Bitcoin [BTC] bounces back: All you need to know as king coin crosses $26k

- BTC traded momentarily above $26,000 on 14 March.

- On-chain data indicated positive sentiment.

During the intraday trading session on 14 March, Bitcoin [BTC] momentarily traded at a staggering high of $26,500 for the first time since August 2022. The rally in price was due to the positive sentiment that lingered in the market as many expect potential US interest rate cuts.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

After trading below the $20,000 price mark last weekend following the collapse of Silicon Valley Bank (SVIB), BTC regained its momentum and rallied after Federal Regulators confirmed that they would make SVIB depositors whole.

BTC has since clinched important milestones on-chain. Per data from on-chain data provider Santiment, during the trading session on 14 March, BTC whales made the highest count of transactions exceeding $1 million since November 2022.

An increase in whale transactions is a great indicator of bullish sentiments in the market. If momentum is sustained, further price growth is guaranteed.

🥳 #Bitcoin is continuing its amazing recovery, shooting all the way above $26.5k alongside #bullish #Fed news of potential US interest rate cuts. Whales are making the highest level of $BTC $1M+ transactions in 4 months after breaking 9-month price highs. https://t.co/me6fogpy6X pic.twitter.com/HIGnVAqYKz

— Santiment (@santimentfeed) March 14, 2023

Further, the recent uptick in the king coin’s price “has sent +2.7M Coins into profitability,” on-chain data provider Glassnode said in a tweet.

According to Glassnode,

“This indicates that ~20% of the Adjusted Circulating Supply was acquired within the $20k – $26k region.”

BTC’s “Adjusted Circulating Supply” refers to the number of coins that are actively in circulation, minus any coins that have not moved for a long period (these are considered “lost” coins).

Glassnode’s statement that around 20% of BTC’s adjusted circulating supply was acquired within the price range of $20,000 to $26,000 meant that these holders were put back in profit when BTC traded above $26,000.

The recent surge in #Bitcoin price action (+22%) has sent +2.7M Coins into profitability. This indicates that ~20% of the Adjusted Circulating Supply was acquired within the $20k – $26k region.

This workbench is available for Tier 2 membership and above: https://t.co/BgfZ9OsJPA pic.twitter.com/pxCg90n3M7

— glassnode (@glassnode) March 14, 2023

What else do we see on-chain?

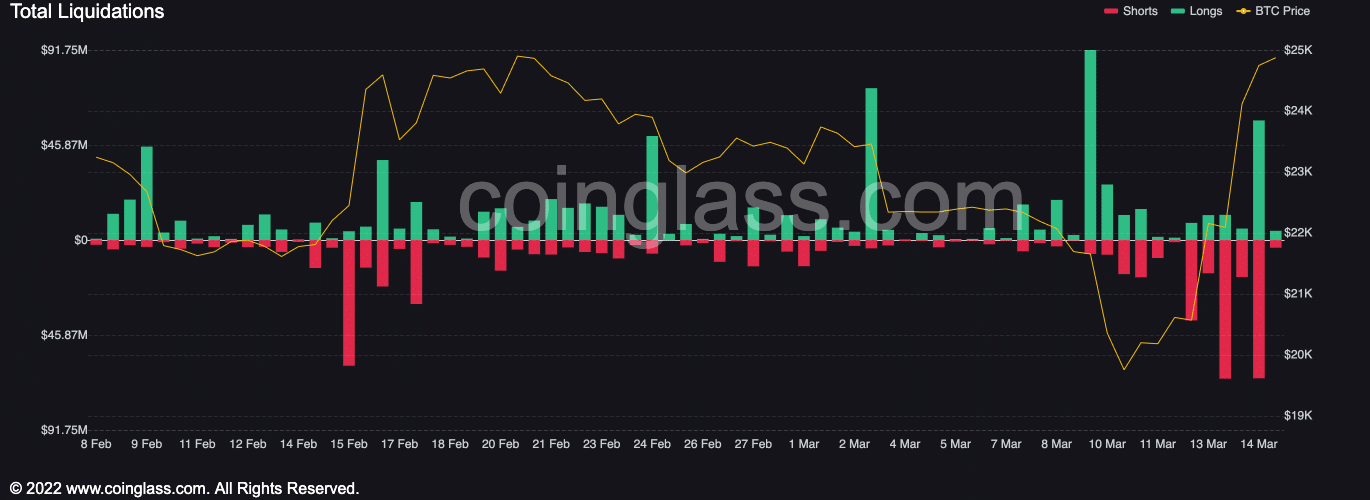

Market sentiment has improved significantly since the week began. BTC’s price traded as high as $24,574 on Monday and forced the liquidation of about $81 million BTC short positions. With many betting in favor of further price growth, data from Coinglass revealed that short traders remained the biggest losers in the BTC market.

Source: Coinglass

Is your portfolio green? Check out the Bitcoin Profit Calculator

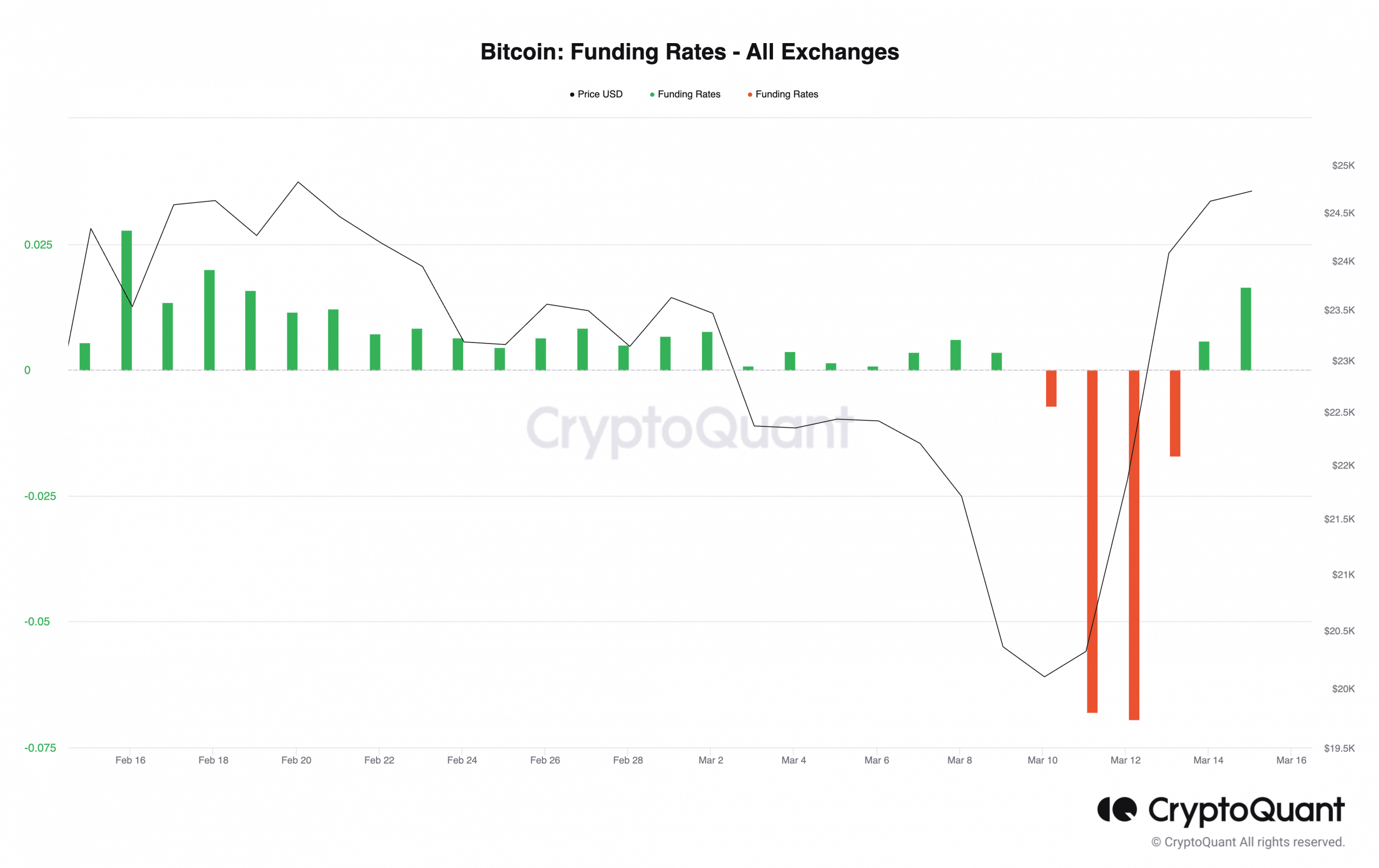

Further, for the first time since SVIB’s collapse, BTC funding rates have turned positive. When an asset’s funding rates are positive, it indicates that the demand to go long (buy) is high. This can be seen as a bullish signal, suggesting that traders are willing to pay a premium to maintain their long positions.

Source: CryptoQuant

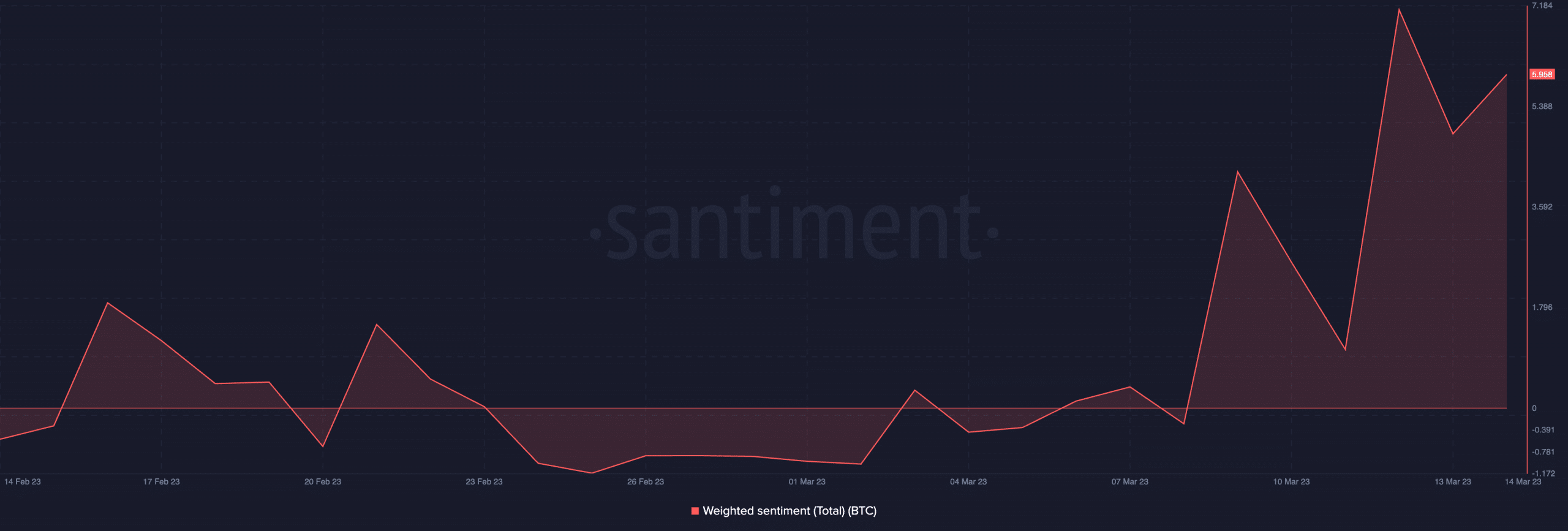

At press time, BTC’s weighted sentiment was a positive 5.958. If BTC sustains this level, prices could increase further.

Source: Santiment