The Ultimate Guide to Its Tools, Features, and Controversies

If you know Web3, you know OpenSea. Since its launch at the end of 2017, the NFT marketplace has largely been the poster child for the world of Ethereum and crypto art, and it’s got the numbers to prove it.

OpenSea’s total historical trading volume sits comfortably at just shy of $41 billion, according to Dune analytics. To put that in perspective, KnownOrigin, one of OpenSea’s competitors that launched around the same time, has a total trading volume of just over $30 million.

Having dominated the market for almost six years, OpenSea has been as influential to the NFT ecosystem as any project, artist, or builder. However, this outsize impact hasn’t always been for the better, as the company has increasingly begun to clash with NFT community members over some pretty significant issues related to Web3.

The last six months, in particular, have presented the marketplace with several challenges with which it’s still grappling, as well as the first real contender with a shot at replacing it as NFT marketplace ruler. With that in mind, here’s a look at everything you need to know about OpenSea.

What is OpenSea?

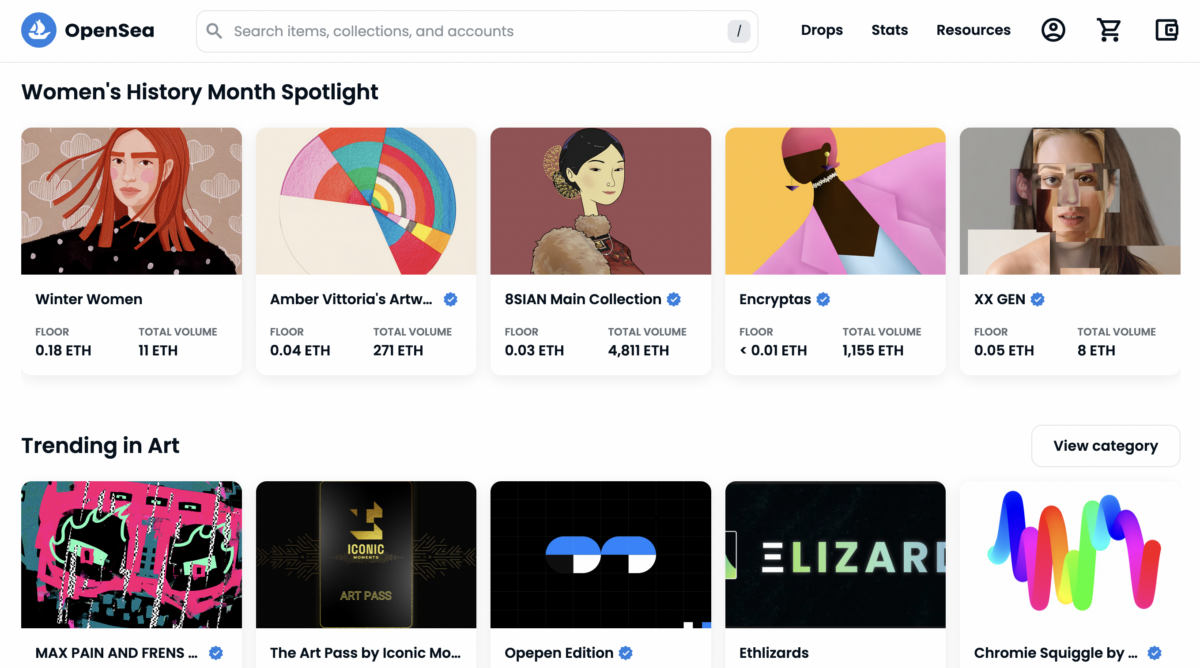

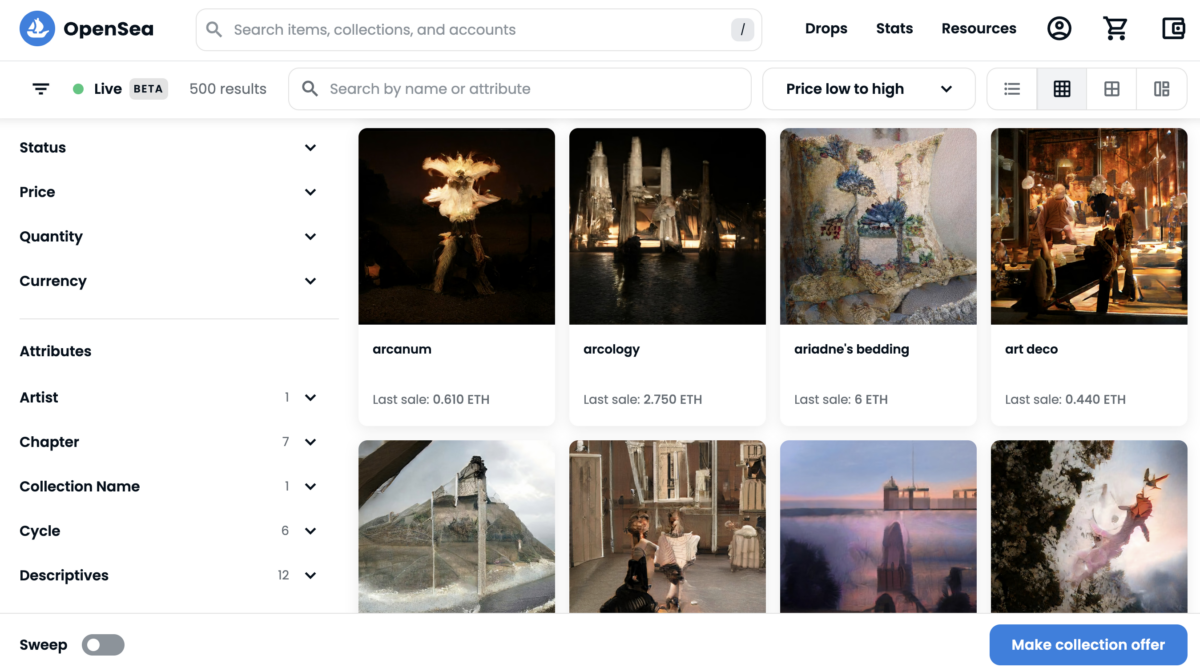

OpenSea is one of the most well-known, peer-to-peer NFT marketplaces in existence. Users can buy, sell, trade, and create NFTs on the platform in various categories ranging from photography and PFPs to gaming, membership tokens, and fine art projects.

OpenSea is the all-around hitter of NFT marketplaces. It’s easy to navigate and provides a limited but versatile suite of analytics tools and sorting options for users looking to dig a little deeper into collection histories or NFT trait rarities. Rather than honing in on a particular niche of Web3 users, the platform is a solid one-stop shop for a broad range of Web3 enthusiasts, including newcomers, experienced traders, and low-volume retail NFT buyers.

OpenSea’s rise to power

It’s difficult to overstate the magnitude of OpenSea’s rise over the last few years. Having been founded in 2017 by software engineer and entrepreneur Devin Finzer and programmer Alex Atallah, the marketplace hit a $1.5 billion valuation by the summer of 2021. By January 2022, that number surged to $13.3 billion after the company raised $300 million in a Series C funding round.

While NFTs had been around in some form or another since 2011, they had yet to hit an inflection point and gain significant traction in the public’s eye, even in 2017. In creating OpenSea, Finzer and Atallah had identified a need to build a platform that could function as a focal point for the then largely disparate communities of Web3 enthusiasts.

“At first, Devin and Alex set out to create a marketplace to unite siloed communities during the early days of NFTs,” said an OpenSea spokesperson while speaking to nft now on the company’s origins. “While embracing a range of potential outcomes, the upside was always there: becoming a destination where people could interact with NFTs, and thus explore a brand new economy on the internet.”

That economy has grown substantially since the platform’s late-2017 launch, even considering Web3’s most recent crypto winter. As of September 2022, trading volume in the Ethereum NFT sphere hit 8.22 million ETH ($11.5 billion). Furthermore, a recent report by research and consulting firm Verified Market Research predicted the market cap for the NFT industry could reach $231 billion by 2030.

OpenSea has played a crucial role in helping that market mature. From May 2021 to November 2022, the platform was responsible for the majority of trading volume in the NFT space.

OpenSea tools and features

OpenSea rolls out new features and tools on the platform with some regularity, all aimed at increasing trust in the platform, user safety, and improving infrastructure for the larger ecosystem.

One of the platform’s recent and significant updates came in June 2022 with the introduction of Seaport, a Web3 marketplace protocol that enables users to more safely and efficiently buy and sell NFTs. Before Seaport, OpenSea used Wyvern, a less-efficient protocol created by a third party. In comparison, Seaport cuts down on redundant transfers and, according to a company blog post on the development, reduces gas fees for users by 35 percent. Seaport is open source; OpenSea doesn’t control or operate it, and the company has encouraged smart contract developers to improve the protocol with them.

The marketplace has introduced several features in the last year, including a copymint detection system, a way to hide suspicious NFT transfers to users’ wallets, and an ability for creators to launch collections with dedicated drop pages directly on OpenSea called Drops. But not all of its product launches have been well-received.

OpenSea’s royalty woes

Throughout the years, OpenSea has launched or made changes to products and services it offers that connect to Web3’s most pressing issues — and not always gracefully. The platform has frequently clashed with artists and creators, who castigate the marketplace for what they perceive to be offenses to the health of the NFT community and the individuals that form its bedrock.

The critiques can be difficult to weigh fairly. Due to its stature and long history in the space, OpenSea makes for an easy target, whether or not its detractors’ arguments are legitimate. Regardless, like every marketplace in the ecosystem, the company has had its share of difficulties and shortcomings over the years. The platform has struggled with developing a fair and effective stolen items policy, has a history of site functionality issues during times of high traffic and following periods of intense growth, and has taken a rather centralized approach to implementing rules relating to its user base.

But the highest-profile issue that the Web3 community takes with OpenSea is its inconsistent stance on creator royalties. Royalties (also known as creator fees) enable artists to be compensated for a work well beyond its primary sale, giving them a cut of the profits every time their NFT changes hands. Royalties have helped artists and builders in Web3 create a rich, varied, and thriving art ecosystem and play a major role in its sustainability, providing a crucial income source for the funding of future projects.

Until the recent development of on-chain enforcement tools, royalties weren’t originally enforceable on a technical level. Even so, some collections on OpenSea weren’t created on upgradable smart contracts, preventing them from being able to use the newly developed tools. For collections built on upgradable contracts, however, it’s up to the marketplaces facilitating the buying and selling of their NFTs to implement and enforce those royalties payments through these new tools.

Until recently, OpenSea had done a great deal to support artists in this way. As of October 2022, the marketplace was the platform that had paid out the most creator royalties by a significant margin. And in November of the same year, the marketplace announced that it would introduce a tool for new collections to enforce royalties on its platform.

The announcement marked OpenSea’s first crack at an on-chain solution for royalties enforcement. And while this was hailed as a positive, creator-friendly move, users were unsettled by the fact that such royalty enforcement wasn’t going to apply to existing collections on OpenSea — the very collections that helped establish the platform as a leading Web3 force.

After severe backlash from nearly every prominent NFT artist and project head in the space, OpenSea announced it would continue to enforce creator fees on legacy collections, a move that many at the time saw as both a win for creators and an event that catalyzed a kind of unionization movement in Web3.

In February 2023, however, OpenSea altered its position on royalties once again. In a Twitter thread, the company announced that it would be moving collections that don’t use on-chain enforcement tools (the vast majority of collections on its platform) to optional royalties. And once again, many artists in the community took umbrage with this.

OpenSea has cited a sea change in marketplace dynamics as the main reason for its move to optional royalties on its platform, and there’s some credibility in that claim. Collectors in Web3 simply don’t want to pay royalties if they can avoid it, and marketplaces have to listen to the collectors that make up their target audience. This trend isn’t theoretical — marketplaces are increasingly abandoning royalties enforcement, and zero-royalty platforms like Blur have begun siphoning off massive amounts of trading volume from OpenSea, usurping the company’s previously-held majority market share.

OpenSea vs. Blur

The rise of Blur is one of the most significant developments in NFT marketplace history and has everything to do with what OpenSea is trying to achieve with its royalties moves in recent months. Blur’s strategy of appealing to a small but robust demographic of pro traders by rewarding its users with free airdrops of its own token has proven widely effective in its current goal of optimizing for market share. Since November 2022, Blur has either sat neck-and-neck with OpenSea or completely outpaced it in terms of trading volume (although OpenSea still retains the higher count of active users).

However, OpenSea may bear some responsibility for partially catalyzing the market shift it is now lamenting. The royalty policy it recently canned had forced creators to choose between earning full royalties on either OpenSea or Blur, setting royalties to optional upon detection of a collection’s trading on royalty-optional platforms. Ironically, it was OpenSea’s own Seaport that enabled Blur to sidestep this very policy, drawing even more users to Blur’s shores. Regardless, the move put creators and collectors in an uncomfortable position.

OpenSea’s attempts to uphold royalties as long as it did are worth appreciating, and the platform isn’t the artist-hating behemoth that some make it out to be. But as it and others vie for dominance in the NFT ecosystem, creators are caught in the middle in what many see as a race to the bottom of one of Web3’s founding principles: empowering and properly compensating artists for their work.

Ultimately, as some have argued, it may be the case that Web3 platforms are simply more concerned with gaining market share, as success in this goal allows them to secure more financing through venture rounds. Either way, the current market dynamic sits poorly with the community of artists that generates the wealth the NFT ecosystem swims in and who sincerely believe in the ability of Web3 tech to foster a more equitable future for creatives.

The decentralization conundrum

Several of the problems OpenSea gets criticized for have no easy solutions. The platform’s stolen item policy, which has previously led to the inadvertent punishment of users who unknowingly purchased a stolen NFT on the marketplace, is one example of this. It’s worth noting that OpenSea listened to community feedback and consequently updated its policy to better disincentivize theft and improve the accuracy of stolen item reports. It’s also implemented malicious URL detection and removal and a system that aims to prevent the reselling of stolen items.

While there is an argument that OpenSea can and should have done more to develop as fair and effective a policy as possible for stolen items earlier than it did, it’s also not a stretch to say that dealing with security in a decentralized world remains an inexact science, especially when an organization is trying to ensure legal compliance in the U.S.

The platform’s March 2022 hiccup in how it approached U.S. sanctions law requirements likewise falls under this category. Balancing a largely anonymous and international user base with potentially ruinous legal repercussions is difficult.

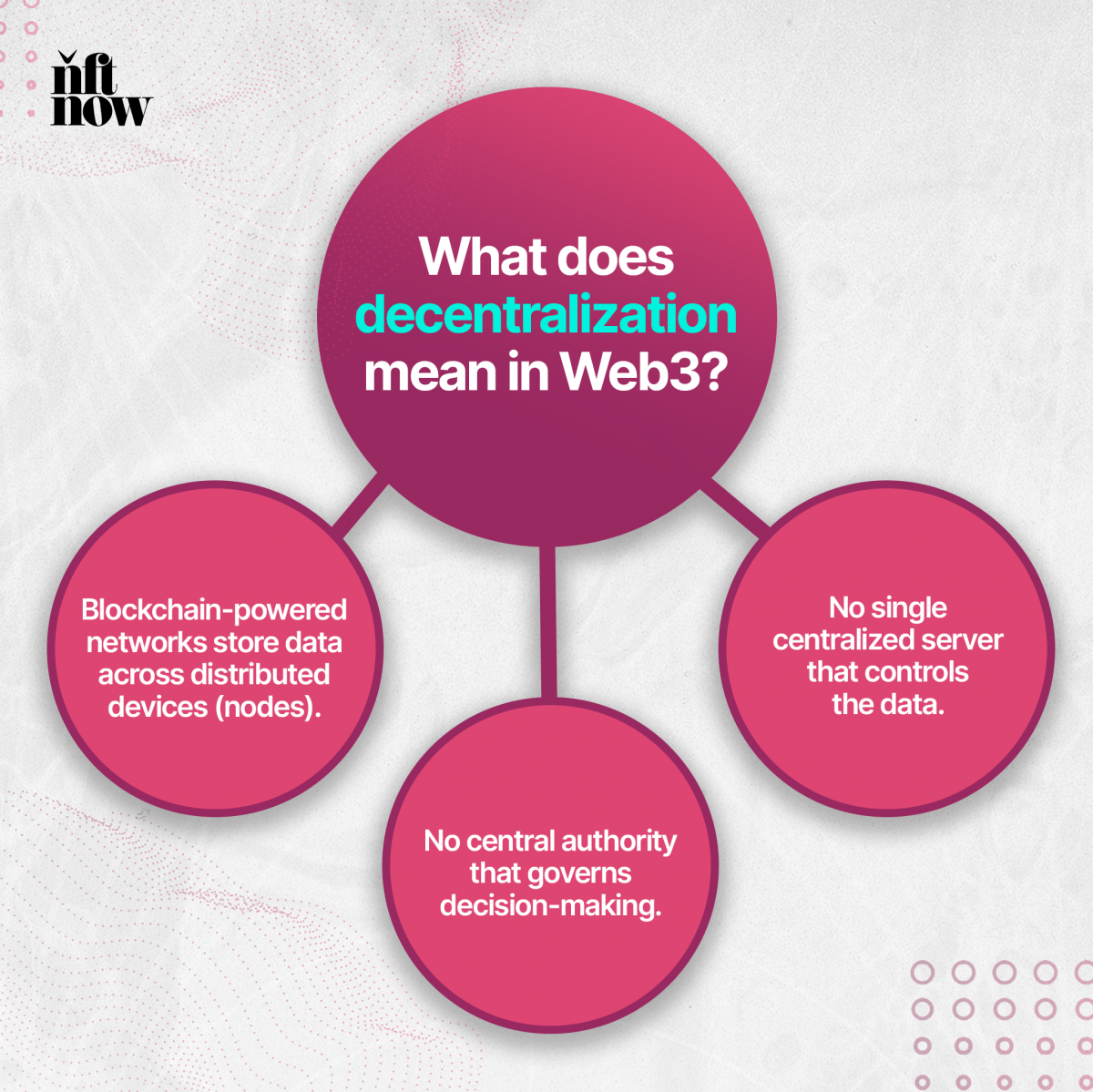

All of these issues live under the banner of one of Web3’s founding tenets: decentralization, the idea that broad authority to make changes affecting a community should be dispersed throughout that community rather than vested in a single individual or organization. Massive NFT platforms like Opensea are in an unenviable position here. Calls for a “truly decentralized marketplace” will be familiar to anyone who has been in the NFT space for more than a few weeks. Those calls, however well-intentioned, tend to be ill-thought-out.

OpenSea believes that the centralization debate is a crucial and compelling one that, like every controversial issue in the space, evolves over time and requires an approach that can be adjusted if necessary. And while it’s easy to argue that OpenSea is a centralized entity, it’s also worth noting that most Web3 entities are.

Centralization is a spectrum. Nifty Gateway, for example, is a custodial platform that stores its users’ NFTs in a wallet from which they need to be withdrawn to be traded on other platforms. And even the founders of SuperRare have recognized that decentralization is a work in progress and that “decentralization by centralized means” may be one of the best ways of fullying realizing the promise of this particular tenet of Web3.

OpenSea believes that coordinated action on some authoritative level is sometimes necessary to keep things running smoothly and its users safe in an environment full of risks and unknowns. Web3 is a volatile landscape that shifts by the hour. Expecting any one individual to keep up and respond perfectly to it is unreasonable; having the same expectations of an unwieldy, multi-billion-dollar organization is unreasonable.

OpenSea’s future

None of which is to say that OpenSea can’t do a better job on the things the NFT community often rebukes it for; it must if it wants to maintain its spot as a top Web3 marketplace. It owes creators — not just collectors — innovation that they can use and that upholds their rights as Web3 citizens. Likewise, it can do more to clearly communicate sudden changes in policy to its users and implement decisions in a more transparent and precise way.

“We believe that eventually, the physical economy will shift in this direction, and it’s possible that one day, nearly everything we own will be owned and transferrable on the blockchain in the form of an NFT,” CEO Devin Finzer underscored of the company’s approach to the evolution of Web3 in a November 2022 blog post. “We have conviction that this technology will eventually power the biggest markets on the planet and fundamentally transform society. That’s the vision we’re rallying around at OpenSea.”

All of which sounds rhetorically on the money. But rhetoric is easy; how the marketplace decides to execute that vision fairly while facing rapidly shifting market dynamics, increasing competitive pressure, and a movement of creators coalescing around the royalties issue remains to be seen.