Cardano [ADA] cools off into key range – Where can traders look for gains

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ADA’s four-hour chart was bullish.

- The bulls had minimal leverage as per long vs. short positions.

Cardano [ADA] rebounded strongly after hitting its recent low of $0.3020 on 12 March. It saw aggressive buying at the above lows pushing its price break key resistances as Bitcoin [BTC] surged to the $26k area.

Read Cardano’s [ADA] Price Prediction 2023-24

However, BTC saw a sharp rejection at $26k and was operating below $25k at press time. Similarly, ADA hit the price ceiling at $0.368 and entered a retracement, pushing it into a key price range. As such, BTC’s price action will determine ADA’s price direction in the next few days/weeks.

ADA re-enters a previous short-term consolidation range

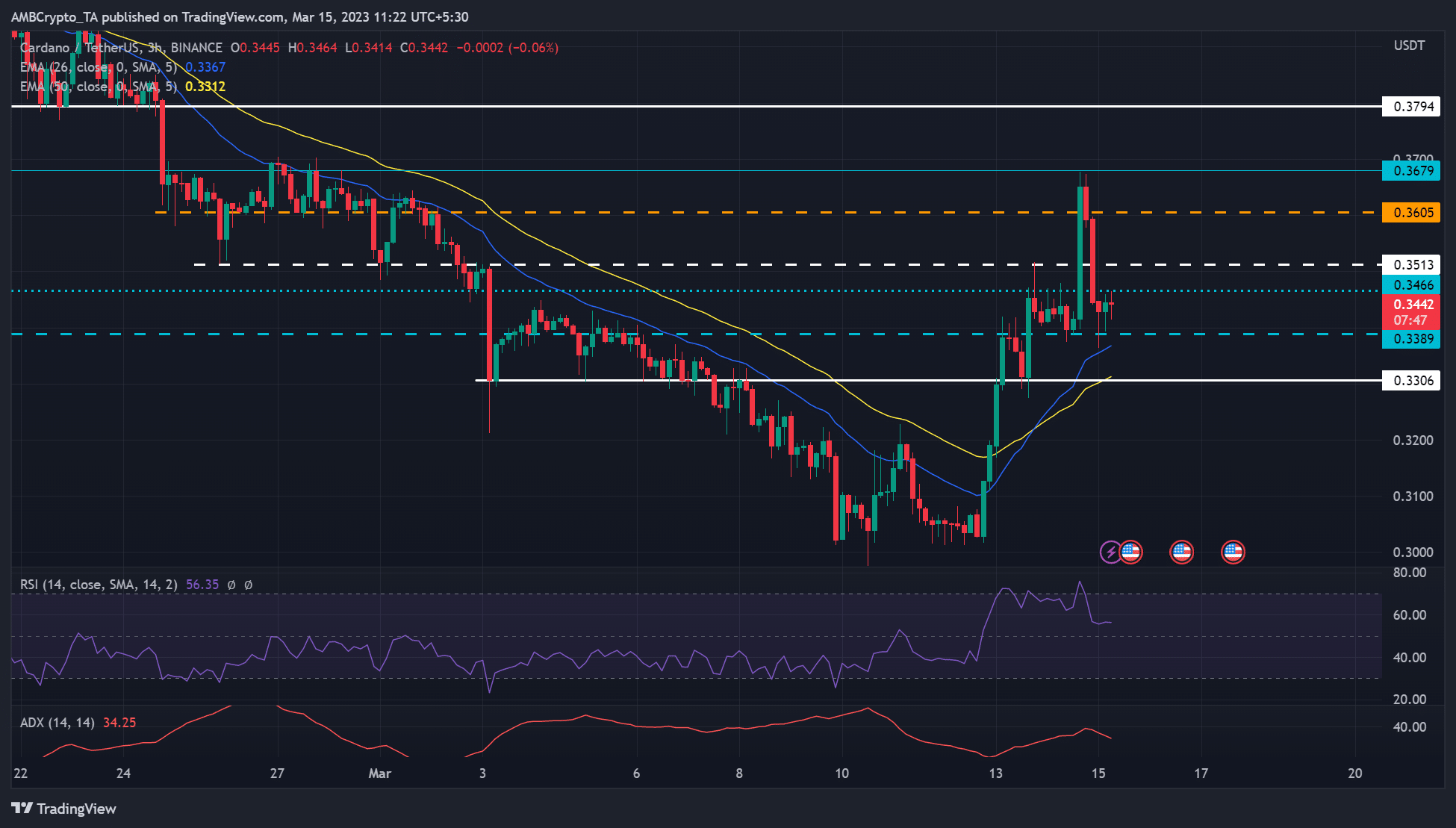

Source: ADA/USDT on TradingView

ADA had initially breached the $0.3306 – $0.3466 consolidation range during BTC’s extra rally after the February US CPI data release. The price rejection at $0.3679 set ADA back into the range. But the price action was in the upper range, suggesting a likely bullish breakout if BTC maintains the $24k level and surges.

Therefore, ADA could swing between $0.3306 and $0.3466 before a possible breakout. A break of the range and a close above $0.3466 could tip near-term bulls to push the price toward the overhead resistance at $0.3679. But they must clear the hurdles at $0.3513 and $0.3605.

Alternatively, ADA could witness intense selling pressure if the price closed below $0.3306. But the drop could slow down at the double bottom pattern’s neckline of $0.3200 or the previous low of $0.3020. These levels could be used as short-selling targets, especially if BTC witnessed a sharp retracement towards $20k.

The Relative Strength Index (RSI) pulled back from an overbought territory and moved sideways, indicating buying pressure drop, but selling and buying pressure was almost equivalent at press time. Similarly, the Average Directional Index (ADX) sloped downwards, showing likely further retracement or consolidation for ADA. Given the RSI’s sideways movement, consolidation was highly likely.

Bulls have limited leverage in the short-term

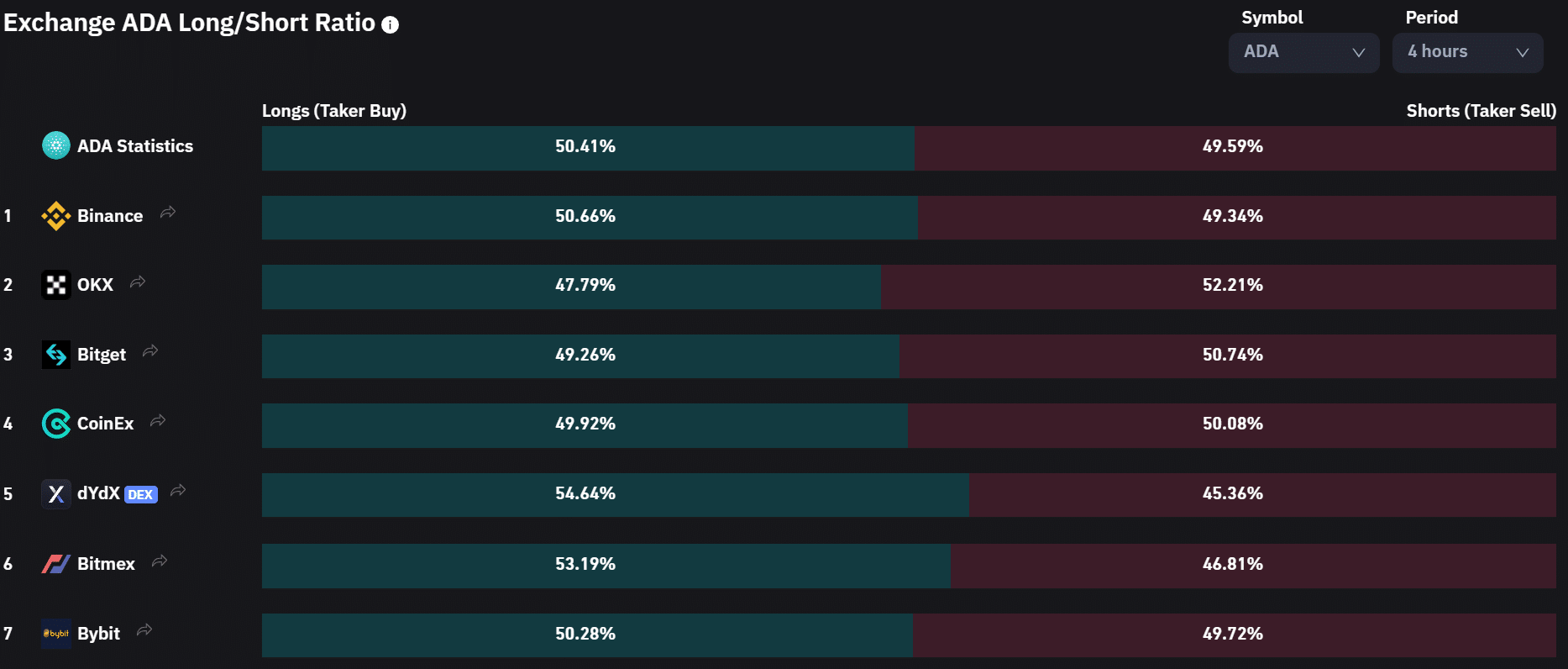

Source: Coinglass

Is your portfolio green? Check out ADA Profit Calculator

Bulls had slight hope based on the ADA’s long/short ratio that showed slight leverage on the four-hour timeframe. It shows investors’ positive expectations in the short term. But bears and potential retracement could also not be overruled.

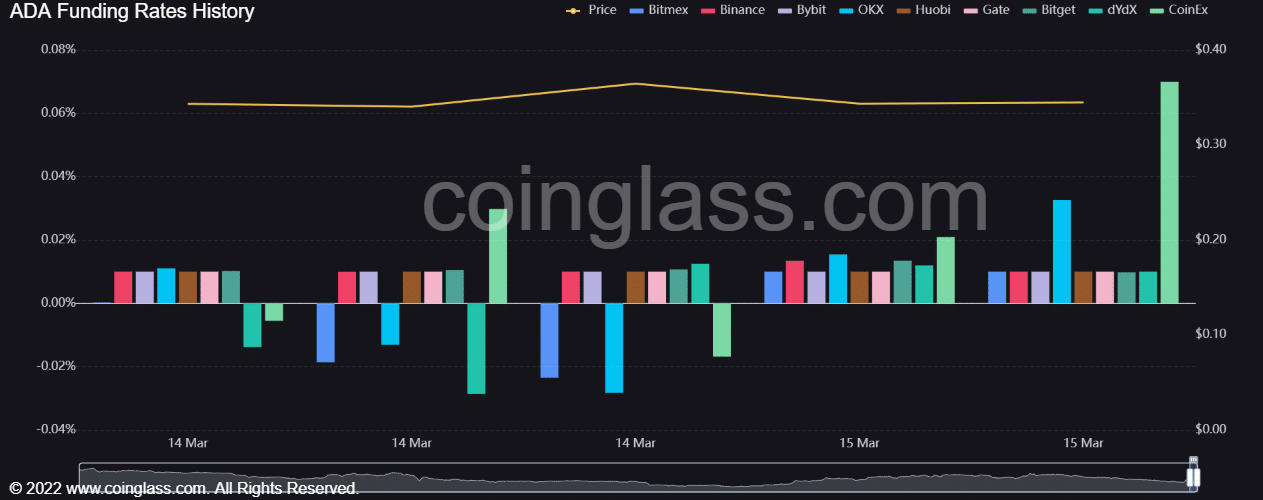

In addition, ADA’s funding rate was positive across major exchanges, indicating the underlying bullish sentiment. But investors should track BTC’s price action to make more profitable moves.

Source: Coinglass