Best Crypto For Day Trading In 2023: An Overview

beginner

So, what happens when you combine two already extremely volatile ways of making money? You get double the risk and double the rewards, of course!

(Well, not exactly double. But the potential is there!)

Crypto day trading can be a great way to earn some money, but please beware that it is not for everyone — there is much risk involved. Unless you have some experience with day trades or have learned a lot about them and crypto, you should not consider it as a primary source of income.

But before learning how to maximize your gains, you should first familiarize yourself with what day trading entails and how it works, particularly in the crypto markets. So, let’s explore what it means to day trade digital currencies!

Please note that this article does not constitute investment advice.

What Is Crypto Day Trading?

Day trading is the act of buying and selling an asset in a single day. Crypto day trading is exactly the same, but with one exception: the asset here is a cryptocurrency or a crypto pair. Day traders typically buy and sell multiple times throughout the day in order to take advantage of short-term price fluctuations. This can be a highly profitable activity, but it also comes with many risks.

By selling and buying assets in rapid succession, traders aim to capitalize on short-term price fluctuations instead of long-term trends. Because of this, day trading is an entirely different beast from regular investment: it requires analyzing prices and crypto assets through another lens.

How to Pick Cryptocurrencies for Day Trading?

When it comes to choosing cryptocurrencies and crypto pairs for day trading, there are a few things you need to look for. Before doing any other research, make sure that the crypto you’re planning to go for has low fees. This way, you can maximize your profits by minimizing your costs — after all, nobody wants to spend all their earnings on trading fees.

Volatility

First and foremost, you will need some volatile cryptos for trading. Volatility means that the asset’s price is constantly changing, and there are a lot of profit opportunities. Although this is often seen as a downside, it is a benefit in day trading, as, without it, there is scarcely any way to make reliable profits.

Volume

Secondly, the cryptocurrencies you choose should have high liquidity and a huge trading volume. In other words, lots of people are trading that crypto, making it easy to buy and sell the asset. When trading crypto pairs with low trading volume, you might encounter sharper price swings but can also get stuck with digital assets you don’t need, being unable to sell them.

Current News

Finally, there’s also news. Recent market and industry developments are less of a factor in day trading than in long-term investment. That’s because day traders make a profit off price fluctuations, not necessarily bullish or bearish trends.

However, current news can still tell you what cryptocurrency or crypto pairs will be trending and, therefore, will have active price movement in the near future. Additionally, you can use the news to predict whether you should open short or long positions.

What are the Best Cryptos to Day Trade?

Now that we know what to look for in a good day trading crypto, let’s take a look at some of the best options out there.

Fantom (FTM)

Fantom is probably the least known cryptocurrency on this list, but it does not make it any less lucrative for day traders. It has all the things one might wish for in a digital asset suitable for crypto day trading: low fees, fast transaction times, and high volume.

At the time of writing, it was within the top 70 cryptocurrencies by market capitalization on CMC, which ensures at least a baseline level of liquidity. A big crypto asset like this is also more likely to be listed on various crypto day trading platforms, which allows traders to use advanced trading strategies like arbitrage.

Ripple (XRP)

Ripple is a great crypto to trade daily for a few reasons. First, it has a very low transaction fee of just 0.000001 XRP, which makes it perfect for those who want to make a lot of trades without having to worry about high fees eating into their profits. Second, Ripple is incredibly fast, with transactions taking just four seconds to confirm. This speed is perfect for day traders who need to make quick trades and don’t have to wait around for slow block times.

Ripple is also highly volatile, which can lead to big profits if you know how to capitalize on its price movements. Moreover, thanks to its unbelievable popularity, there are always people willing to capitalize on its price swings, making them even more extreme.

Solana (SOL)

If you’re looking for a fast and scalable crypto for day trading, Solana is a terrific option. This coin can handle up to 50,000 transactions per second, which is incredibly fast compared to other blockchains. Additionally, as Solana’s transaction fees are very low, you won’t have to worry about losing money on fees.

Another great thing about Solana is that it’s both popular and future-proof. Although the latter does not matter much for day traders, it ensures that there are always new (and often inexperienced) traders seeking out this cryptocurrency on any crypto trading platform. This increases its liquidity and profit-making potential even further.

Bitcoin (BTC)

Bitcoin, the largest and most well-known cryptocurrency, has the biggest market cap in the industry. Apart from this, it is the most liquid crypto, meaning there are always buyers and sellers available. Bitcoin has exceptionally huge trading volume and high volatility, and, overall, one can consider it a solid choice for day trading.

Cosmos (ATOM)

If you’re looking for the best day trading coins that are volatile and have the potential to make you some serious profits, Cosmos is a great pick. This coin has seen some massive price swings in its short time on the market, and it shows no signs of slowing down. The key to day trading Cosmos is to watch the market closely and take advantage of every opportunity.

Ethereum (ETH)

Ethereum has a really wide price range, which means that there will be plenty of opportunities to buy low and sell high. Additionally, Ethereum is one of the most popular cryptocurrencies, so you’ll always be able to find buyers and sellers.

Another attention-worthy thing about Ethereum is that it’s relatively stable. Unlike some other coins, Ethereum doesn’t experience huge price swings on a daily basis. Although this may seem counterintuitive, this can also be great for day trading — it allows you to go for less risky strategies and walk away with a more reliable profit at the end of the trading day.

Cardano (ADA)

A great crypto for day trading, Cardano is highly volatile and boasts much upside potential. ADA is often compared to Ethereum, but Cardano is actually more scalable and faster. Additionally, Cardano has a strong community behind it that is constantly working on improvements, thus ensuring there will be interest in this crypto.

Polkadot (DOT)

DOT has everything a day trade might need: good liquidity, availability on a wide variety of trading platforms, low fees, and more. This cryptocurrency has an extremely dedicated community and, what matters even most, a solid and innovative functionality that ensures its price movements are worth following.

Overall, with more than enough profit-making opportunities and risks at bay, DOT is a solid pick for day trading.

How to Start Day Trading?

There are a few things you need to do before getting into crypto day trading. First of all, you should find a good day trading crypto platform that will have all the features you might need. If you’re new to trading, it could be a good idea to create several accounts on different platforms to try them out before you commit. Most platforms also have demo accounts that let you glimpse into day trading without having to make a deposit.

There’s no one “best crypto day trading platform” — just one that works for you. We recommend looking for crypto exchanges with high liquidity and trading volume, a user-friendly interface, and low trading fees.

Once you find the exchange you like, you can give day trading a go.

At first, practice with smaller amounts to get a taste for it: many advanced traders use their intuition to make some of their trades, so the experience is invaluable. Once you’ve learned a bit about order types, like the stop-loss, and figured out what goes where on your chosen crypto exchange, you can start thinking about your strategy.

Crypto Day Trading Strategies

The key to successful day trading is to have a strategy in place before you start. This means knowing what you’re looking for in a trade and having an exit plan ready. Once you have these things figured out, you can start looking for trades that fit your criteria.

Whichever day trading strategy you decide to go for, make sure that you have a solid plan in place before you start trading. This will help you minimize your losses and maximize your profits.

There are several known and tested day trading strategies out there — let’s take a look at some of them.

Copy Trading

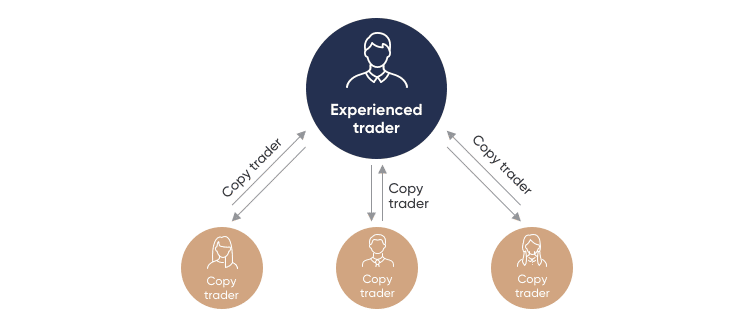

Copy trading is perfect for beginners or those who want to trade crypto but don’t have the time or knowledge to do it themselves.

Just like the name suggests, copy trading involves basically copying the trades of another crypto trader. When they buy or sell a coin, you do the same. The benefit is that you don’t have to research which coins to trade; that’s all done for you. You can simply sit back and watch your account grow… or shrink.

However, there are a few things you need to be aware of before starting to copy trade crypto.

- Make sure you choose a reputable and trustworthy trader to copy.

- Remember that past performance is not indicative of future results. Just because a trader had success in the past doesn’t mean they’ll be successful again in the future.

- Don’t put all your eggs in one basket. Just like you diversify your portfolio by trading multiple different assets, you should follow a wide variety of traders when copy trading. That will allow you to minimize your losses and to capitalize on different market niches.

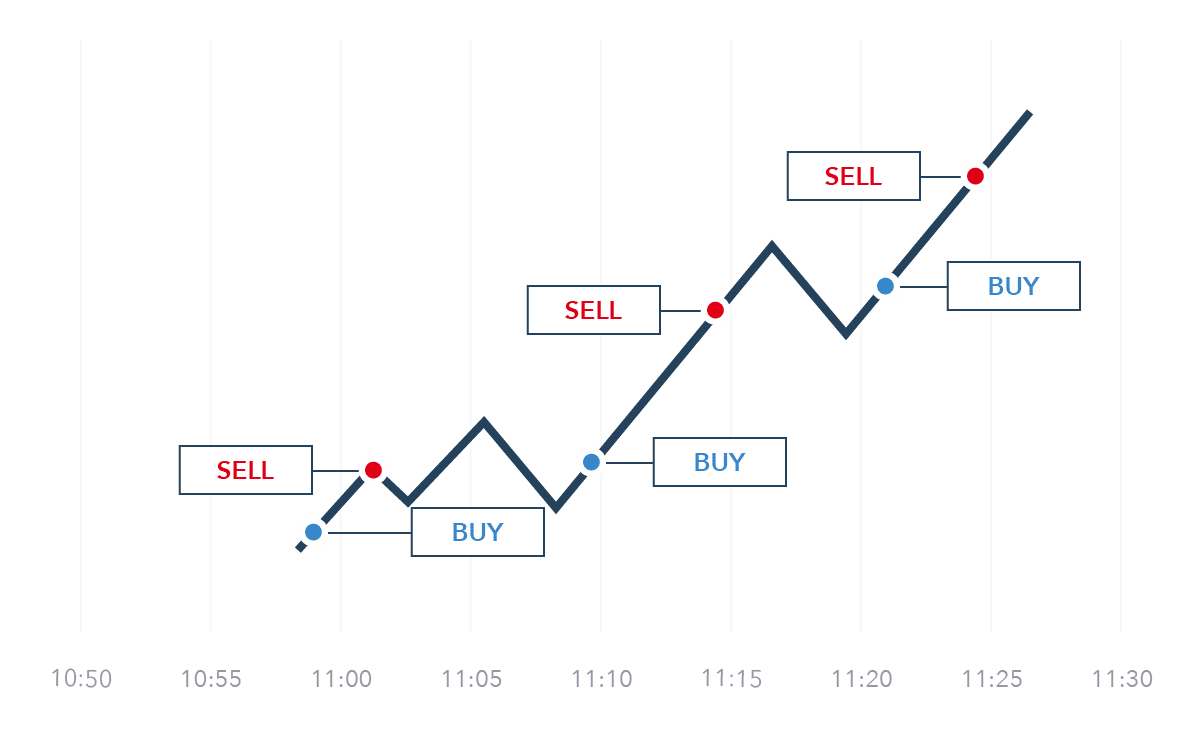

Scalping

Crypto scalping is a trading strategy with the aim of profiting from small price changes. It involves buying and selling crypto assets in quick succession and can be applied to any time frame, though most commonly, this strategy is employed in shorter time frames, such as one minute or five minutes.

Scalpers typically look for coins with high liquidity and low spreads to minimize their transaction costs. Some of the top choices for crypto scalping include Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

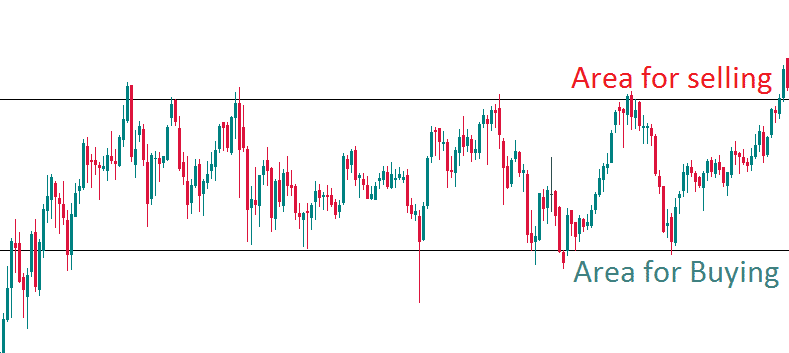

Range Trading

Range trading involves looking for coins that keep bouncing back and forth between two prices. These coins usually have high liquidity, which means there are a lot of people buying and selling them. This makes it easy to get in and out of trades quickly. Additionally, these coins tend to be less volatile than others on the market, which means they’re less likely to experience sudden price swings.

The best crypto pairs for range trading are the ones with high liquidity but relatively low volatility.

High-Frequency Trading (HFT)

HFT is an algorithmic trading strategy that involves using powerful computer programs to make hundreds, if not thousands, transactions per second. It is usually only used by institutional traders as it requires an expensive rig to be profitable: your processing speed needs to be really high.

HFT is highly efficient and can be incredibly profitable, but it is too resource-intensive for most people.

The main aim of HFT is to take advantage of small price movements in a short period of time. This type of trading requires a lot of experience and knowledge about the market as well as good analytical skills.

You can learn more about it here.

Arbitrage

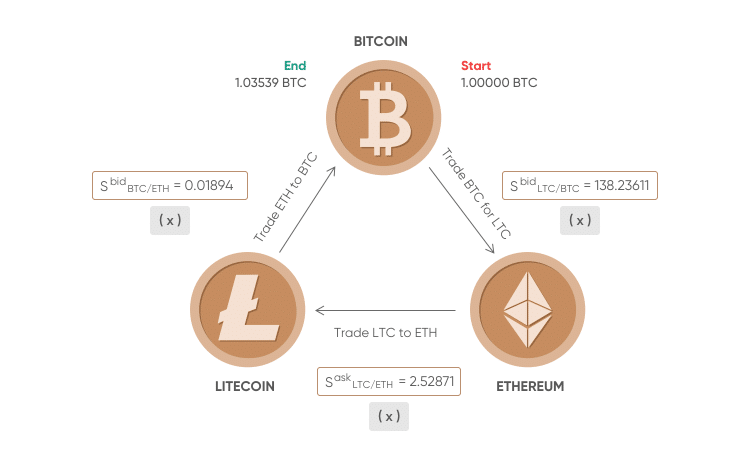

Arbitrage involves taking advantage of price differences on various exchanges. For example, let’s imagine that Bitcoin is trading for $30K on Exchange X and $31K on Exchange Y. A day trader could buy BTC on Exchange X and then sell it immediately on Exchange Y and get a profit of $1,000.

Arbitrage requires a good understanding of the market and the industry. Above that, you will also need to have accounts on many different platforms and grasp what cryptocurrencies may have wildly different prices on various crypto exchanges. Last but not least, you will have to be really quick to take full advantage of the price spread.

Crypto Signals for Day Trading

A crypto signal is basically a piece of advice or information that tells you when to buy or sell a particular coin. These signals can come from human analysts or from automated bots. There are a lot of different crypto signal providers out there, so it’s important to do your research and find one that suits your needs.

These days, many scammers try to get novice crypto traders to join private telegram groups promising millions of profit for the low price of $9.99. Avoid them like wildfire: in most cases they have no idea what they’re talking about.

If the community of a signal provider is big enough, it can easily manipulate prices on the unregulated crypto market, so beware of that and adjust your strategy accordingly. Sometimes it can be a good idea to follow those signal providers just to get a glimpse of what is going to happen in the crypto market shortly.

Crypto Day Trading Robots

Trading bots can be a great help to both beginner and experienced crypto day traders alike. They come in many configurations and forms and can chase different goals — the primary one being making you a profit, of course.

Those robots automate your day trading strategy by executing your trades for you. Learn more about them here.

Where Can You Day Trade Crypto?

There are quite a few platforms out there that support crypto day trading. Some of the most popular ones include Binance, Coinbase Pro, Kraken, and Changelly PRO. Some traditional exchanges like Chicago Mercantile Exchange allow their users to day trade crypto as well, but they are usually more heavily regulated than their crypto-focused counterparts.

Final Thoughts

There are a lot more things to learn about crypto day trading strategies: ways to minimize risk, find the best entry and exit points, and much more. We hope this overview has sufficiently introduced you to the wonderful yet (occasionally) stressful world of cryptocurrency day trading.

If you want to go further on your journey, you can read our articles on crypto indicators and the crypto trading glossary — they will be useful to any trader. And if you decided that day trading isn’t for you, check out our overview of all the main ways you can make money with crypto.

FAQ: Best Day Trade Crypto

Which crypto is best for day trading?

There’s no one crypto that is the best for day trading. As a day trader, you should be ready to engage with many different digital assets, as that’s the optimal way to make a profit.

Is day trading crypto profitable?

Crypto day trading is incredibly risky, so naturally, it has high-profit potential too.

How much does the average crypto day trader make?

Typically, experienced traders succeed in about 50% of their trades. However, their exact income depends on the crypto pairs they’re trading.

Should I buy and sell crypto daily?

That depends on your investment strategy and risk aversion. Day trading is not the only way to make a profit and doesn’t suit every single investor.

Can you do day trading in crypto?

Yes, day trading in crypto is possible, but it requires extensive knowledge and skill to day trade successfully. Crypto markets are highly volatile, and inexperienced traders can easily find themselves facing heavy losses. It’s important to have a strategy and research the market to decide when to enter and exit trades. Additionally, traders should pay attention to technical indicators, news, and other factors that could influence the price of crypto before attempting day trading.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.