Top 7 Best Crypto Tax Software 2023

beginner

Are you tired of the hassle of calculating your cryptocurrency taxes? With the rise of digital currencies, keeping track of all your transactions and their accurate reporting to the IRS becomes a challenge. But what if there was a solution capable of simplifying the process for you?

As the popularity of cryptocurrencies continues to grow, so does the need for efficient tax reporting. The IRS has been cracking down on crypto tax evasion, making it more important than ever to file your taxes correctly. Fortunately, several crypto tax software options are available now to help you navigate the complex world of crypto taxes.

If you’re looking for the best crypto tax software for the tax season, you’re in luck. In this article, we’ll go over some of the top options and help you choose the one that’s right for you. Whether you’re a seasoned crypto investor or just getting started, these tools can make tax season a little less stressful. So let’s dive in and explore the best crypto tax software options on the market.

Why Do We Need Crypto Tax Tools?

Cryptocurrencies have boomed in recent years, becoming popular trading assets among individuals and businesses alike. As such, an increasing number of people have transacted cryptos during the last tax year. But unlike traditional asset management services that can easily report to the tax authorities, crypto poses a significant challenge due to its complexity. For example, one has to consider the multiple sources from which crypto might be originating (i.e., crypto mining, trading, staking, etc.).

That’s why crypto tax software tools are crucial for submitting crypto-related taxes correctly. Crypto tax software provides more extensive features than traditional tax filing programs such as TurboTax. It can accurately report each user’s gains and losses associated with their cryptocurrency transactions during the year while factoring in all relevant information like business expenses or any applicable deductions. This helps users minimize audit risks and ensure they meet their reporting obligations accurately and on time.

What Features Should I Look for in Tax Software?

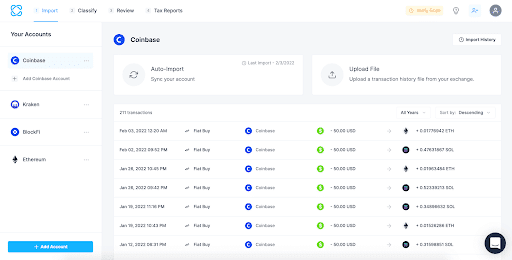

When it comes to selecting the best crypto tax software programs, there are several features you should seek to make sure you have the best experience. First, verify the platform is easy to use and understand. Tax season can be stressful, so having a platform that offers simple instructions and an intuitive interface will help streamline the process. Hunt for automatic import capabilities: this will save you time because you will not have to enter the details of your transactions manually.

Furthermore, you should pay attention to customer support when making your decision. Even if you plan on filing taxes by yourself, there’s still no guarantee that everything will go smoothly. Access to email or chat support can give you peace of mind as you know that help is at hand in case issues arise along the way. Finally, ensure that your software exports can connect with your tax software; this way, you won’t have to re-enter data into another type of software or spreadsheet. All these features combined can contribute to making the process smoother and submitting an accurate crypto tax report in no time.

The Best Crypto Tax Software

If you’re browsing the best crypto tax software solutions, keep reading. We’ve compiled a list of the top 5 options, complete with their standout features, costs, and more. This way, you can make an informed decision and choose the software that’s right for you.

1. Koinly

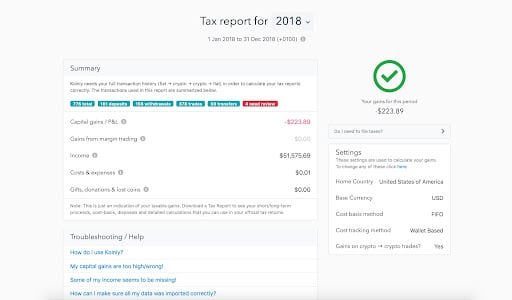

Koinly is the best overall choice for traders looking to simplify their crypto tax reporting. It offers sync and importing capabilities so that you can easily get a summary of your crypto income and view your realized/unrealized capital gains hassle-free. Not only does Koinly fill out the necessary IRS Form 8949s, but it also includes Schedule D in its tax report. This makes Koinly one of the most comprehensive crypto tax software available. Moreover, users can take advantage of specialized tax reports that better reflect how money has been used or exchanged throughout the year.

Koinly developers have made this system extremely user-friendly and efficient. The software continuously updates after each transaction, so you never need to worry about processing information manually! Koinly charges a very low fee for usage, given its level of service. Besides, it provides support from top-notch professionals who are always willing to answer any questions that users may have in relation to their accounts.

2. CoinLedger

CoinLedger provides an essential service for cryptocurrency traders — transaction reporting. It enables users to track, analyze, and report their transactions quickly and accurately. Originally started in 2018 as CryptoTrader.Tax, CoinLedger now offers its users one of the most comprehensive packages available to the crypto trading community.

Frequent traders cannot underestimate the convenience of eliminating the necessity to review transactions manually. This can be especially helpful if you made multiple trades on the same day (or maybe in the same week or month). To traders who are after more comprehensive support, CoinLedger offers an unlimited plan that allows them to track an unlimited number of transactions, thereby giving customers a thorough understanding of all their investments at once.. On top of this, they also provide a free tax preview in order to further assist their users in compliance with their financial obligations.

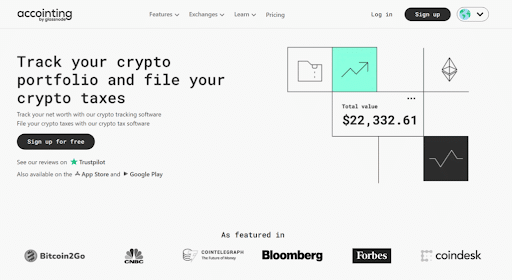

Accointing is an excellent crypto tax app that simplifies the process of organizing and filing your cryptocurrency portfolio. Its intuitive web-based software allows users to quickly input their transaction data, categorize them, and prepare tax forms with just a few clicks. It also offers a variety of useful features, such as its tax-loss harvesting tool, which is especially helpful when it comes to minimizing losses during bear markets.

Their free plan covers only 25 transactions a year on your tax report, which still provides plenty of functionality for smaller portfolios. If you are unsure about commitment, you may find it interesting that Accointing also offers customers a 30-day money-back guarantee that allows them to get a full refund within the first month if results don’t comply with their country’s regulations. There’s even a personalized tax report feature that takes into account all the details and generates recommendations for you automatically, making filing taxes an easier and less tedious task year after year.

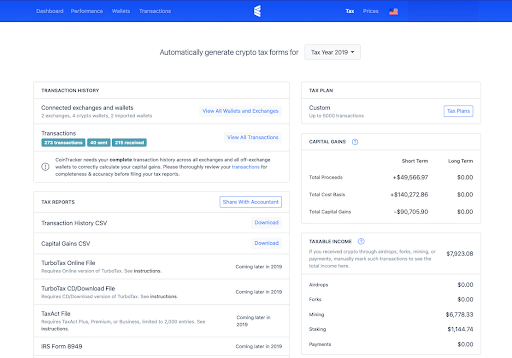

4. CoinTracker

CoinTracking is a cryptocurrency portfolio tracking and tax reporting service that lures customers with a great free plan. It facilitates tracking of up to 100 transactions and provides 25 customizable reports that, in turn, can be used to generate tax and capital gains reports. This is especially useful for those who are starting out in the world of cryptocurrency because they can get an accurate assessment of their investments without having to pay for costly services. The automatic transaction imports from over 110 exchanges via APIs are also extremely helpful in keeping track of all the transactions made on different platforms, empowering the user to make more informed decisions about where and when to invest. CoinTracking gives users secure storage options for their holdings to keep their funds safe even if the exchange gets hacked or goes down. All these features make CoinTracking an attractive choice for investors looking for a comprehensive cryptocurrency portfolio management system at no cost.

5. ZenLedger

ZenLedger is a great crypto tax software option for users who need extra accounting features such as NFT tracking and tax-loss harvesting. Not only does it generate personalized Form 8949, Schedule 1, and Schedule D, but it also comes with an impressive 1-year refund policy. This makes it a perfect choice if you need to make sure that your filings are accurate for the IRS.

Additionally, ZenLedger offers NFT support, which enables you to track your digital asset transactions as well as optimize your taxes where available through loss harvesting strategies. Unfortunately, unlike some of its competitors, the software platform doesn’t accept payments in cryptocurrency — something to keep in mind if this matters to you. But overall, ZenLedger is a solid choice due to a robust set of features designed to save users time and ensure their filing to the IRS is accurate.

Final Thoughts

In conclusion, investing in cryptocurrency carries certain tax implications and responsibilities. The right software can make the process a lot smoother and help minimize errors associated with filing taxes. As we have outlined, there are a multitude of software options out there, each with its own pros and cons. Though making the decision may seem daunting at first, the best option for you depends on what features you need and how willing you are to spend time inputting data.

Ultimately, the task of choosing crypto tax software is not something that should be taken lightly. Consider your options and compare them to your needs so that you end up with the best fit for tax season. And as always, if you ever have questions about any crypto-related taxes or related issues, don’t hesitate to reach out to an experienced accountant or tax professional for help navigating this exciting world of cryptocurrencies.

Best Crypto Tax Calculator: Frequently Asked Questions

How do cryptocurrency taxes work?

Cryptocurrencies are unique assets that allow users to take part in financial activities in a decentralized and anonymous manner. However, these features also make accounting for taxes on crypto transactions difficult. Without taking careful notes and keeping detailed records of your activity, it can be hard to keep track of capital gains, losses, and income across all of your crypto wallets.

Fortunately, crypto tax software exists to simplify this process. By connecting your wallets and exchanges to the software, you can easily import all your transactions with ease. The software will then generate an aggregated tax report which will include all relevant information, such as buy/sell prices, fees paid, trades made and much more. When tax season comes, this can save countless hours without sacrificing accuracy or overlooking important details. Such technology makes managing your crypto taxes much easier than manually tracking individual transactions — granting people more time to focus on their investments rather than tedious record-keeping tasks.

How do I keep track of crypto taxes?

Crypto taxes can be a daunting task, and the complexity increases as the number of transactions grows. However, having the right tools on hand can help to simplify crypto tax filing and make it easier to keep track of activities throughout the year. One such tool that is widely used and accepted by crypto traders across the globe is crypto tax software platforms. These platforms provide comprehensive methods to record, monitor activity, and manage taxes related to transactions with digital assets.

Koinly is one example of a reliable crypto tax software platform that offers users extremely user-friendly dashboards to view their overall holdings, portfolio growth, ROI, invested fiat, mining profits, staking earnings, capital gains, and other valuable tracking metrics for tax purposes. Subscribers can also easily view their total liabilities from a handy snapshot of all their trading activities over the year. It lays out in detail exactly what losses or gains have been incurred during tax periods. This provides a clear outlook on how much tax is due versus how much was earned or lost during each taxable period.

What is the best way to file crypto taxes?

The Internal Revenue Service (IRS) considers cryptocurrencies as “property,” and therefore, any profits or losses from buying, selling, or trading them must be reported for taxes. The best way to file crypto taxes is by using Form 1040 Schedule D to reconcile capital gains with losses. Additionally, if you have multiple transactions conducted during the same tax year, you may need to use Form 8949, which will report your transaction date, cost basis, proceeds from the sale or exchange of the cryptocurrency, and other pertinent details of every transaction.It is worth noting that cryptocurrencies can fall into different asset classifications depending on the purpose of holding them. Short-term holdings are typically taxed at regular income rates, while long-term holdings may be taxed as capital gains at lower rates. Individuals should make sure they keep detailed records of their transactions throughout the year so they do not miss out on potential deductions or risk incurring penalties due to failure to pay crypto tax liabilities in full and on time.

Is crypto tax software free?

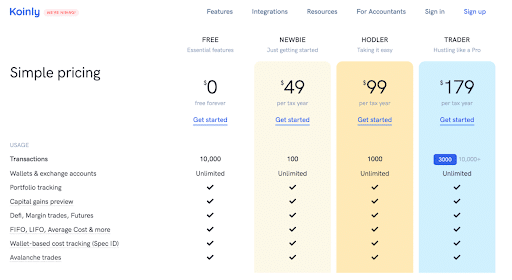

Crypto tax software can be a great tool for investors who want to stay on top of their taxes. Many of these software solutions have free features, such as tracking down to 10,000 crypto transactions. This way, you can keep track of your profits and losses over the course of the year. However, most of these services do charge a fee if you want any help with producing comprehensive crypto tax reports at the end of the year. For example, Koinly offers a free membership that allows you to track up to 10K transactions before charging extra fees.

Using crypto tax software is a great way to ensure compliance with local tax regulations while keeping track of your trading activity in one easy-to-access place. Even if you don’t plan on paying for additional services, having an easy-to-use platform for tracking down all of your cryptocurrency trades can help provide records in case of an audit by local authorities. Plus, by understanding the exact profits and losses incurred each year, investors are able to make more informed decisions about future cryptocurrency investments.

Can I do my crypto taxes myself?

The question of whether or not you can do your crypto taxes yourself is complex and depends on your individual circumstances. If you are self-employed, you must report any income generated from cryptocurrencies. Crypto income is indicated as self-employment income on IRS Form 1040 Schedule C, so you will need to pay the applicable self-employment taxes alongside it. Individuals with high crypto profits may want to consider hiring tax professionals to manage their tax filing, as taxes on crypto are more complex than regular income sources.

Using online tools such as Turbo Tax can help make the process easier. However, it is important that you keep accurate records of all trades, transfers, and purchases throughout the year. Additionally, certain exchanges provide an IRS form 8949, which can further assist in tracking gains or losses when filing cryptocurrency taxes. Ultimately, it’s up to each person what method they prefer when doing their crypto taxes. With a little bit of preparation and research, individuals can handle the process themselves without making any costly mistakes.

Do I Have to Pay Taxes on Bitcoin?

The laws related to capital gains taxes on Bitcoin vary from country to country, but it is typically required to pay taxes on any profits made from digital assets. Generally speaking, the longer you hold onto Bitcoin or other crypto assets, the lower your tax rate will be. In many cases, holding crypto long enough can even qualify you for a 0% tax rate on capital gains. Currently, certain countries such as Portugal and Italy levy no capital gains tax on crypto-related income if it is held for more than one year. Unfortunately, this isn’t always the case everywhere; some countries (e.g., Austria) have requirements that would qualify holders for a 0% capital gains tax rate, but they generally apply only to certain income brackets.

All in all, it’s important to stay up to date with ever-shifting laws concerning crypto taxation around the world to ensure that any applicable taxes on Bitcoin transactions are paid accurately and legally. Knowing how your taxes work in regard to crypto investments can help pave the way for a financially secure future and help alleviate any worry or stress associated with unanticipated taxes due down the line.

Are crypto-to-crypto trades taxed?

Crypto-to-crypto trades also have tax implications. Generally, any exchange of cryptocurrencies resulting in a change in ownership is considered a taxable event. This means that if you trade one type of cryptocurrency for another, like Bitcoin for Ripple (XRP), then you’re liable for taxes. When you get a crypto asset, it has a value, or cost basis. When you sell, exchange, or do anything else with it, it has a new value. The IRS cares about the difference between the two values.

The Internal Revenue Service classifies cryptocurrency as property instead of currency, so all crypto-to-crypto exchanges are treated as taxable disposal when more than one coin is involved. As such, traders must calculate their crypto gain or loss with income inclusion principle to report their profits or losses accurately on their yearly tax returns and pay capital gains taxes accordingly. It’s important to keep track of each transaction so that you can accurately compute your capital gains or losses when filing taxes.

How to avoid taxes on crypto?

Taxpayers should make sure they pay their fair share of taxes, but they should also be aware of strategies they can use to minimize their tax liability. One way to do this is by applying strategies such as tax-loss harvesting, which involves offsetting gains with losses to lower one’s total taxable income. Additionally, by focusing on long-term gains over short-term ones and bundling deductions when possible, taxpayers will have greater flexibility in the amount of taxes owed for a given year.

Tax avoidance is not only legal but beneficial for taxpayers when done correctly. By being knowledgeable about tools that can help them legally reduce their taxable income, such as those outlined above, taxpayers can keep as much money as possible in their own pockets without running afoul of the law. As cryptocurrencies continue to gain popularity and rely heavily on taxation, it becomes more important than ever that investors understand what they must do in order to remain compliant while still mitigating their tax burden.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.