What next after Bitcoin Cash [BCH] reclaims $110 from riding BTC’s coattails

- BCH’s correlation with BTC has led to a rally in its price

- If positive conviction remains, the coin’s value can be expected to appreciate even further

Due to its statistically significant positive correlation with Bitcoin [BTC], Bitcoin Cash’s [BCH] price has also rallied in the last 24 hours. This, following the decision by the U.S. Department of the Treasury, Federal Reserve, and Federal Deposit Insurance Corporation (FDIC) to restore all customer deposits at failed Silicon Valley Bank (SVB).

When SVB collapsed on 11 March, BCH slipped below $110 and oscillated between $109 and $110 for most of the weekend. However, as BTC’s price rallied in the early trading hours of 13 March following the Federal Regulators’ decision to make all SVIB depositors whole, BCH reclaimed $110 and exceeded it.

Still on a rally at press time, BCH’s price had appreciated by 5% in the last 24 hours. At the time, the cryptocurrency was trading at $127.31.

Is your portfolio green? Check out the Bitcoin Cash Profit Calculator

Are the bulls here to stay?

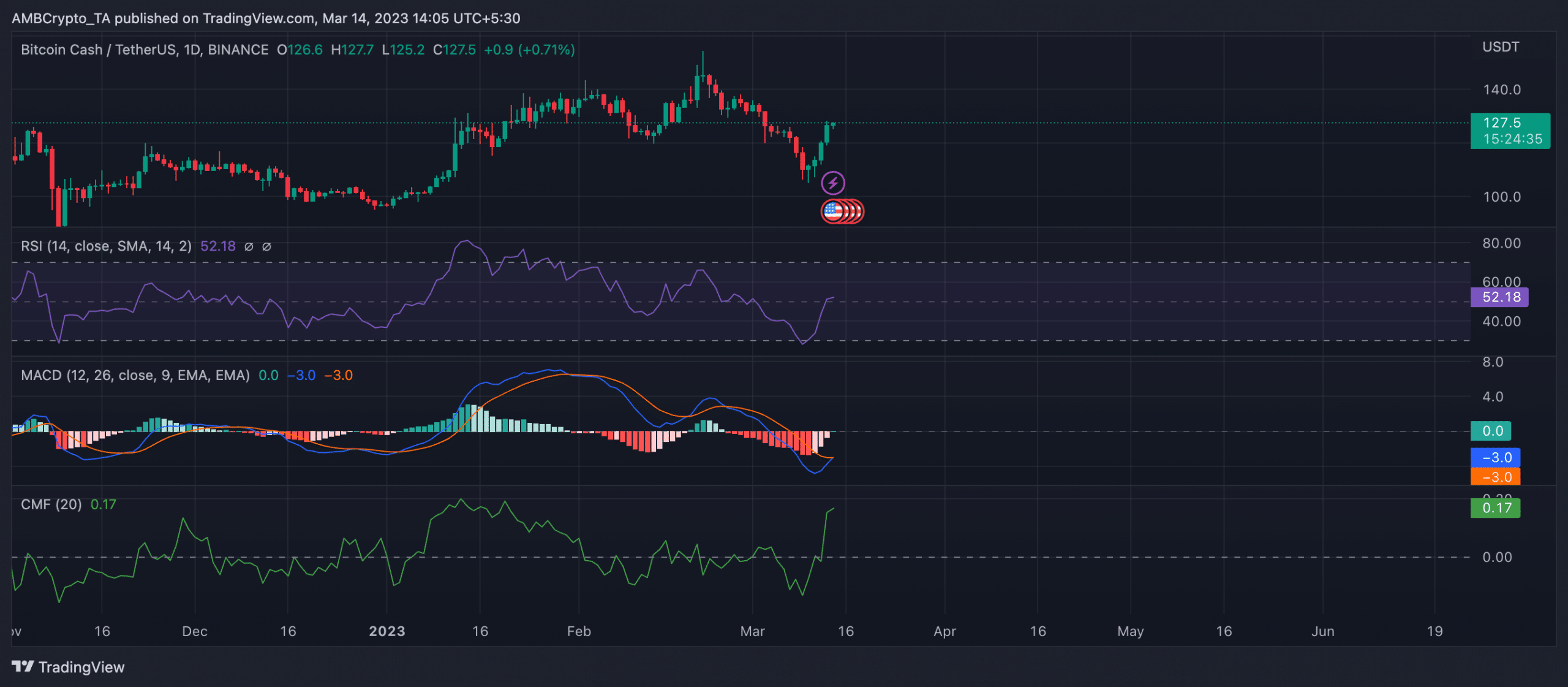

An assessment of BCH’s price movement on the daily chart revealed that the latest rally was leading up to the commencement of a new bull cycle.

At press time, the Moving Average Convergence Divergence (MACD) was preparing to intersect with the trend line in an upward direction. Once this happens, a new bull cycle would begin and BCH’s price will appreciate further.

Thanks to improving sentiment and growing accumulation, the Relative Strength Index (RSI) reclaimed its spot above the 50-neutral line and was pegged at 52.18. Likewise, the dynamic line of BCH’s Chaikin Money Flow (CMF) returned a positive reading of 0.17.

This was another piece of evidence supporting the notion that BCH’s price will appreciate further, especially if positive sentiment lingers.

Source: BCH/USDT on TradingView

Realistic or not, here’s BCH’s market cap in BTC’s terms

Set-up for success on-chain

According to on-chain data provider Santiment, BCH has seen sustained demand over the last 24 hours. As a result, the count of daily active addresses transacting the coin has hiked by 100%. At press time, 132,370 addresses were transacting BCH.

Greater network activity is a known recipe for the sustained rally of an asset’s price. With BCH’s weighted sentiment still in positive territory, if the active addresses count continues to rally, buying momentum will grow. This will eventually lead to a another significant price uptick.

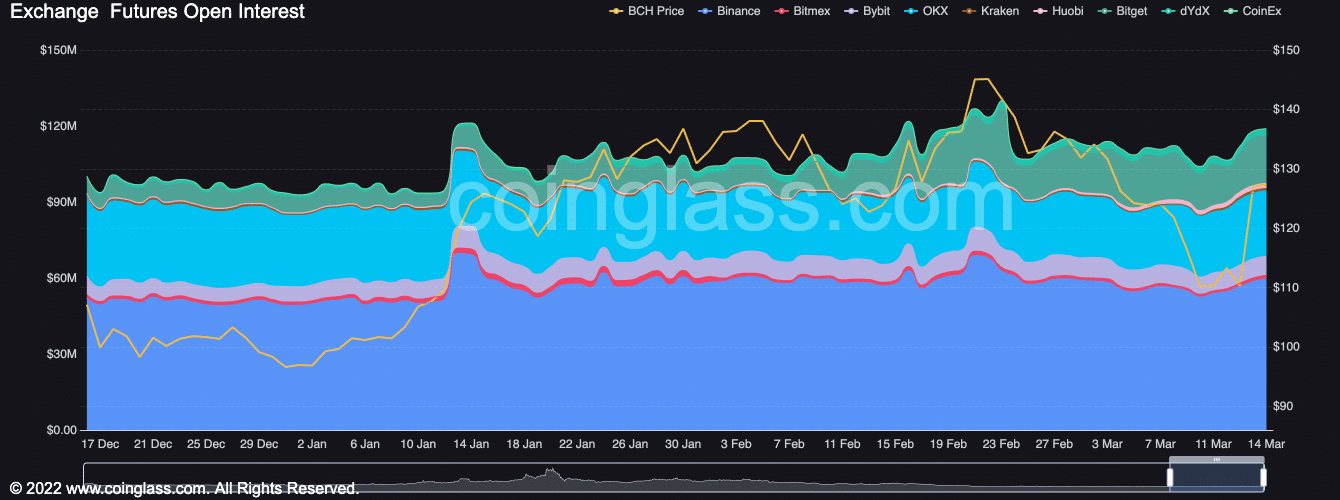

Consider this – In the last 24 hours alone, BCH’s Open Interest has risen by 5%. Generally, an increase in Open Interest is considered a bullish signal, especially as it suggests that there is growing optimism and confidence in the asset’s price direction.

Source: Coinglass

Hence, BCH’s price might continue to appreciate. However, a decline in the king coin’s price might also precipitate a fall in BCH’s value.