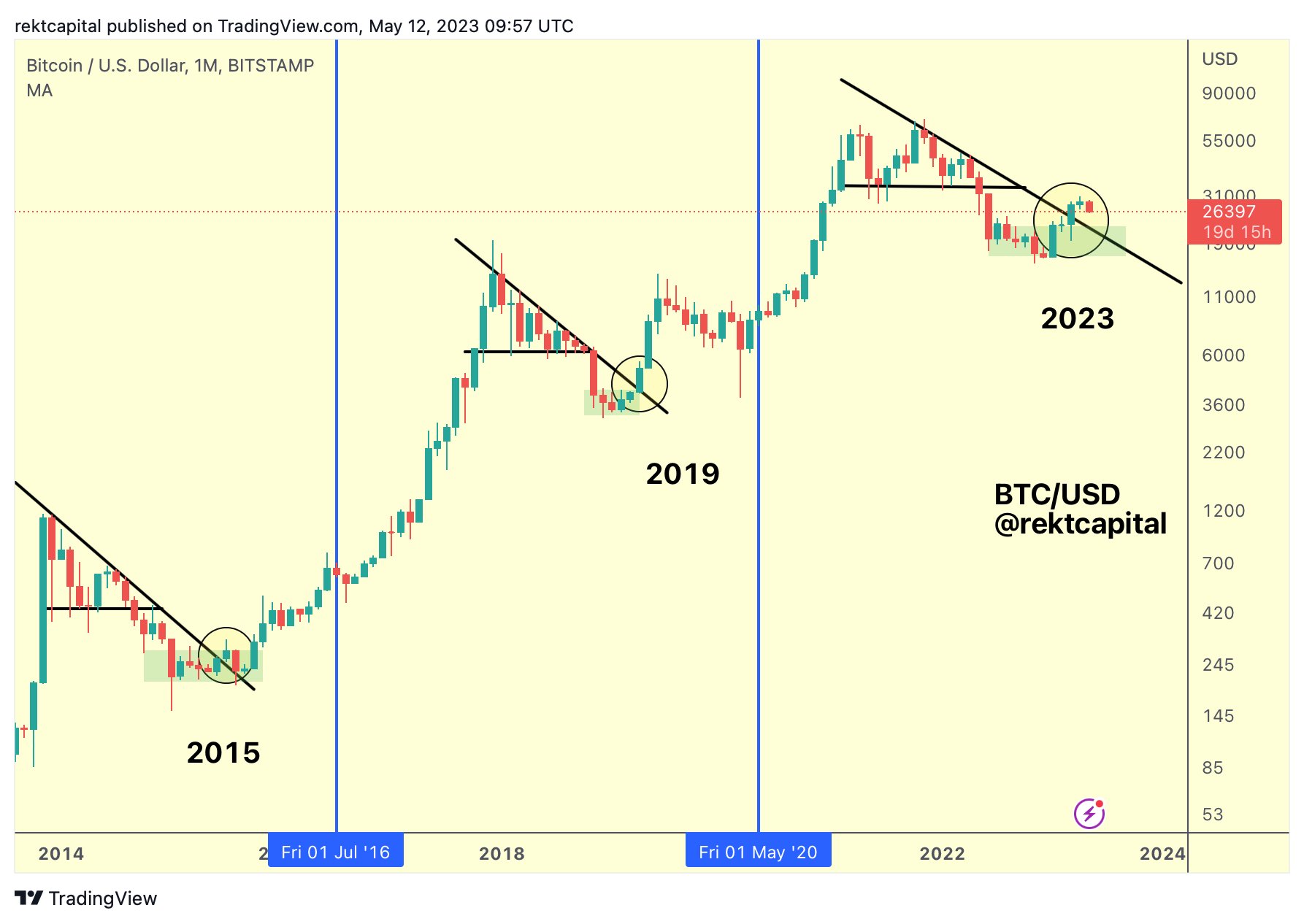

Psuedonymous analyst Rekt tells his 345,100 Twitter followers that Bitcoin appears to be acting similar to its 2015 price action, when it retested a diagonal resistance as support before igniting a bull market.

In 2015, Bitcoin lost about 38% of its value in a month prior to launching a parabolic rally.

Says Rekt,

“If BTC is to experience a 2015-like retest of the macro downtrend, then price can still drop even deeper than what we’ve seen thus far.”

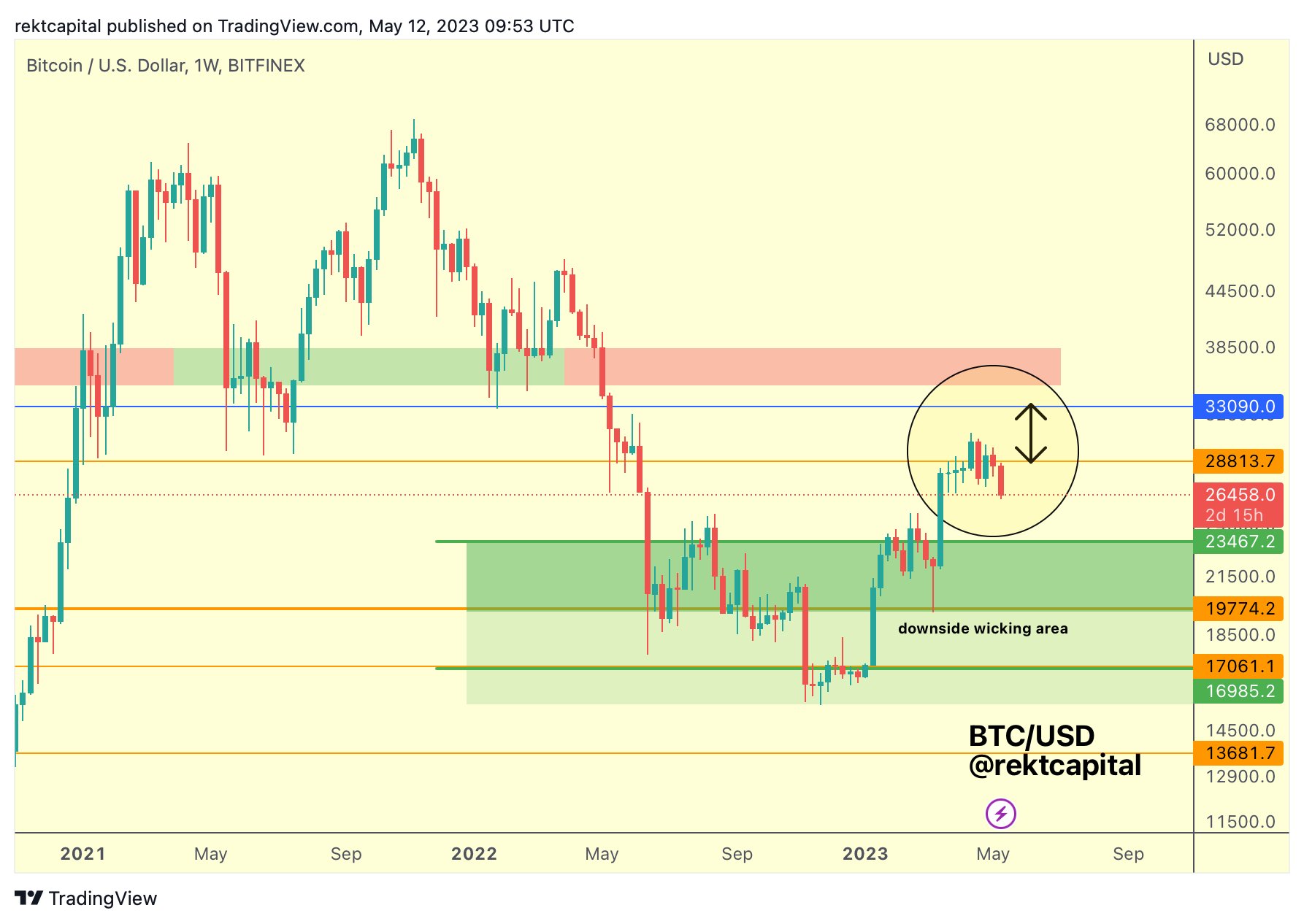

According to Rekt, Bitcoin could plunge to its key psychological support at around $20,000 as long as it is trading below resistance at $27,000.

“BTC has failed to reclaim the $28,800 level on the weekly already.

And a BTC weekly close below $27,000 would likely enable further downside into the lows $20,000s”

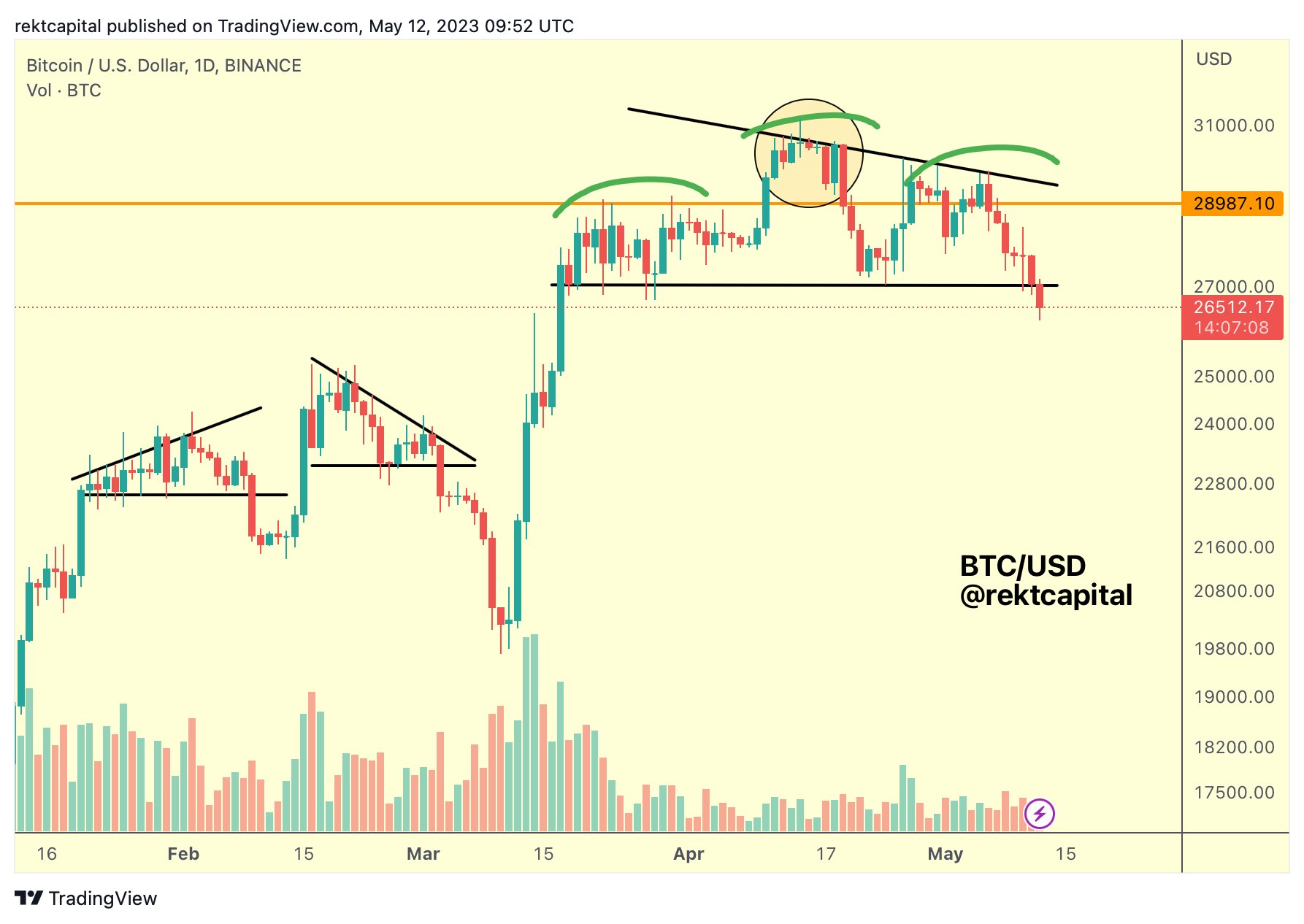

Rekt also warns that Bitcoin is flashing a bearish signal on the daily timeframe as it is now trading below the neckline of a head-and-shoulders pattern at $27,000. According to the analyst, BTC’s inability to reclaim $27,000 as support will likely confirm the reversal pattern.

“BTC one-day close sub-neckline (black) -> partial breakdown.

Flip $27,000 to resistance -> full breakdown confirmation.”

At time of writing, Bitcoin is trading for $26,733.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Naeblys/Panuwatccn