Fractional Shares of Fine Art vs. NFTs

NFT

Technology is revolutionizing the art world, presenting investors with novel opportunities and challenges. The emergence of fractional shares of fine art and NFTs has created a unique intersection of art and technology, prompting many to question which investment option holds greater promise.

Here, we delve into the world of art investments to better understand the potential of fractional shares of fine art and NFTs.

Fractional Shares of Fine Art: Democratizing the Market

Fractional shares of fine art enable investors to own a stake in high-value artworks without purchasing them outright. This innovative approach democratizes the art market, making it accessible to a broader range of investors.

Leading fractional art platforms:

- Masterworks

- Yieldstreet

- Particle Collection

These platforms allow investors to buy a share in an artwork, sharing ownership with others. Investing in fractional shares offers several advantages over NFTs:

- Lower entry costs: Investors can participate in the art market without the significant upfront capital required for traditional art investments.

- Portfolio diversification: Fractional ownership provides a means to diversify one’s investment portfolio, mitigating risk and potentially improving returns.

- Access to expert curation: Platforms use art experts to select and manage artworks, providing investors with high-quality pieces.

However, fractional shares also come with risks. Liquidity can be limited, as shares may not always be easy to sell. Additionally, the value of shares is not guaranteed to increase. Investors must rely on platform management for art selection and maintenance.

One notable example of a successful fractional art investment is the 1982 Jean-Michel Basquiat painting “The Warrior,” which was sold on the Masterworks platform. Shares were initially offered at $20 each, and the artwork later sold at auction for over $41 million, generating a 32% return for investors.

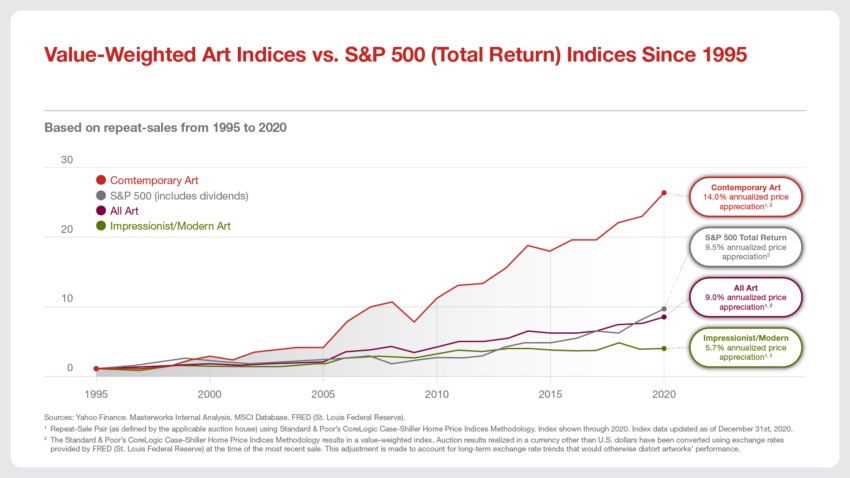

Strong historical art market performance rivals the S&P 500. Source: Investing.com

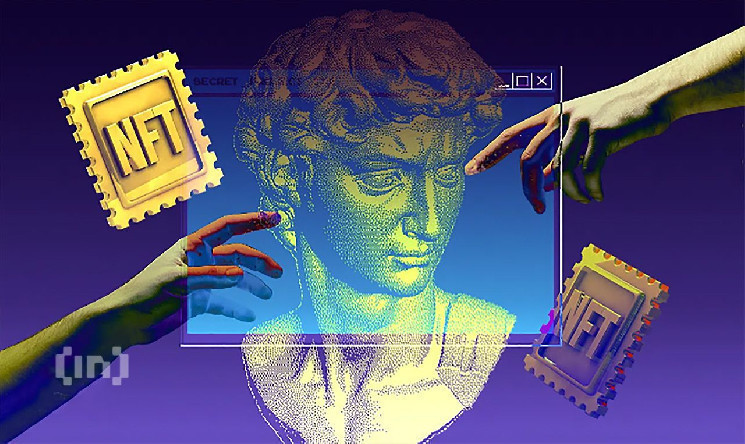

NFTs: Unlocking Digital Creativity

NFTs (non-fungible tokens) have gained significant traction in recent years. These digital tokens, built on blockchain technology, allow artists to mint unique digital art pieces. Which can then be bought, sold, or traded.

NFTs offer several benefits:

- Verifiable scarcity and provenance: NFTs are unique digital assets. Their scarcity can be verified on the blockchain, ensuring authenticity and preventing forgery.

- Global market access: The digital nature of NFTs allows for seamless global transactions, connecting artists and collectors worldwide.

- The potential for high returns: Some NFTs have fetched astronomical prices, such as Beeple’s “Everydays: The First 5000 Days,” which sold for $69 million at Christie’s auction house.

However, NFTs also present challenges. Their value can be highly volatile, and the market is still in its infancy. Furthermore, legal and regulatory frameworks around NFTs are evolving, breeding uncertainty for investors.

Blockchain: The Backbone of Digital Art Investments

Blockchain technology plays a crucial role in shaping the future of art investments. Thus ensuring security for both fractional ownership and NFTs. Its decentralized nature and transparency help combat fraud, enhance provenance tracking, and streamline transactions. Consequently, blockchain technology fosters trust in the digital art market.

For example, platforms like SuperRare and Async Art rely on blockchain technology to establish the provenance of digital artworks and facilitate secure transactions between collectors.

The Long-Term Value Debate: Fractional Shares vs. NFTs

When it comes to long-term value and potential returns, both fractional shares and NFTs have their merits. Fractional shares offer access to established and emerging artists, with historical price appreciation trends providing guidance. However, the market can be influenced by external factors, such as economic fluctuations and changing tastes.

In contrast, NFTs are a newer asset class with limited historical data. Some NFTs have fetched astronomical prices, but predicting future trends remains a challenge. The digital nature of NFTs also raises questions about long-term preservation and relevance.

For instance, while a traditional artwork like Picasso’s Les Femmes d’Alger might have a predictable appreciation rate, the value of an NFT like CryptoPunk #7804, which sold for $7.6 million, is less certain due to its novelty and the rapid pace of change in the digital art world.

Balancing Risk and Reward

Ultimately, the decision to invest in fractional shares or NFTs depends on an investor’s risk tolerance, interests, and objectives. Fractional shares offer a more traditional approach, with potential exposure to blue-chip artworks and a track record of value appreciation. On the other hand, NFTs provide a cutting-edge investment opportunity that may yield significant returns but carries higher risks.

For instance, an investor with a conservative approach might prefer fractional shares in established artists like Monet or Banksy, while a more adventurous investor could be drawn to the world of NFTs, exploring digital artists like Pak or XCOPY.

As the art market continues to evolve, savvy investors will keep a close eye on developments, seeking opportunities to capitalize on the unique potential of both fractional shares and NFTs. By understanding the pros and cons of each, investors can make informed decisions, balancing risk and reward in their pursuit of art market success.

While the future of art investments lies at the intersection of technology and creativity, it is essential for investors to carefully consider their investment strategies. Whether opting for fractional shares of fine art or diving into the world of NFTs, the key lies in understanding the market, leveraging technology, and adapting to the rapidly evolving landscape of art investments.